If your financial journey has led you to this page, you’ve achieved something significant. You’re no longer asking, “How do I save?” but, “How do I allocate this capital strategically?” When your investable surplus crosses that ₹10 Lakh mark, the landscape shifts entirely.

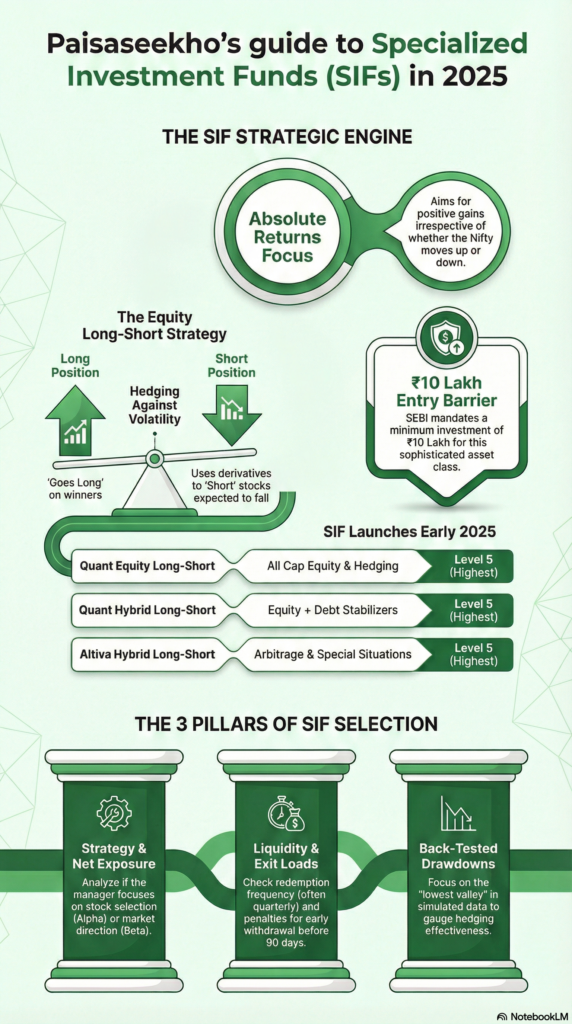

I know the frustration. You see the massive potential in the markets, but traditional mutual funds feel restrictive. They can only go long (buy). They don’t have the tools to protect you fully during intense Market Volatility. You need something that aims for Absolute Returns, a positive gain, irrespective of the Nifty’s direction.

Welcome to the world of Specialized Investment Funds (SIFs).

SIFs are the sophisticated, SEBI-Regulated answer to that need. They give experienced investors like you access to strategies previously reserved only for hedge funds and expensive Portfolio Management Services (PMS).

The challenge is this: SIFs are new (launched in late 2024/early 2025). You cannot simply look up “Best SIFs in India” based on 5-year returns, because that data doesn’t exist yet. This means the process of choosing the right SIF, the one that suits your Minimum Investment and risk profile, requires deep analysis, not past performance.

This guide will break down the crucial factors you must evaluate when assessing the Best SIFs in India, helping you look beyond short-term hype and focus on strategic excellence and transparent risk control.

What Is an SIF (Specialized Investment Fund)?

A Specialized Investment Fund (SIF) is a SEBI-regulated investment category introduced in India to offer advanced investment strategies that go beyond traditional mutual funds.

Unlike regular mutual funds that usually rely on one-directional market movement (markets going up), SIFs can use a mix of long positions, short positions, and hedging techniques to generate returns across different market conditions.

In simple terms:

SIFs aim to make money not just when markets rise, but also when they fall or move sideways.

Because of their complexity and higher risk profile, SIFs are designed for experienced and sophisticated investors, which is why SEBI has set a ₹10 lakh minimum investment requirement.

1. Why “Best” SIFs Cannot Be Judged by History (The 2025 Reality)

The first step in SIF investing is letting go of the habits you built in the Mutual Fund world.

The New Investment Paradigm

When choosing the “Best” mutual fund, you typically rely on three things: the fund’s 5-year CAGR, its Sharpe Ratio (for Risk-Adjusted Returns), and the fund manager’s long-term track record.

With SIFs, that’s simply not possible yet.

Analogy Alert: Judging the New Highway

Imagine a brand new, multi-lane expressway opening near your home. You can’t judge how fast the traffic moves based on last year’s slow, bumpy road. You have to look at the design of the new road, the width of the lanes, the quality of the asphalt, the traffic rules, and the engineering behind the curves.

