For the last few years, the investment world has been noisy. Everyone was talking about crypto, Futures & Options (F&O), and quick-money schemes. The humble Public Provident Fund (PPF) was often ignored. It was seen as the “grandparent” of investments, boring, slow, and old-fashioned.

But in 2026, the game has changed completely.

With the Union Budget 2026-27 and the New Income Tax Act 2025 coming into play, the rules of wealth creation have been rewritten. The government has decided to bring “boring” back in style. They have taken the PPF and given it a massive upgrade.

If you are a young earner in a city like Indore, Surat, or Coimbatore, and you want to build serious wealth without losing sleep over stock market crashes, this article is for you. We are going to talk about how the “New” PPF has reclaimed its throne as the King of Debt investments.

We will explore how a simple change in the deposit limit can help you build a corpus of ₹54 Lakhs, and the best part? The taxman cannot touch a single rupee of it.

Let’s dive into the PPF limit increase 2026 and why it matters for your wallet.

1. The Big Change: From ₹1.5 Lakh to ₹2 Lakh

For a very long time, the maximum money you could put into your PPF account was capped at ₹1.5 lakh per year. This was a decent amount, but as salaries grew and inflation rose, it started to feel a bit small.

Budget 2026 has introduced a major enhancement that reinvigorates this instrument.

The Headline News: The annual deposit limit for the Public Provident Fund has been increased from ₹1.5 lakh to ₹2 lakh.

Why is this such a big deal?

Think of your investment portfolio like a cricket team. You have your aggressive batsmen (Stocks/Equity) who hit sixes but also get out for zero. Then, you have your “The Wall” (Rahul Dravid style), the player who never gets out and keeps the scoreboard ticking.

PPF is your “Wall.” It is the defensive core of your portfolio. By increasing the limit to ₹2 lakh, the government is allowing you to protect more of your money from market risks and taxes. This increase allows for a larger quantum of tax-free compounding.

For a young investor in a Tier 2 city, where saving huge amounts can be tough, this new limit is likely all the “safe” investment room you will ever need. You don’t need to look for complicated corporate bonds or risky chit-funds. You just need to maximize this one account.

2. The Math: How ₹2 Lakh Becomes ₹54 Lakh

Let’s get to the most exciting part, the numbers. Many people ignore PPF because they think 7.1% interest is “too low.”

They forget one magic word: Compounding.

When you invest in PPF, you are looking at a 15-year lock-in period. To many, 15 years sounds like a lifetime. But to a compound interest calculator, 15 years is just the warm-up act. The longer you stay, the faster your money grows.

