Executive Summary: The Year of the Great Recalibration

As the Indian economy approaches the close of the fiscal year 2025-26, the nation stands at a complex intersection of macroeconomic stability and microeconomic transformation. For the astute observer (and particularly for the aspiring investor in India’s emerging Tier 2 and Tier 3 cities) the past twelve months have served as a rigorous lesson in adaptation. The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, was not merely a statement of accounts but a philosophical pivot, accelerating the transition from a state-subsidized savings model to a consumption-driven, asset-focused economy.

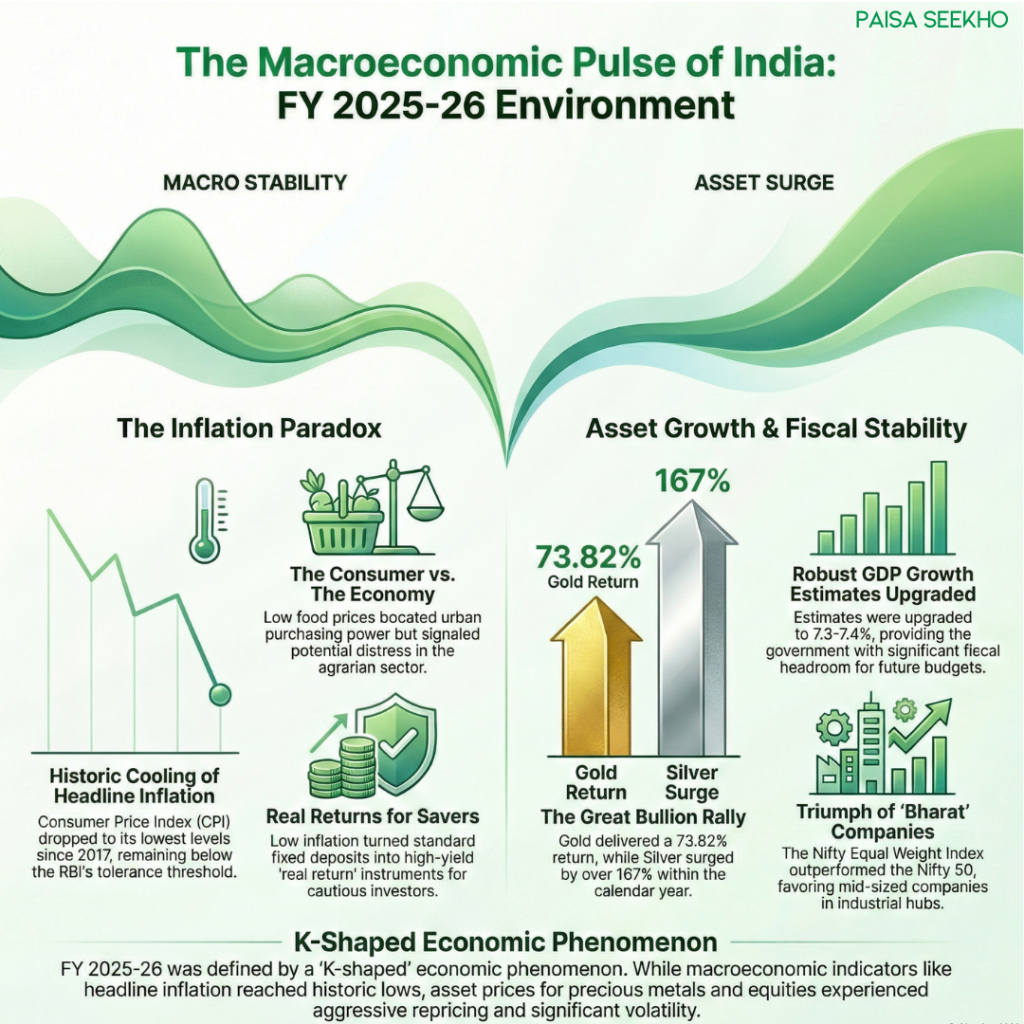

This comprehensive research report, commissioned to analyze the economic impact of Budget 2025 and to project the contours of the upcoming Budget 2026, aims to serve as a foundational document for wealth creation strategies. While the headline narratives of FY 2025-26 have been dominated by the spectacular rally in precious metals and the resilience of the broader equity markets, the underlying currents reveal a more nuanced story. We have witnessed a historic decoupling of consumer inflation, which plummeted to 1.33% by December 2025, from asset inflation, which saw gold deliver returns exceeding 73% and silver surging by over 167%.1

For the citizens of “Bharat”—the millions residing in cities like Coimbatore, Indore, Jaipur, and Bhubaneswar—this period has redefined the rules of engagement with money. The New Tax Regime has put more disposable income into pockets by eliminating tax liabilities for those earning up to ₹12 lakh, yet the removal of indexation benefits on debt and real estate has fundamentally altered long-term savings equations.3

In this exhaustive analysis, we dissect the granular impact of Budget 2025. We explore how the “infrastructure-led urbanization” promised in Budget 2025 has translated into tangible property appreciation in non-metro hubs, how the PM Vishwakarma scheme is reshaping the rural artisan economy, and why the removal of tax shelters is forcing a migration toward high-beta assets. Furthermore, we synthesize the collective expectations of industry bodies and economic analysts to forecast the probable interventions in Budget 2026, offering a strategic roadmap for maximizing investment returns in the coming fiscal year.

