It’s the end of the month, and you’ve finally got some extra cash in hand. You want to grow this money, but you’re stuck between Fixed Deposits vs Mutual Funds. On one hand, your parents might say, “Beta, invest in an FD – it’s safe.” On the other hand, your colleagues might insist that mutual funds are the way to wealth creation, chanting “Mutual fund sahi hai!” every chance they get.

So, how do you decide? For beginners – especially those who are new to the world of investing- both fixed deposits (FDs) and mutual funds hold strong appeal. They can help you build financial stability while catering to different risk appetites. Let’s break down how each works, their pros and cons, and which might be best suited for your needs.

What Are Fixed Deposits?

A fixed deposit is a savings instrument offered by banks and certain financial institutions. You invest a lump sum for a predetermined period, ranging from a few months to several years, and earn a fixed rate of interest.

Key Features of Fixed Deposits

- Guaranteed Returns

Once you lock your money in an FD, the interest rate is fixed. You get a predictable return on maturity, so you know exactly how much you’ll earn at the end of the term. - Low Risk

Fixed deposits are considered one of the safest investment avenues in India, often preferred by conservative or older investors who want capital protection over high returns. - Flexible Tenures

Tenure can range from 7 days to 10 years, depending on the bank’s offerings. This flexibility allows you to choose a period that aligns with your financial goals. - Auto-Renewal Options

Many banks provide automatic renewal for FDs, which simplifies the process if you want to continue earning without withdrawing your funds.

Advantages of Fixed Deposits

- Simplicity

You deposit money, pick a tenure, and then wait. No monitoring of market trends or share prices. - Liquidity

Although breaking an FD prematurely might incur a small penalty, you can still access your funds if needed. This can be easier than, say, selling a property or waiting for a lock-in period on certain mutual funds. - Reliable for Goal-Based Savings

Planning your next vacation or a family function? FDs help you know exactly how much you’ll have on maturity, helping you budget.

Disadvantages of Fixed Deposits

- Interest Rates Can Be Low

While they’re stable, the returns may not outpace inflation—especially if you’re locked in at a lower rate for several years. - Premature Withdrawal Penalties

Need money in an emergency? You might lose some interest if you liquidate the FD before maturity. - Lack of Growth Potential

FDs don’t benefit from stock market upswings. Once the interest rate is fixed, that’s the maximum return you’ll get, no matter how the economy performs.

What Are Mutual Funds?

Mutual funds pool money from various investors and invest it in a mix of equities (stocks), bonds, or other securities. A fund manager, who is a financial expert, handles these investments with the goal of generating returns.

Key Types of Mutual Funds

- Equity Funds

Primarily invest in stocks. While these can yield higher returns over the long term, they come with more risk due to market volatility. - Debt Funds

Invest in government bonds, corporate bonds, or other fixed-income instruments. They’re usually more stable but offer moderate returns. - Hybrid or Balanced Funds

A mix of both stocks and debt, aiming to balance risk and return.

Advantages of Mutual Funds

- Potential for Higher Returns

Especially with equity mutual funds, you can benefit from the growth of the stock market over time. - Professional Management

You don’t need to track the stock market daily; the fund manager does it on your behalf. - Variety and Flexibility

You can pick from a huge range of funds—sectoral, thematic, large-cap, small-cap—based on your comfort with risk. - SIPs (Systematic Investment Plans)

You can start investing in mutual funds with as little as ₹500 per month, making it accessible even for those just beginning their careers.

Disadvantages of Mutual Funds

- Market-Linked Risks

The value of your investment can fluctuate. If the market dips, your fund’s value might go down as well. - Fees and Charges

Mutual funds charge an expense ratio, which can eat into returns over time. Some funds may also charge an exit load if you withdraw too soon. - No Guaranteed Returns

Past performance isn’t always a predictor of future returns, so there’s always an element of uncertainty.