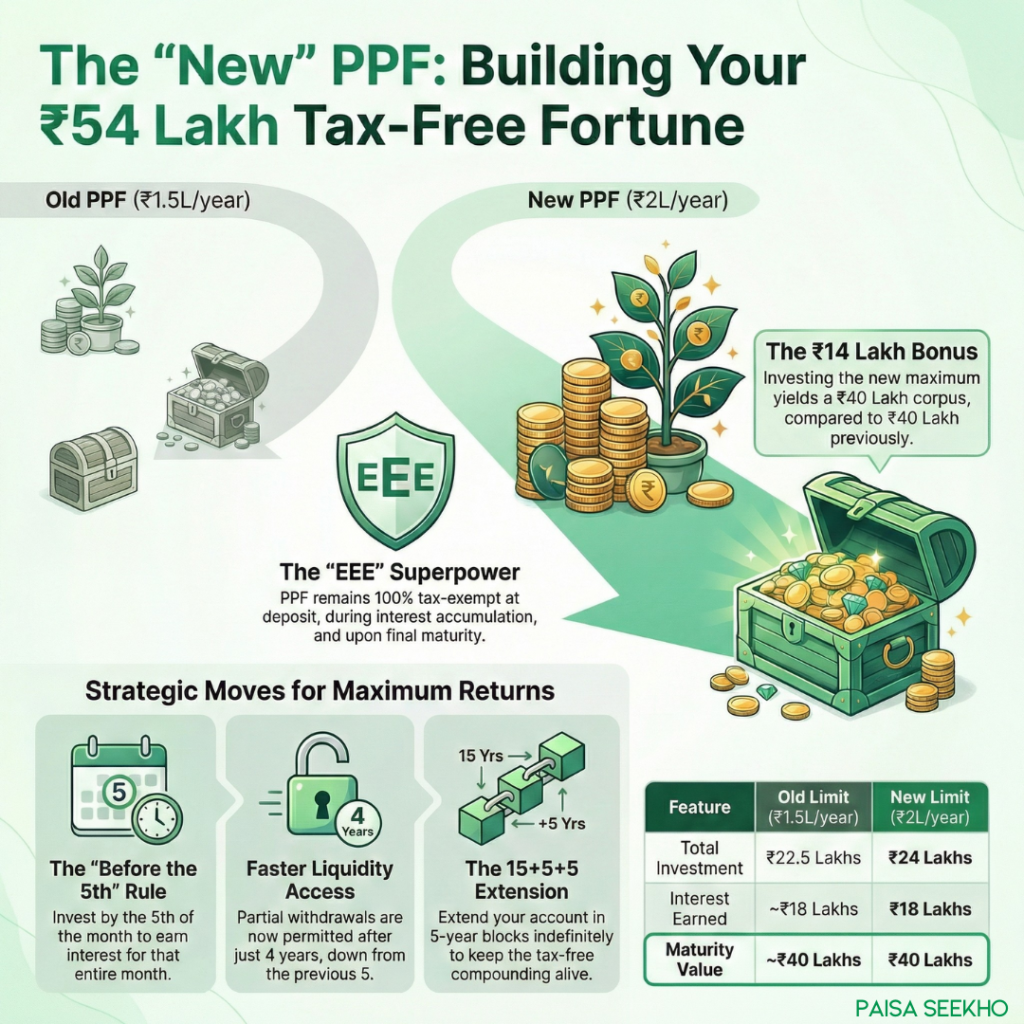

Scenario A: The Old Way (Limit ₹1.5 Lakh)

If you invested the old maximum of ₹1.5 lakh every year for 15 years at the current rate of 7.1%:

- Total Investment: ₹22.5 Lakhs

- Interest Earned: ~₹18 Lakhs

- Final Maturity Value: ~₹40 Lakhs

That is a great amount. But let’s look at the new superpower.

Scenario B: The New Way (Limit ₹2 Lakh)

Now, thanks to the budget update, you increase your contribution to the new limit of ₹2 lakh annually.

- Total Investment: ₹30 Lakhs

- Interest Earned: ~₹24 Lakhs

- Final Maturity Value: ~₹54 Lakhs

The Difference:

By investing just ₹50,000 more per year (which is roughly ₹4,000 extra per month), your final payout increases by ₹14 Lakhs!

This ₹54 Lakh is not a small amount. In a Tier 2 city, this could be:

- The down payment (or even full payment) for a house.

- A massive fund for your child’s higher education.

- The seed capital for your own business.

And remember, this calculation assumes the interest rate stays at 7.1%. If rates go up in the future, this amount gets even bigger.

3. The “EEE” Superpower: Why Tax-Free Matters

In the world of investing, it’s not about what you earn; it’s about what you keep.

This is where the PPF stands undefeated. It enjoys a status called EEE. This stands for:

- Exempt (Investment): The money you put in (up to the limit) reduces your taxable income under Section 80C.

- Exempt (Interest): The interest you earn every year is NOT taxed.

- Exempt (Maturity): When you withdraw the full ₹54 Lakhs after 15 years, you pay zero tax.

Why is this important in 2026?

Let’s compare this to other “safe” options to understand why the Tax free investment India tag is so valuable.

The Comparison: PPF vs. Fixed Deposit (FD)

Let’s say you put that same ₹2 Lakh in a Bank Fixed Deposit.

- Interest Rate: Small Finance Banks might offer you 8.25%. This looks higher than PPF’s 7.1%, right?

- The Trap: FD interest is fully taxable.

- The Reality: If you are in the 30% tax bracket, your 8.25% return drops to roughly 5.7% after tax.

- The Result: The “lower” interest rate of PPF (7.1%) actually beats the “higher” rate of the FD in your pocket.

The Comparison: PPF vs. Sovereign Gold Bonds (SGB)

Previously, people bought SGBs from the stock market because they were considered tax-free. But the Budget 2026 changed the rules. Now, capital gains on secondary market SGBs are taxable. This makes PPF one of the very few remaining 100% tax-free havens for Indian investors.

4. The Liquidity Hack: It’s Not Locked as Tight as You Think

The biggest complaint young investors have about PPF is: “But my money is stuck for 15 years!”

We understand. When you are 25, blocking money until you are 40 feels scary. What if you have a medical emergency? What if you need money for a wedding?

Budget 2026 has addressed this fear directly.

The Liquidity Improvement:

The government has relaxed the withdrawal rules. Previously, you had to wait 5 years before you could make a partial withdrawal. Now, partial withdrawals are permitted after 4 years.

This small change is significant. It reduces the “rigidity” of the scheme. It means that once you cross that initial 4-year hurdle, your PPF account starts acting like a semi-liquid emergency fund. You can access a portion of your money if life throws a curveball at you.

Strategy tip:

Do not treat PPF as an ATM. Just knowing that the money can be withdrawn after 4 years should give you the confidence to start the account today.

5. PPF vs. VPF vs. ELSS: The Battle of Section 80C

With the limit increased to ₹2 Lakh, you might be wondering: “Should I put all my money here, or look at other tax-savers?”