1. The Macroeconomic Environment of FY 2025-26

To accurately assess the impact of Budget 2025, one must first anchor the analysis in the broader economic reality that unfolded throughout the fiscal year. FY 2025-26 was characterized by a distinct “K-shaped” phenomenon where macroeconomic stability indicators (like CPI inflation) improved dramatically, while asset prices experienced volatility and aggressive repricing.

1.1 The Inflation Anomaly: Stability or Stagnation?

One of the most striking outcomes of the fiscal policies enacted in 2025 has been the dramatic cooling of headline inflation. By late 2025, India found itself in a rare low-inflation regime, a scenario that defies the historical trend of emerging economies grappling with price instability.

Historical Context and Current Trends

For nearly a decade, India battled sticky inflation. However, data from the Ministry of Statistics and Programme Implementation (MoSPI) reveals that by the third quarter of FY 2025-26, the Consumer Price Index (CPI) had largely been tamed. In September 2025, headline inflation dropped to 1.54%, the lowest since June 2017.5 This downward trajectory continued, with October seeing a plunge to 0.25% and November recording 0.71%.6 Even as the year closed, December 2025 inflation stood at a benign 1.33%, remaining well below the Reserve Bank of India’s lower tolerance threshold for four consecutive months.2

Table 1: Monthly Inflation Dynamics (Late 2025) 2

| Month | Headline Inflation (CPI) | Rural Inflation | Urban Inflation | Food Inflation (CFPI) | Key Economic Signal |

| September 2025 | 1.54% | Lower | 2.04% | -2.28% | Lowest headline rate since 2017; significant relief for urban consumers. |

| October 2025 | 0.25% | -0.25% | 0.88% | Negative | Deflationary pressures emerge in the rural basket; agrarian income stress visible. |

| November 2025 | 0.71% | 0.10% | 1.40% | -3.91% | Sustained negative food inflation indicates supply glut or demand destruction. |

| December 2025 | 1.33% | -3.08% | -2.09% | -2.71% | Slight uptick driven by fuel/light, but food remains in deflation (-2.71%). |

The Implication for Investors The persistence of negative food inflation—recorded at -2.71% in December 2025—is a double-edged sword.2

- For the Consumer: It represents a massive boost in real purchasing power. Households in Tier 2 and 3 cities, where food constitutes a larger portion of the consumption basket, effectively saw their cost of living stagnate or decline. This “saved capital” likely found its way into asset markets, explaining the liquidity that supported the gold and mid-cap equity rally.

- For the Economy: Persistent deflation in food prices signals potential distress in the agrarian sector. Since rural demand drives sectors like FMCG, two-wheelers, and tractors, this data point explains the sluggish volume growth seen in some mass-market consumer goods companies.

- For the Investor: A low-inflation environment typically precedes an interest rate cut cycle. When inflation is at 1.33%, a fixed deposit offering 7% provides a massive “real return” of nearly 5.7%. However, as we will discuss later, the tax changes in Budget 2025 complicated this equation.

1.2 The Divergence of Asset Prices

While the cost of survival (food, basic utilities) remained low, the cost of prosperity (assets like gold, silver, and real estate) surged. This divergence suggests that Budget 2025 facilitated a wealth transfer to asset owners.

- Precious Metals: The year 2025 will be remembered as the year of bullion. Gold delivered a 73.82% return, moving from ₹76,308/10g in January to ₹1,32,640/10g in December.1 Even more spectacularly, Silver delivered a 167% return, cementing its status as the “poor man’s gold” and a critical industrial metal.1

- Equity Markets: The divergence was visible here too. While the headline Nifty 50 offered respectable double-digit returns, the Nifty Equal Weight Index (which gives equal importance to smaller companies) outperformed significantly, returning over 15%.7 This indicates that the rally was broad-based, benefiting the mid-sized companies often headquartered or operating in Tier 2 industrial hubs.

1.3 GDP Growth and Fiscal Math

The backdrop for Budget 2025 execution was a robust GDP growth forecast. CRISIL’s chief economist noted that the budget preparation for 2026 is occurring under “better-than-expected” growth scenarios, with GDP estimates for FY 2025-26 upgraded to 7.3-7.4%.8 This robust growth, combined with higher nominal GDP, has kept tax collections buoyant. The fiscal deficit is estimated at 4.4% of GDP, showing a path of consolidation despite high capital expenditure (Capex) of ₹11.21 lakh crore.9

This macroeconomic stability—high growth, low inflation, and controlled deficit—provides the government with “fiscal headroom” for Budget 2026. For you, this is the most critical takeaway: the government can afford to give tax breaks in 2026 without breaking the bank.