With Specialized Investment Funds (SIFs), you must ignore non-existent history and focus on the fundamental engineering:

- The Strategy: How is the fund designed to handle stress?

- The Manager: Does the fund manager have the specific expertise in derivatives and the Long-Short Strategy?

- The Allocation: Does the portfolio structure justify the high-risk mandate?

The “Best SIFs in India” right now are the ones with the most robust strategy and the most transparent risk management framework, not the highest theoretical returns.

2. Analyzing the Contenders: A Look at Early SIF Launches (2025)

The moment Specialized Investment Funds (SIFs) were introduced in December 2024, the market was waiting for the first wave of launches. The first few funds to hit the market, like those from Quant and Altiva in late 2025, don’t have three-year returns or established risk-adjusted metrics yet. This means we cannot compare them based on history.

Instead, as a sophisticated investor, you must use other metrics, like portfolio structure, return anticipation, and manager expertise, to gauge their potential performance. Chalo, dekhte hain what the first funds are telling us about the Strategy Focus of the SIF category.

1. Quant Equity Long Short Fund

Launched on 17 September 2025, this fund is a classic example of an Equity Long-Short Fund that aims for Absolute Returns by focusing heavily on equity and hedging risk. Notice the high risk band (Level 5) reflecting the use of derivatives.

| Asset Component | Allocation Range (%) | Risk Rationale |

| All Cap Equity or Arbitrage | 65 to 100 | The primary driver of returns (Long exposure). |

| Unhedged Derivative Strategies (Long) | 0 to 35 | Used to take tactical bets on rising securities. |

| Unhedged Derivative Strategies (Short) | 0 to 25 | The crucial Hedging tool to profit when stocks fall. |

Operational Metrics:

| Metric | Value |

| Minimum Investment | INR 10 Lakhs |

| Minimum SIP | INR 10,000 |

| Risk Band | Level 5 (Highest Risk) |

| Exit Load | 1% if units redeemed before 15 days |

The Return Anticipation for this fund is instructive: they expect underperformance in a raging bull market but outperformance in a bear market, volatile market, or range-bound market. This perfectly illustrates the purpose of the Equity Long-Short Strategy, to protect your capital when others are losing theirs.

2. Quant Hybrid Long-Short Fund

This fund offers a slightly different take, combining growth potential with the stability of fixed income. It provides a more balanced approach than the pure Equity SIF, making it potentially attractive for Portfolio Diversification.

| Asset Component | Allocation Range (%) | Risk Rationale |

| Equity Arbitrage or Unhedged Equity Spot (Long) | 35 to 65 | Growth portion. |

| Debt | 25 to 65 | The stabilizer, used to manage Market Volatility. |

| Unhedged Equity Derivative Strategies (Long) | 0 to 40 | Tactical bets on the equity market. |

Operational Metrics:

| Metric | Value |

| Minimum Investment | INR 10 Lakhs |

| Minimum SIP | INR 10,000 |

| Risk Band | Level 5 (Highest Risk) |

| Exit Load | 1% if units redeemed before 15 days |

This Hybrid fund’s benchmark is the Nifty 50 Hybrid Composite Debt 50:50 Index. By analyzing how this debt-equity index has performed (e.g., 12.37% return over 3 years), you can set realistic expectations for the SIF’s potential Risk-Adjusted Returns.

3. Altiva Hybrid Long Short Fund

The Altiva fund showcases even more complex Advanced Strategies, focusing on special situations and arbitrage rather than broad market bets.

| Core Strategy | Allocation Range |

| Cash-Future Arbitrage and Covered Call | 20% to 40% |

| Fixed Income | 40% to 60% |

| Special Situations (IPO, Mergers, etc.) | 0 to 10% |

| Derivative Strategies | 10% to 20% |

Operational Metrics:

| Metric | Value |

| Minimum Investment | INR 10 Lakhs |

| Minimum SIP, SWP, STP | INR 1,000 |

| Exit Load | 0.5% if units redeemed before 90 days |

This fund emphasizes stability (high Fixed Income) and uses back-tested strategy returns (e.g., 11.53% over two years) as a proxy for future performance. This demonstrates the manager’s Strategy Focus on delivering low-volatility returns.

