For the last five years, smart investors in India had a favorite “cheat code.” It was the ultimate financial hack, whispered in WhatsApp groups and shouted by YouTube influencers.

The hack was simple: “Don’t buy Sovereign Gold Bonds (SGBs) when the government issues them. Buy them from the stock market (secondary market) instead.”

Why? Because often, these bonds traded at a discount on the stock exchange. You could buy gold cheaper than the market rate, earn 2.5% interest every year, and when the bond matured, your entire profit was 100% Tax-Free.

It was the perfect investment. It was safe, it paid interest, and it beat the taxman. It felt like a free lunch.

But in 2026, the government decided that the free lunch was over.

With the Union Budget 2026-27, a small but deadly change was made to the taxation rules of Sovereign Gold Bonds. This change has caused panic selling, a crash in bond prices, and a complete rethink of how Indians should invest in gold.

If you are holding SGBs, or were planning to buy them to save tax, you need to read this. The “Tax Hack” is dead. But don’t worry, a new hero has emerged to take its place.

In this article, we will decode the new SGB taxation 2026 rules, explain why Gold ETFs are the new champions, and give you the Best way to invest in gold India for the coming decade.

1. The Shock: What Changed in Budget 2026?

To understand the panic, we first need to understand the old rule.

The Old Rule (Pre-2026):

The law stated that “Capital Gains arising on redemption of Sovereign Gold Bonds” were exempt from tax. Most investors (and even many experts) interpreted this to mean that anyone who held the bond until maturity got the tax exemption, whether they bought it directly from the RBI or from someone else on the Stock Exchange.

The New Rule (2026 Onwards):

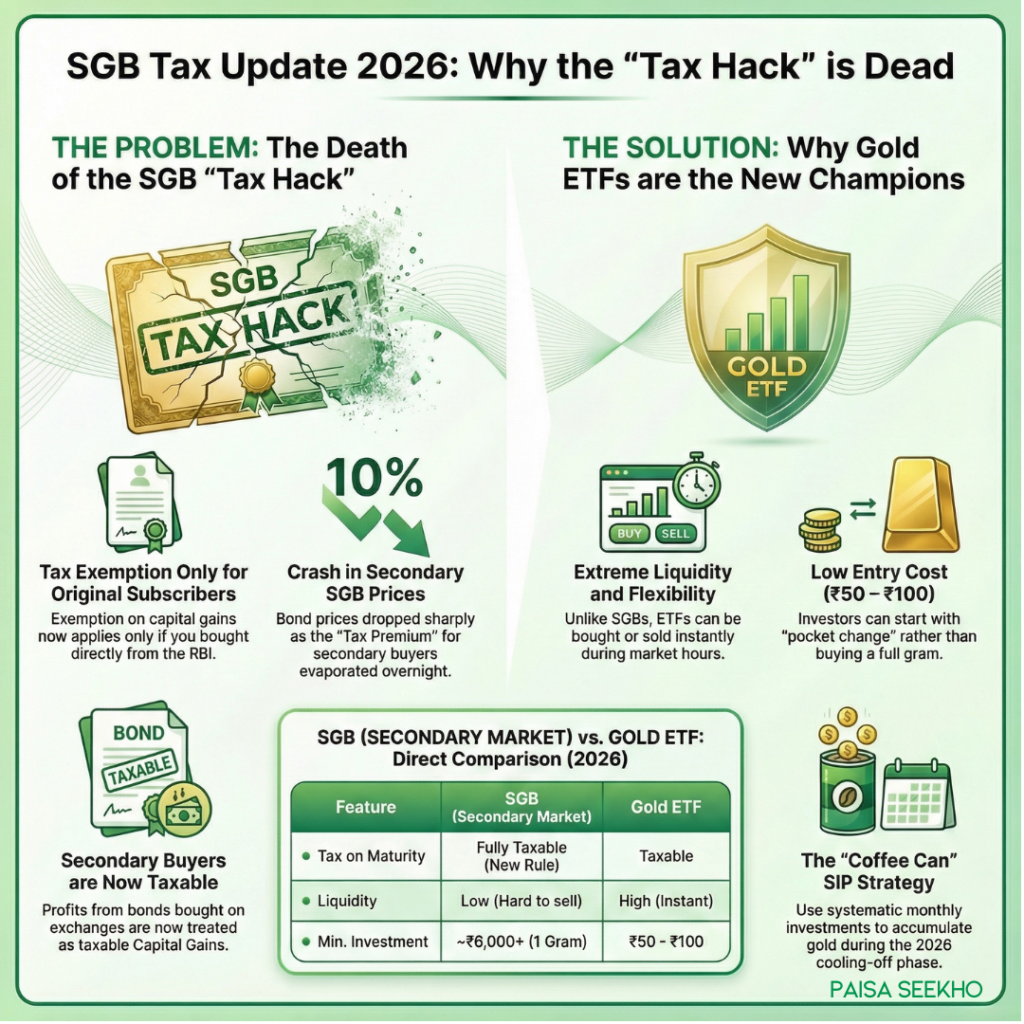

The Union Budget 2026 has issued a critical clarification that acts like a sledgehammer to the secondary market. The amendment states: The tax exemption on capital gains at redemption applies ONLY to original subscribers.