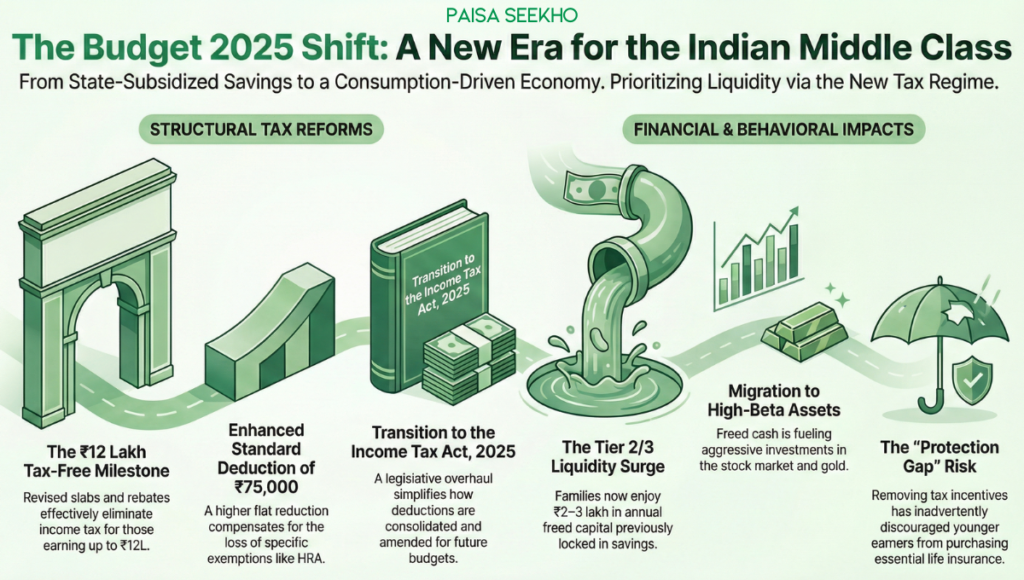

2. Personal Taxation and the Middle Class: The Budget 2025 Shift

The most tangible impact of any Union Budget is felt in the “take-home salary” of the middle class. The impact of Budget 2025 was transformative in this regard, aggressively pushing the transition toward a simplified, exemption-free tax structure.

2.1 The New Tax Regime: Anatomy of the Change

Finance Minister Nirmala Sitharaman’s Budget 2025 made the New Tax Regime the default and, for many, the only logical choice. The policy intent was to reduce compliance burden and put discretionary cash into the hands of taxpayers, rather than forcing them into government-mandated savings schemes.

Key Structural Changes in Budget 2025:

- The ₹12 Lakh Tax-Free Milestone: The headline achievement of Budget 2025 was the adjustment of slabs and rebates such that individuals earning up to ₹12 lakh annually effectively pay zero income tax under the New Regime.3 This was achieved through a combination of revised slabs and the rebate under Section 87A.

- Enhanced Standard Deduction: To placate salaried employees who lost HRA and 80C benefits, the standard deduction was hiked to ₹75,000.9 This provided a flat reduction in taxable income, acknowledging the standard costs associated with employment.

- Slab Rationalization: The tax slabs were widened to ensure that income moves into higher tax brackets more gradually.

Table 2: The Budget 2025 Tax Slabs (New Regime) 3

| Income Slab (INR) | Tax Rate | Notes on Impact of Budget 2025 |

| 0 – 4,00,000 | Nil | Basic exemption limit. |

| 4,00,001 – 8,00,000 | 5% | Low rate encourages compliance among entry-level earners in Tier 2 cities. |

| 8,00,001 – 12,00,000 | 10% | The “sweet spot” for the middle class. |

| 12,00,001 – 16,00,000 | 15% | Moderate progression. |

| 16,00,001 – 20,00,000 | 20% | Still competitive compared to global standards. |

| 20,00,001 – 24,00,000 | 25% | High income bracket begins. |

| Above 24,00,000 | 30% | Peak rate applies. |

Financial Implication for Tier 2/3 Families

For a family in a city like Nagpur or Vizag, where the cost of living is lower than Mumbai, an annual household income of ₹12-15 lakh is substantial.

- Old Regime: To pay zero tax on ₹12 lakh, one would need to exhaust Section 80C (₹1.5L), Section 80D (₹25k), HRA (rent receipts required), and Home Loan interest (₹2L). This required locking away substantial capital and maintaining extensive paperwork.

