If you walked into a family wedding in 2025, the conversation likely revolved around one thing: Gold prices. “Sona kitna mehenga ho gaya!” (Gold has become so expensive!) was the refrain in every Indian household. And they were right. Gold had a spectacular year.

But while everyone was busy watching the yellow metal, a quiet revolution was happening in the background. The “Poor Man’s Gold”, Silver (Chandi), was outperforming its rich cousin by a mile.

For the astute investor in India’s Tier 2 and Tier 3 cities, 2025 wasn’t just the year of precious metals; it was the “Year of the Great Recalibration”. While consumer inflation dropped to a historic low of 1.33% by December, asset prices went through the roof.

In this deep dive, based on our “Budget 2025-26 Investment Insights“ report, we will uncover the data that shocked the market: How Silver delivered a staggering 167% return in a single year, and why your portfolio needs to look beyond just Gold in 2026.

Which asset gave highest returns in India in 2025?

Answer: Without a doubt, the highest-performing major asset class in India for the calendar year 2025 was Silver, delivering an absolute return of 167.07%.

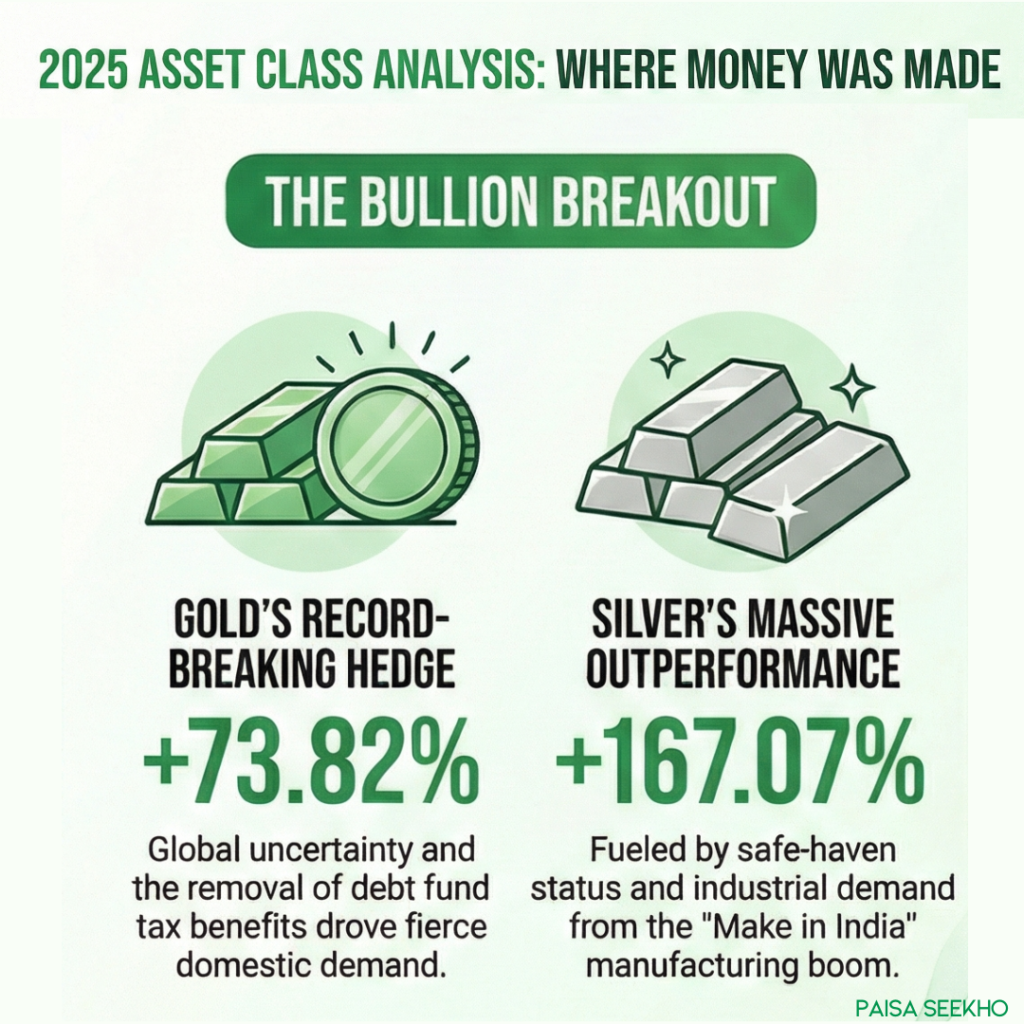

Let’s look at the numbers that defined the year. 2025 will be remembered as the “year of bullion”. The divergence between the cost of survival (low inflation) and the cost of prosperity (high asset prices) was most visible here.

The Tale of the Tape (Jan 2025 – Dec 2025):

- Gold (10g): Started the year at ₹76,308. By December 31, it skyrocketed to ₹1,32,640.

- Total Return: +73.82%.

- Silver (1kg): Started the year at ₹85,913. By December 31, it reached an eye-watering ₹2,29,452.

- Total Return: +167.07%.

To put this in perspective: If you had invested ₹1 Lakh in Gold in January, you would have roughly ₹1.73 Lakh by December. But if you had put that same ₹1 Lakh into Silver, you would be sitting on nearly ₹2.67 Lakh.

While Gold grabbed the headlines because of its cultural importance in marriages, Silver quietly made millionaires out of those who understood its industrial value.

Reasons for silver price rally in 2025

Answer: Silver’s massive rally was driven by its “Dual Nature”, it acted as a safe haven asset (like Gold) during global uncertainty, but more importantly, it saw explosive demand as an industrial metal for “Make in India” sectors like solar panels and electronics.

Unlike Gold, which is mostly stored in vaults or worn as jewelry, Silver is a working metal. It is essential for the modern economy.