What does “Original Subscriber” mean?

- Scenario A: You applied for the SGB when the government opened the issue (Series I, Series II, etc.). You are the original subscriber. You are safe. Your returns at maturity are still tax-free.

- Scenario B (The Problem): You missed the issue. You went to your Demat account (Zerodha, Groww, Upstox) and bought an existing SGB listed on the exchange (e.g., SGBNOV25). You are a secondary buyer.

Under the new 2026 rules, if you are the person in Scenario B, your “Tax Hack” is gone. Even if you hold that bond until it matures in 2030 or 2032, the profit you make (the difference between the buying price and the maturity price) will be treated as Capital Gains and taxed according to your slab or the specified long-term rate.

This seemingly small change has completely destroyed the “arbitrage” opportunity that savvy investors were using.

2. The Impact: Why SGB Prices Crashed 10%

Have you checked the prices of listed SGBs lately? If not, brace yourself. Following the budget announcement, secondary market SGB prices saw a sharp correction, falling by nearly 10%.

Why did this happen? It’s simple economics.

The price of any asset is determined by its perceived value.

Previously, an SGB on the secondary market had two value components:

- The Gold Value: The price of the underlying 1 gram of gold.

- The Tax Premium: The value of the future tax saving. Buyers were willing to pay a bit more (or accept a smaller discount) because they knew the final payout would be tax-free.

Overnight, the government removed Component #2 for secondary buyers. The “Tax Premium” evaporated.

Suddenly, that SGB was no longer a magical tax-saving instrument. It became just another taxable debt instrument that tracks gold.

The “Tax Arbitrage” Evaporation:

Smart money realized this instantly. If I buy an SGB on the exchange now, I have to pay tax on the profit. So, why should I pay a premium price? Sellers rushed to exit, and buyers vanished. The result? A 10% crash. The premium that these bonds commanded has disappeared.

For a young investor in 2026, this means buying SGBs on the exchange is no longer a clever “hack.” It is now a tax-inefficient way to hold gold, especially since these bonds often suffer from low liquidity (it’s hard to sell them quickly when you need money).

3. The Solution: Enter Gold ETFs (The New Standard)

So, if the SGB tax hack is dead, where should you put your money?

You still need gold in your portfolio. Gold is the “goalkeeper” of your wealth, it protects you when the stock market crashes or when inflation spikes.

With the SGB tax advantage diluted for secondary buyers, Gold Exchange Traded Funds (ETFs) have regained prominence as the most efficient route for retail exposure.

What is a Gold ETF?

Think of a Gold ETF like a Mutual Fund that buys only one thing: 99.9% pure gold bars.

When you buy 1 unit of a Gold ETF on the stock market, you are electronically buying a tiny fraction of that gold bar stored in a secure vault.

Why ETFs are winning in 2026:

1. No “Original Subscriber” Confusion:

With ETFs, the rules are clear. You buy, you sell, you pay tax on the profit. There is no hidden clause about “who bought it first.” The clarity is refreshing after the SGB confusion.

2. Extreme Liquidity:

Have you ever tried to sell an SGB on the stock market? It can be a nightmare. Sometimes there are no buyers, or the price offered is way below the actual gold rate. Gold ETFs are highly liquid. You can buy or sell them in seconds during market hours, just like a share of Reliance or Tata Motors. For a young investor who might need cash for an emergency, this liquidity is priceless.

3. The “Pocket Change” Entry:

To buy an SGB, you usually need to buy at least 1 gram. In 2026, with gold prices soaring, 1 gram costs thousands of rupees (approx ₹6,000+). Gold ETFs allow for “fractional” ownership. You can buy 1 unit (which might represent 0.01g of gold) for as little as ₹50 to ₹100. This means you can invest the price of a coffee into gold. You don’t need to save up for months to buy 1 gram.

4. Head-to-Head: SGB (Secondary) vs. Gold ETF

Let’s look at the data. If you are standing at the crossroads today, deciding between buying an old SGB from the market or a fresh Gold ETF, here is how they stack up.

| Feature | SGB (Secondary Market Purchase) | Gold ETF (Exchange Traded Fund) |

| Tax on Maturity | Taxable (New 2026 Rule) | Taxable |

| Interest Income | 2.5% per year (Taxable) | Nil |

| Liquidity | Low/Medium (Hard to sell quickly) | High (Instant selling) |

| Entry Cost | High (~₹6,000+ for 1 gram) | Low (~₹50 – ₹100) |

| Lock-in Period | Matures after 8 years (from issue date) | None (Sell whenever you want) |

| Expense Ratio | Nil | Low (0.5% – 1.0%) |

| Risk | Price risk + Liquidity risk | Price risk only |

The Verdict:

- The SGB Advantage: The only remaining advantage of the SGB is the 2.5% annual interest. However, this interest is fully taxable. And to get it, you have to lock your money into an instrument that is hard to sell.