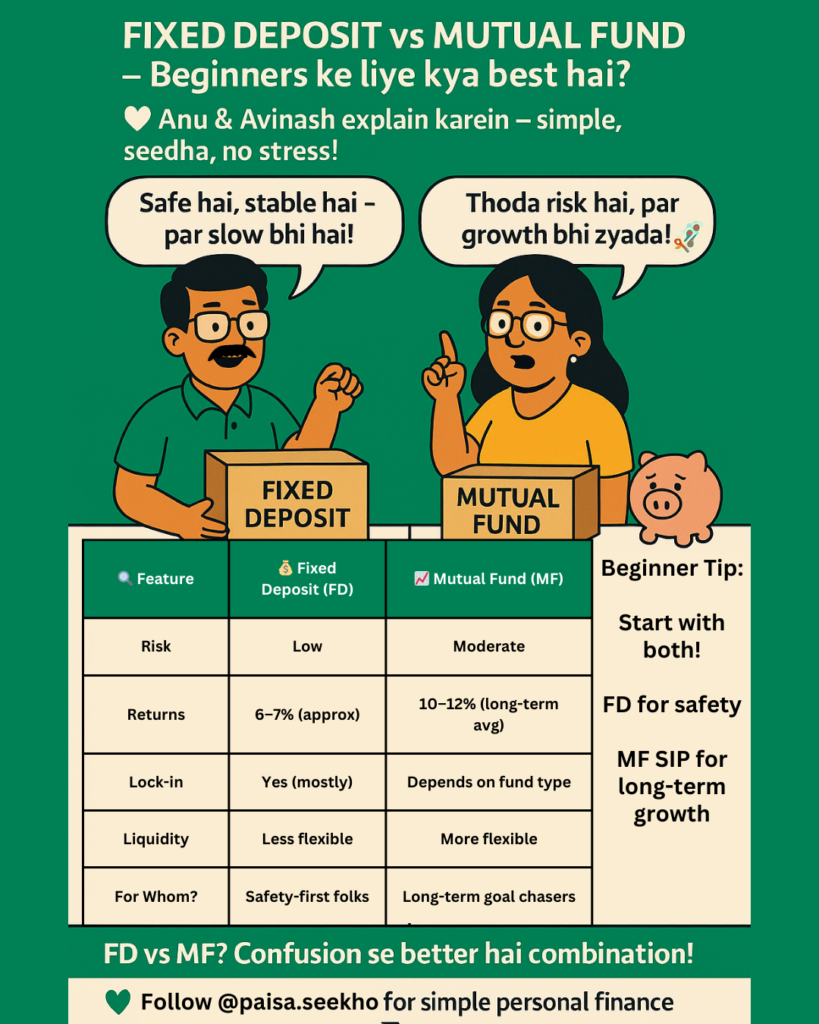

Fixed Deposits vs Mutual Funds: Key Differences

Risk and Return

- Fixed Deposits

Very low risk with predictable, but often modest, returns. - Mutual Funds

Higher risk but potential for higher returns, especially over the long haul.

Liquidity

- Fixed Deposits

Fairly liquid, but early withdrawal can lead to penalties or reduced interest. - Mutual Funds

Generally liquid, though equity funds can take a few days to redeem. Some funds come with exit loads or lock-in periods (like ELSS for tax savings).

Taxation

- Fixed Deposits

Interest earned is fully taxable under “Income from Other Sources.” TDS (Tax Deducted at Source) may apply if interest exceeds ₹40,000 per year (₹50,000 for senior citizens). - Mutual Funds

Tax depends on the type of fund and holding period. Equity funds held longer than one year qualify for long-term capital gains (LTCG) tax at 10% beyond ₹1 lakh of gains per year. Debt funds have different rules. Always check the latest regulations or consult a tax advisor.

Monitoring and Effort

- Fixed Deposits

Set it and forget it. Very little monitoring is required. - Mutual Funds

Ideally, review performance regularly (like quarterly or annually). Although you have a fund manager, it’s good to stay aware of market trends or major changes in fund strategy.

Which is Better for Beginners?

The choice between Fixed Deposits vs Mutual Funds depends on your financial goals, time horizon, and comfort with risk.

- If You’re Extremely Risk-Averse

Fixed deposits provide peace of mind with guaranteed returns. They’re straightforward and safe, which might suit you if you’re saving for a near-term goal (like a wedding in a year or two) and can’t afford to lose any principal. - If You Want Moderate to High Returns Over the Long Term

Mutual funds—especially equity funds—might be your best bet. While you’ll face market volatility, sticking to a longer timeframe (5 years or more) can potentially yield returns that outpace inflation. - If You’re Looking for a Balanced Approach

It’s not necessarily a matter of choosing “either-or.” Many beginners start with a mixed strategy—placing a portion of their savings in FDs for stability and another portion in mutual funds for growth. Over time, as they become more comfortable, they may adjust the balance. - If You Value Tax Benefits

Equity-linked savings schemes (ELSS) in mutual funds offer tax deductions under Section 80C, with a 3-year lock-in. Fixed deposits also have tax-saving FDs with a 5-year lock-in, but their returns could be lower compared to an ELSS over the same period.

Practical Tips for New Investors

Understand Your Goals

Are you building an emergency fund, saving for a short-term goal (like a bike purchase), or focusing on long-term wealth creation (like retirement)? Your objective should guide your choice. FDs are often used for short- to medium-term goals. Mutual funds can be a long-term wealth-building tool.

Diversify

You don’t have to go all-in on one type of investment. Spreading your money across FDs, mutual funds, and even recurring deposits (RDs) can cushion volatility and reduce risk.