What This Means for Your Investment Decision

The early SIF launches confirm two things:

- High Risk is Standard: All SIFs carry the highest risk band (Level 5) due to their Derivatives Exposure.

- Strategy is Everything: Since past returns are absent, your decision must be based on which fund’s Strategy Focus (Pure Equity Long-Short vs. Hybrid Fixed Income Focus) aligns best with your existing Portfolio Diversification needs.

Funds like the Magnum Hybrid Long Short Fund, also launching in late 2025, will follow similar patterns. Use the portfolio structure and the fund manager’s expertise as your primary guides when judging the “Best SIFs in India.”

3. The Strategic Heart: Absolute Returns and Advanced Strategies

The core reason you opt for a Specialized Investment Fund (SIF) over a regular equity fund is the promise of Absolute Returns, delivering a positive result irrespective of overall Market Volatility.

The Equity Long-Short Fund Mandate

The flagship category for this goal is the Equity Long-Short Fund. This strategy is the strategic engine of many SIFs:

- Go Long: Buy stocks expected to rise (the winners).

- Go Short: Use Derivatives Exposure (up to 25% unhedged) to bet against stocks expected to fall (the wealth destroyers).

This dual-directional capability means that in a flat or declining market, the gains from the Short Book offset the losses in the Long Book, protecting your capital. This is the ultimate form of Hedging your equity exposure.

SIF Categories: Your Strategic Choices

When evaluating the Best SIFs in India, you must first categorize them by their overall risk mandate, which is defined by the underlying assets:

| SIF Category | Primary Allocation | Strategy Focus | Typical Volatility |

| Equity-Oriented | Min. 80% Equity | Equity Long-Short Fund (Pure Alpha) | Highest |

| Hybrid Schemes | Mix of Equity, Debt, Derivatives, REITs | Dynamic Asset Allocation, Risk Mitigation | Moderate-High |

| Debt-Oriented | Fixed-Income Securities | Interest Rate and Credit Risk Management | Moderate |

For investors prioritizing growth with protection, the Equity Long-Short Fund and Hybrid Long-Short schemes offer the most powerful balance of Absolute Returns potential and structural safety.

4. Beyond Returns: The 3 Core Pillars for Choosing the Best SIFs

Since historical data is limited, your assessment should rely heavily on the regulatory disclosures and the Strategy Focus detailed in the Scheme Information Document (SID).

Pillar 1: Strategy Focus and Mandate (The ‘How’)

Don’t just look at the category name; look at the commitment.

- The Net Exposure: If a manager promises low Market Volatility, check their target net exposure (Long minus Short). A fund targeting a near-zero net exposure is focused purely on stock selection (alpha), while a fund with a 30-50% net exposure is taking a larger directional bet on the overall market (beta).

- The Ex-Top 100 Play: Some Equity Long-Short Funds focus on the mid and small-cap space (e.g., Equity Ex-Top 100). This aims to exploit pricing inefficiencies outside of the most liquid large-cap stocks but carries a higher inherent risk. Ensure this higher risk matches your portfolio’s overall objective.

Pillar 2: Liquidity, Exit Load, and Commitment (The ‘Lock-in’)

Unlike open-ended mutual funds, liquidity in SIFs is restricted. This must be capital dedicated to long-term wealth growth.

- Check the Exit Load: SIFs often impose exit loads to discourage short-term trading. For example, some funds charge a 1% exit load if you redeem within the first 15 days, or 0.5% if redeemed within 90 days. This penalty ensures your Minimum Investment is serious capital.

- Redemption Frequency: Most SIFs are Interval Investment Strategies, meaning redemptions are processed quarterly or twice a week, not daily. If you need monthly access to these funds, an SIF is not the right fit. This low Liquidity is a feature, not a bug, it gives the manager confidence to execute the complex Long-Short Strategy without fear of sudden large withdrawals.

- Minimum Investment Check: Always verify the AMC’s compliance rule. While the SEBI mandate is ₹10 Lakh, the AMC sets the initial SIP minimum (often around ₹10,000).

Pillar 3: Risk-Adjusted Returns and Back-Tested Performance (The ‘Expected’)

Since live data is scarce, fund houses will provide back-tested returns, simulated performance based on running the SIF’s strategy historically.

- Risk Band: Every SIF must disclose its risk level. You will often find Specialized Investment Funds (SIFs) landing in the highest Risk Band (Level 5). Acknowledge that the potential for Absolute Returns comes with higher inherent risk due to the Derivatives Exposure and tactical allocation.