Let’s compare the PPF interest rate 2026 and features against its biggest competitors: VPF (Voluntary Provident Fund) and ELSS (Equity Linked Savings Scheme).

| Feature | PPF (Public Provident Fund) | VPF (Voluntary Provident Fund) | ELSS (Equity Mutual Funds) |

| Who can open? | Everyone (Salaried, Business, Freelancer) | Only Salaried Employees | Everyone |

| Risk Level | Very Low (Sovereign Guarantee) | Very Low | High (Market Linked) |

| Returns (2026) | 7.1% (Fixed/Floating) | ~8.15% (Depends on EPFO) | 12-15% (Historical Avg) |

| Tax on Maturity | Tax-Free | Taxable if interest > ₹2.5L/yr | Taxable (LTCG > ₹1.25L) |

| Lock-in | 15 Years (Partial w/d after 4 yrs) | Until Retirement (mostly) | 3 Years |

The Verdict:

- Choose ELSS if you want high growth and can handle the stock market going up and down. But remember, ELSS returns are taxable if they exceed ₹1.25 Lakhs.

- Choose VPF if you are a salaried employee who wants slightly higher interest than PPF. However, if your contribution exceeds ₹2.5 Lakhs a year, the interest becomes taxable.

- Choose PPF if you want absolute peace of mind. It is the only option that is open to everyone (even if you quit your job and start a business) and remains 100% tax-free regardless of how much interest you earn.

For a balanced portfolio, we recommend filling your “Defensive Core” with PPF first.

6. Steps to Maximize Your Returns

If you have decided to go for the ₹54 Lakh corpus, here is how you should execute it to squeeze out every extra rupee of interest.

Rule 1: The “Before the 5th” Rule

The government calculates PPF interest on the lowest balance between the 5th and the last day of the month.

- Mistake: Investing on the 6th of April. You lose interest for the whole month of April.

- Smart Move: Invest on or before the 5th of April.

If you can, invest the full ₹2 Lakh lump sum before April 5th every year. This ensures you earn interest on the full amount for the full 12 months.

Rule 2: Consistency is Key

You cannot invest ₹2 Lakh one year and ₹500 the next and expect the same results. To hit that ₹54 Lakh target, you need the discipline to invest ₹2 Lakh every single year for 15 years.

Tip: Set up a standing instruction from your bank account.

Rule 3: The Extension Trick (The 15+5+5 Rule)

What happens after 15 years? Do you have to take the money out?

No!

You can extend your PPF account in blocks of 5 years indefinitely. And guess what? You can continue to earn the tax-free interest.

If you start at age 25, your account matures at 40.

- Extend it for 5 years -> Matures at 45.

- Extend it for another 5 -> Matures at 50.

By the time you are 50, that ₹54 Lakhs would have compounded into a significantly larger amount, serving as a massive retirement nest egg.

7. Conclusion: The Foundation of Your Wealth

In the Strategic Wealth Paradigm of 2026, we talk a lot about “Portfolio Building” rather than just chasing products.

Building a portfolio is like building a house. You can have fancy windows (Stocks) and a nice paint job (Gold), but if your foundation is weak, the house will collapse during a storm.

The Public Provident Fund is your concrete foundation.

It is safe. It is government-backed. And now, with the limit raised to ₹2 Lakh, it is bigger and better than ever.

In a world where taxes are rising and “loopholes” like SGBs are closing, the PPF stands tall as the last fortress of tax-free wealth.

Action Plan:

- Log in to your net banking today.

- Check your PPF limit usage for this year.

- If you haven’t maxed it out to ₹2 Lakh, try to add more before March 31st.

- Start planning your finances to hit the ₹2 Lakh target starting next April.

Your future self (with ₹54 Lakhs in the bank) will thank you.

FAQs

Q: What is the new PPF deposit limit for 2026?

A: The Union Budget 2026-27 has increased the annual deposit limit for the Public Provident Fund (PPF) from ₹1.5 lakh to ₹2 lakh. This allows investors to deposit up to ₹2 lakh per financial year in their PPF account.

Q: How much corpus can I build with 2 lakh annual PPF investment?

A: If you invest ₹2 lakh annually in a PPF account for 15 years at an interest rate of 7.1%, you will build a tax-free corpus of approximately ₹54 lakh.

Q: Is PPF interest taxable under New Tax Act 2025?

A: No. PPF continues to enjoy the EEE (Exempt-Exempt-Exempt) status. The interest earned and the maturity amount remain completely tax-free under the New Income Tax Act 2025.

Q: Can I withdraw money from PPF before 15 years?

A: Yes, partial withdrawals are allowed. The rules have been relaxed in 2026 to permit partial withdrawals after the completion of 4 years (previously 5 years).

Q: What is the current PPF interest rate in 2026?

A: As of early 2026, the PPF interest rate is 7.1% per annum.