1. The “Safe Haven” Rush Just like Gold, Silver benefited from the fear in the market. With the removal of indexation benefits on debt funds in Budget 2025, conservative investors were spooked. They pulled money out of bonds and poured it into physical assets. Silver, being cheaper per unit than gold, is often the first entry point for smaller investors in Tier 2 cities, hence the nickname “Poor Man’s Gold”.

2. The Industrial Explosion This is the real differentiator. Silver is a critical component in:

- Solar Panels (Photovoltaics): As India pushes for renewable energy, the demand for silver paste used in solar cells has surged.

- Electronics: From smartphones to EV batteries, silver is used in conductive contacts.

- “Make in India”: The manufacturing boom in industrial belts surrounding Tier 2 cities likely fueled a direct industrial demand for the metal.

In 2025, investors weren’t just buying a precious metal; they were buying a “high-beta play on the manufacturing boom”.

Is Silver a better investment than Gold in India?

Answer: For growth, yes. For stability, no. Silver offers significantly higher upside potential (as seen with the 167% return) but comes with much higher volatility compared to Gold.

The Volatility Factor: Silver is a smaller market than Gold. This means a little bit of money moving in or out can swing prices wildly.

- Gold is the “Ultimate Hedge.” It protects your wealth. Even with a 73% rise, its primary role was stability during the inflation anomaly of 2025.

- Silver is the “Aggressive Play.” It is a wealth multiplier.

The “Asset Class Divergence”: Our report highlights a historic decoupling. While consumer inflation crashed to 1.33%, asset inflation (Gold/Silver) surged. This suggests a wealth transfer to asset owners. If you want to be on the winning side of this “K-shaped” economy, holding hard assets like Silver is becoming essential.

Tier 2 Insight: For investors in cities like Indore or Coimbatore, Silver is often more accessible. You can buy silver coins or bars in smaller denominations compared to the high entry barrier of Gold (which is now over ₹1.3 Lakh per 10g).

Silver price prediction Budget 2026

Answer: The market is anticipating potential policy interventions in Budget 2026, specifically regarding import duties, which could impact domestic prices.

In late 2025, there was a “rush to buy” driven by fears that the government might hike import duties in Budget 2026 to curb the Current Account Deficit. This panic buying pushed premiums to decade highs.

Scenario Analysis for Budget 2026:

- Import Duty Cut: If the government reduces import duty to cool down prices (a medium probability scenario mentioned in our report), we might see a short-term correction in domestic Silver prices. This would be a massive buying opportunity.

- Status Quo: If duties remain high, the “scarcity premium” will continue to drive prices up, especially given the relentless industrial demand.

Investors should watch the Finance Minister’s speech on February 1, 2026, closely. Any mention of “precious metals” or “customs duty” will move the Silver market instantly.

Should I switch from Gold to Silver for 2026 investment?

Answer: Do not switch all your Gold to Silver, but rebalance your portfolio to include Silver. Our recommended “Barbell Strategy” for 2026 suggests a 20% allocation to Silver specifically for hedging and growth.

The Strategic Allocation: Based on the “Budget 2025-26 Investment Insights” report, here is how a Tier 2 investor should structure their portfolio:

- Safety (40%): Keep this in instruments like SSY or SCSS (offering 8.2%).

- Growth (40%): Focus on broad equities like the Nifty Equal Weight Index.

- Hedge (20%): Silver over Gold..

Why Silver over Gold for the Hedge? With industrial demand rising and price momentum strong, Silver offers better growth potential than Gold for the coming year, although with higher risk. The “Make in India” story is far from over, and Silver is a direct beneficiary of that story.

Conclusion

2025 taught us a valuable lesson: The “safe” choice isn’t always the most profitable one. While Gold did its job perfectly as a hedge, Silver emerged as the star of wealth creation.

The 167% rally in Silver wasn’t a fluke; it was driven by fundamental shifts in India’s economy, from the “infrastructure-led urbanization” to the boom in manufacturing.

As we approach Budget 2026, the question isn’t “Gold OR Silver.” The question is, “Do I have enough Silver to capture the industrial growth of New India?”

Don’t let the rally pass you by again.

For a detailed look at the 2026 Investment Strategy and to see the full “Barbell” portfolio allocation, read our comprehensive report: “India’s Economic Transition: A Definitive Report on the Fiscal Impact of Budget 2025”.

FAQs: Investing in Gold & Silver in 2026

Q1: Why did Silver prices increase so much in 2025?

A: Silver prices rallied 167% due to a combination of high industrial demand (solar panels, electronics), its status as a safe haven asset during global uncertainty, and the removal of indexation benefits on debt funds, which pushed investors toward physical assets.

Q2: Is it safe to buy Silver now or is it too expensive?

A: While prices are high (₹2.29 Lakh/kg as of Dec 2025), the long-term industrial demand remains strong. However, buying on dips is recommended. Watch out for Budget 2026 announcements regarding import duties which might offer a better entry price.

Q3: How can I invest in Silver in India?

A: You can invest via physical silver (coins/bars), Silver ETFs (Exchange Traded Funds) on the stock market, or Silver Futures on MCX. For long-term holding, Silver ETFs are efficient as they avoid storage issues.

Q4: Did Gold give better returns than the Stock Market in 2025?

A: Yes, significantly. Gold returned ~73% , whereas the Nifty 50 returned roughly 11.88% and the broader Nifty Equal Weight Index returned ~15%. Bullion outperformed equities in 2025.

Q5: Will the government reduce import duty on Gold/Silver in Budget 2026?

A: It is a possibility (Scenario B in our report). If the government wants to cool down domestic prices and curb smuggling, they might reduce the duty. If this happens, domestic prices will correct, creating a buying opportunity.