- Focus on Drawdowns: The true value of an Equity Long-Short Fund is not its highest peak, but its lowest valley. Look at the back-tested data for the fund’s maximum drawdown (the biggest drop from peak to trough). Lower drawdowns mean the Hedging and short strategies are working effectively to cushion losses during Market Volatility, which translates to better Risk-Adjusted Returns.

5. Positioning SIFs for Portfolio Diversification

The Best SIFs in India should not be used as your core equity holding. They are a tool for Portfolio Diversification and tactical deployment.

SIFs as Your Satellite Portfolio

Think of your portfolio in two parts, like a well-managed karyakram:

- Core Portfolio: Your reliable, long-term wealth builders (Index Funds, large-cap equity MFs). These are your 80% allocation, built for the long haul.

- Satellite Portfolio (SIF): Your 10-20% tactical allocation. This is where the SIF fits. It provides Portfolio Diversification by delivering returns that are less correlated with your core portfolio, because it can profit when your core stocks are under pressure.

This approach balances your long-term wealth growth with a sophisticated Hedging mechanism, ensuring that your overall Risk-Adjusted Returns are optimized.

Final Word: The Calculated Entry

Choosing the Best SIFs in India requires maturity and discipline. It means focusing on the quality of the manager and the strategy’s structure, not last year’s returns.

The Specialized Investment Fund (SIF) is a complex, powerful tool for your strategic capital. If you meet the ₹10 Lakh Minimum Investment, understand the Liquidity trade-offs, and appreciate the power of the Equity Long-Short Fund to deliver Absolute Returns, then the SIF framework is the calculated, sophisticated choice for your next phase of wealth management. Make sure your Strategy Focus is clear before you deploy your capital.

Frequently Asked Questions (FAQs)

1. What is the minimum SIP required for a Specialized Investment Fund (SIF)?

While the Minimum Investment threshold for a Specialized Investment Fund (SIF) is a mandatory ₹10 Lakh (at the PAN level), the AMC (Asset Management Company) often allows systematic investment options. For example, some SIFs set the minimum SIP at ₹10,000 or higher. However, remember that using a SIP does not exempt you from the need to maintain the ₹10 Lakh aggregate investment level; if the total value drops below that due to redemptions, compliance issues arise.

2. Are SIFs truly designed to deliver Absolute Returns, or is that just marketing?

The goal of Absolute Returns is central to the SIF framework, particularly for strategies like the Equity Long-Short Fund. This is because SEBI regulations permit them to use Derivatives Exposure (up to 25% unhedged short positions) for tactical, profit-seeking purposes, a feature unavailable in traditional mutual funds. While no investment guarantees positive returns, the Long-Short Strategy is structurally designed to profit from both rising and falling markets, thus aiming to deliver returns with less correlation to the benchmark, providing better Risk-Adjusted Returns.

3. What specific features should I look for to assess the Liquidity of an SIF?

To assess the Liquidity of a Specialized Investment Fund (SIF), you should look at two factors in the offer documents: 1) Redemption Frequency: Check if the fund is open-ended (rare), or an Interval Investment Strategy (common, often quarterly or weekly). 2) Exit Load: Look for the specific exit penalty structure (e.g., 1% if redeemed before 90 days). The shorter the lock-in period and lower the penalty, the better the effective Liquidity. Given the nature of their Advanced Strategies, SIFs will always have lower liquidity than a standard open-ended fund.

4. How does the SIF framework ensure Portfolio Diversification despite using sophisticated strategies?

The SEBI-Regulated framework for Specialized Investment Funds (SIFs) enforces strict concentration limits to ensure Portfolio Diversification. For instance, an SIF cannot invest more than 25% of its NAV in the debt securities of a single sector. While strategies like the Equity Long-Short Fund are tactical, these underlying diversification rules ensure that the fund manager cannot take massive, concentrated bets on a single stock or sector that would jeopardize the entire corpus, thereby balancing risk against the high-growth potential.

Disclaimer

This blog post is for educational purposes only and is targeted at sophisticated investors. Specialized Investment Funds (SIFs) are complex products that carry higher risks, including the potential loss of capital, and are subject to the ₹10 Lakh minimum investment rule. Consult a qualified financial advisor to understand the Strategy Focus, risk profile, and tax implications before investing.