Watch Out for Inflation

Inflation erodes your money’s purchasing power. If your FD gives you 5% to 6% interest but inflation stands at 6%, you might barely break even, or even lose ground when factoring in taxes. Mutual funds, while riskier, can potentially offer returns that outpace inflation over the long run.

Automate Your Investments

If you’re opting for mutual funds, consider a Systematic Investment Plan (SIP). This approach automates monthly contributions, helping you cultivate a disciplined saving habit without the stress of timing the market.

Revisit Your Portfolio

Even if you lean heavily toward FDs, it’s good to reassess your investments once a year or whenever you have a significant life event, like a job change, marriage, or birth of a child. You might discover that your needs or risk appetite have changed.

Conclusion

The battle of Fixed Deposits vs Mutual Funds doesn’t necessarily have a one-size-fits-all winner. Both serve valid purposes in a beginner’s financial toolkit. Fixed deposits offer a low-risk, predictable path—ideal for short-term goals and anyone uneasy about market swings. Mutual funds, meanwhile, present the potential for higher returns, particularly over longer periods. They can be a strong choice for young earners looking to harness the power of compounding and beat inflation.

Ultimately, the “best” investment is the one that aligns with your financial goals, comfort with risk, and time horizon. You can even blend these options—keeping part of your savings in FDs for peace of mind while venturing into mutual funds for growth. Whichever route you pick, the key is to start early, invest consistently, and stay informed. Remember, the journey to financial security isn’t an overnight sprint, but a steady marathon.

If you’ve found this breakdown helpful, share it with a friend or relative who’s stuck between Fixed Deposits vs Mutual Funds. You can also sign up for a free online session with financial advisors or check out trusted platforms that help guide new investors through these choices. Small, consistent steps today can translate into big wins for your future!

FAQs (Frequently Asked Questions)

Can I invest in both FDs and mutual funds simultaneously?

Absolutely. Many beginners adopt a hybrid strategy—putting part of their savings into FDs for safety and part into mutual funds for higher growth. This approach balances stability with potential returns.

What happens if I need my FD money before maturity?

You can usually break an FD prematurely, but you might incur a penalty or a lower interest rate than originally agreed. Always check the penalty clauses or partial withdrawal rules before you invest.

Are there any lock-in periods for mutual funds similar to FDs?

Certain mutual funds, like Equity Linked Savings Schemes (ELSS), have a mandatory 3-year lock-in if you’re investing for tax benefits. Other mutual funds generally don’t have a strict lock-in period, although some may charge an exit load if you withdraw within a certain timeframe.

How do taxes differ between fixed deposits and mutual funds?

- Fixed Deposits: Interest is fully taxable as per your income tax slab, and TDS applies if yearly interest exceeds ₹40,000 (₹50,000 for senior citizens).

- Mutual Funds: Taxation depends on the type of fund (equity or debt) and holding period. Equity funds sold after 1 year incur a 10% LTCG tax (beyond ₹1 lakh of gains), while debt funds have different rates and holding periods.

Which option is better for an emergency fund—FD or mutual fund?

An emergency fund typically requires easy liquidity and minimal risk. A short-term FD can be a decent choice, although you’d face a small penalty for premature withdrawal. For instant access, a high-interest savings account or liquid mutual funds might be more convenient, though they still carry some degree of risk.

Is there a minimum amount required to start investing in mutual funds?

Most mutual funds allow Systematic Investment Plans (SIPs) starting at just ₹500 per month. Some funds even let you start at ₹100, making it accessible for individuals with varying income levels.

How often should I review my FD and mutual fund investments?

Checking your FDs is straightforward; just ensure you’re aware of the maturity dates and interest rates. For mutual funds, a quarterly or annual review is often enough to gauge performance and reassess alignment with your goals. If there’s a major life change—like marriage or a job switch—review more frequently.

Do seniors benefit more from FDs or mutual funds?

Senior citizens often prefer FDs due to the higher interest rates offered (senior citizen FD rates are usually 0.5% more than regular rates). However, seniors with a higher risk appetite and a longer investment horizon could benefit from hybrid or balanced mutual funds. Always consider individual circumstances, like income stability and health expenditures.

Does it make sense to invest in mutual funds if I’m only planning for 1–2 years?

If your investment horizon is very short (less than 2 years), mutual funds—especially equity-focused ones—may not be ideal due to market volatility. A short-term FD or a low-risk debt mutual fund could be better suited for such a timeframe.

In the Fixed Deposits vs Mutual Funds debate, remember that each has its role. Choose what aligns best with your financial goals and comfort with risk, and don’t hesitate to consult a financial advisor if you’re unsure. The most important step is simply getting started on your investment journey. Good luck, and happy investing!