- The ETF Advantage: ETFs offer freedom. You can buy ₹100 worth today and sell it tomorrow. You don’t have to worry about maturity dates or finding a buyer. In a world without the tax-free benefit, the liquidity of ETFs makes them the superior choice for most young investors.

5. The 2026 Strategy: “Cooling Off” & Accumulation

Now that we know where to invest (ETFs), let’s talk about when and how.

The gold market has been on a wild ride. In 2024 and 2025, gold prices rallied significantly due to wars, geopolitical tensions, and central banks buying up gold.

But markets don’t go up in a straight line forever.

The “Cooling Off” Phase:

Analysts predict a moderation or consolidation phase for gold in 2026. After a massive rally, prices often take a breather. They might stay flat or dip slightly. This is good news for you.

If you are a young investor (22-28 years old), you are in the “Accumulation Phase” of your life. You want prices to be stable so you can buy more.

The Strategy: Systematic Investment Plan (SIP) in Gold ETFs

Don’t dump all your money into Gold ETFs at once. Since prices are cooling off, use a systematic approach.

- Set a Target: Aim to have 5-10% of your total portfolio in Gold. (If you have ₹1 Lakh invested, ₹5,000-₹10,000 should be in Gold).

- The “Coffee Can” SIP: Every time you get your salary, put a small amount (e.g., ₹500 or ₹1,000) into a Gold ETF.

- Buy the Dips: If you see gold prices fall by 2-3% in a week, buy a few extra units.

- Hold for Stability: Don’t check the price every day. Gold is there to save you when your stock market investments fall.

This “SIP Strategy” takes advantage of the low unit cost of ETFs. You can’t do a ₹500 SIP in SGBs because 1 gram is too expensive. But with ETFs, you can build your gold locker rupee by rupee.

6. Common Myths Busted (Don’t Be Fooled!)

There is a lot of misinformation floating around social media right now. Let’s bust the biggest myths about Sovereign Gold Bond capital gains tax.

Myth 1: “SGBs are totally useless now.”

Fact: No. If you apply for a fresh issue of SGBs directly from the government (Primary Market) and hold it till maturity, it is still tax-free. The problem is only for those buying old bonds from the stock market.

Myth 2: “I can sell my SGB back to the government anytime to get tax benefits.”

Fact: You can only redeem SGBs with the RBI after 5 years, and only on specific dates. It gives you tax benefits, but it lacks the instant liquidity of an ETF.

Myth 3: “Digital Gold (on payment apps) is better than ETFs.”

Fact: Be very careful. “Digital Gold” bought on apps often has a huge spread (difference between buying and selling price) of 3-6%. Plus, it is not regulated by SEBI like ETFs are. ETFs are safer and cheaper.

7. Conclusion: Adapt or Pay the Price

The investment landscape of 2026 is ruthless to those who cling to old habits. The “SGB Secondary Market Hack” was great while it lasted, but it is now a trap for the uninformed.

If you buy an SGB on the exchange today thinking it’s tax-free, you are signing up for a nasty surprise from the Income Tax Department when it matures.

Your Action Plan for 2026:

- Stop hunting for SGB bargains on the stock exchange. The tax arbitrage is dead.

- Start a small SIP in a liquid Gold ETF (like Nippon, SBI, or HDFC Gold ETF).

- Treat Gold as a hedge, not a lottery ticket. Allocate 5-10% of your portfolio and let it sit.

The era of easy tax loopholes is ending. The era of simple, transparent, and liquid investing has begun. Make the switch to ETFs and keep your wealth journey clean and efficient.

FAQs

Q: Is SGB profit taxable if bought from secondary market in 2026?

A: Yes. According to the Union Budget 2026, the tax exemption on capital gains at redemption applies only to original subscribers. If you buy an SGB from the secondary market (stock exchange), the capital gains at maturity are fully taxable.

Q: Why did SGB prices fall in 2026?

A: SGB prices in the secondary market fell by approximately 10% because the “tax arbitrage” disappeared. Previously, buyers paid a premium for the tax-free status. Once the government clarified that secondary buyers would be taxed, this premium evaporated, causing prices to crash.

Q: Are Gold ETFs better than SGBs now?

A: For most new investors, Yes. Gold ETFs offer high liquidity, low entry cost (starting at ₹50-₹100), and transparency. Since secondary market SGBs are now taxable just like ETFs, the liquidity and ease of ETFs make them a superior choice for tactical allocation.

Q: What is the best way to invest in gold in India in 2026?

A: The best strategy for 2026 is a Systematic Investment Plan (SIP) in Gold ETFs. Given the prediction that gold prices will moderate/consolidate in 2026, systematically accumulating ETFs allows investors to average their cost without the lock-in constraints of SGBs.