- New Regime (Post-Budget 2025): The tax is zero (up to ₹12L) or minimal without any investment. This liberated nearly ₹2-3 lakh of annual liquidity per household that previously went into PPF or insurance.

- Result: This “freed capital” is the fuel that drove the 2025 consumption and asset rally. It allowed families to invest in higher-risk, higher-reward assets like the stock market or gold, or to spend on lifestyle upgrades, fueling the digital credit boom.12

2.2 The Repeal of the Income Tax Act, 1961

A critical, often overlooked technicality is the transition from the Income Tax Act, 1961 to the Income Tax Act, 2025. The upcoming Budget 2026 will likely be the first to propose amendments to this new Act.13

- Why this matters: The new Act fundamentally restructures how deductions are calculated. For instance, salary-related deductions (Standard Deduction, Leave Encashment, etc.) are now consolidated under Section 19 of the new Act. This structural cleanup means that future budgets (like 2026) can tweak a single section to provide broad-based relief rather than amending dozens of scattered clauses.

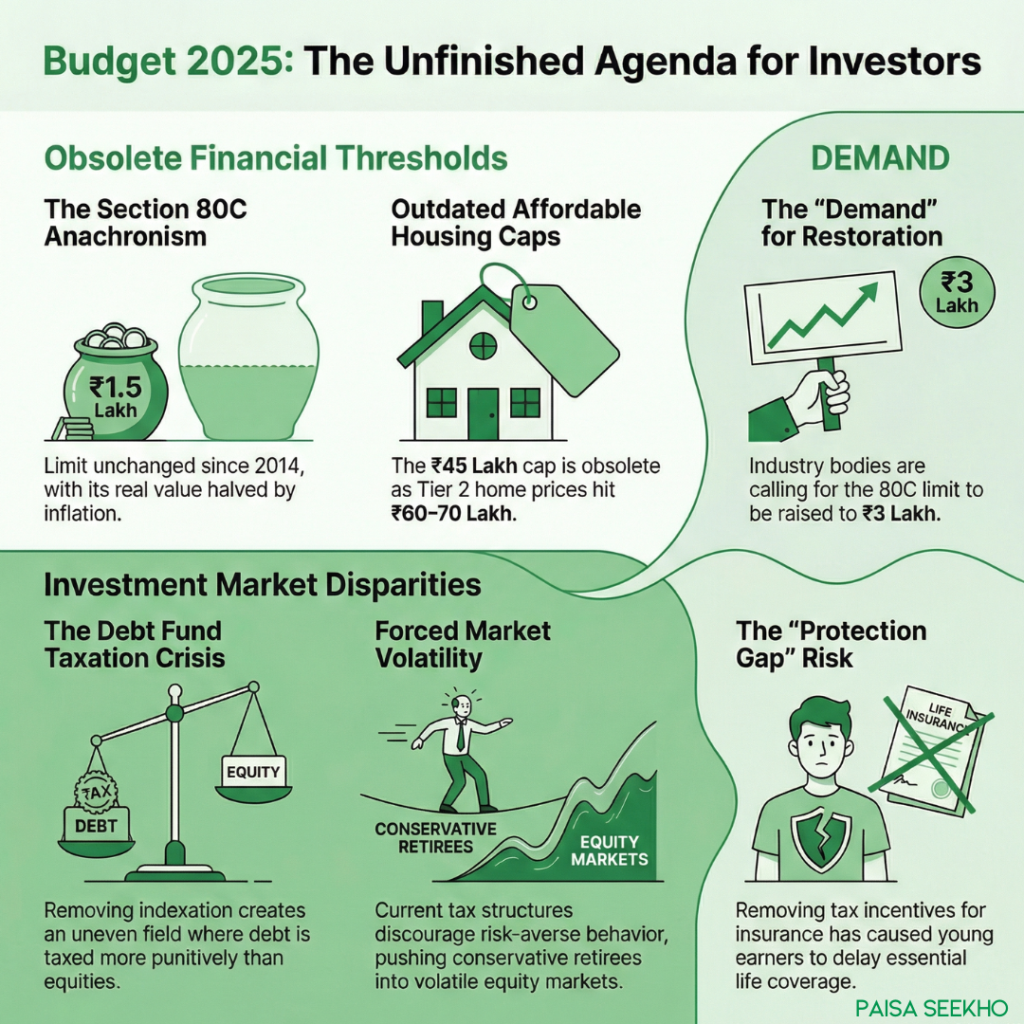

2.3 The “Savings Culture” Shock

While the liquidity boost was welcome, it had a side effect. By removing the incentive to save (via Section 80C), Budget 2025 inadvertently discouraged financial protection. Insurance industry data suggests a widening “protection gap,” where young earners in Tier 2 cities delayed purchasing life insurance because it no longer offered a tax break.14 This behavioral shift is a significant risk that financial planners are now urging the government to address in Budget 2026.

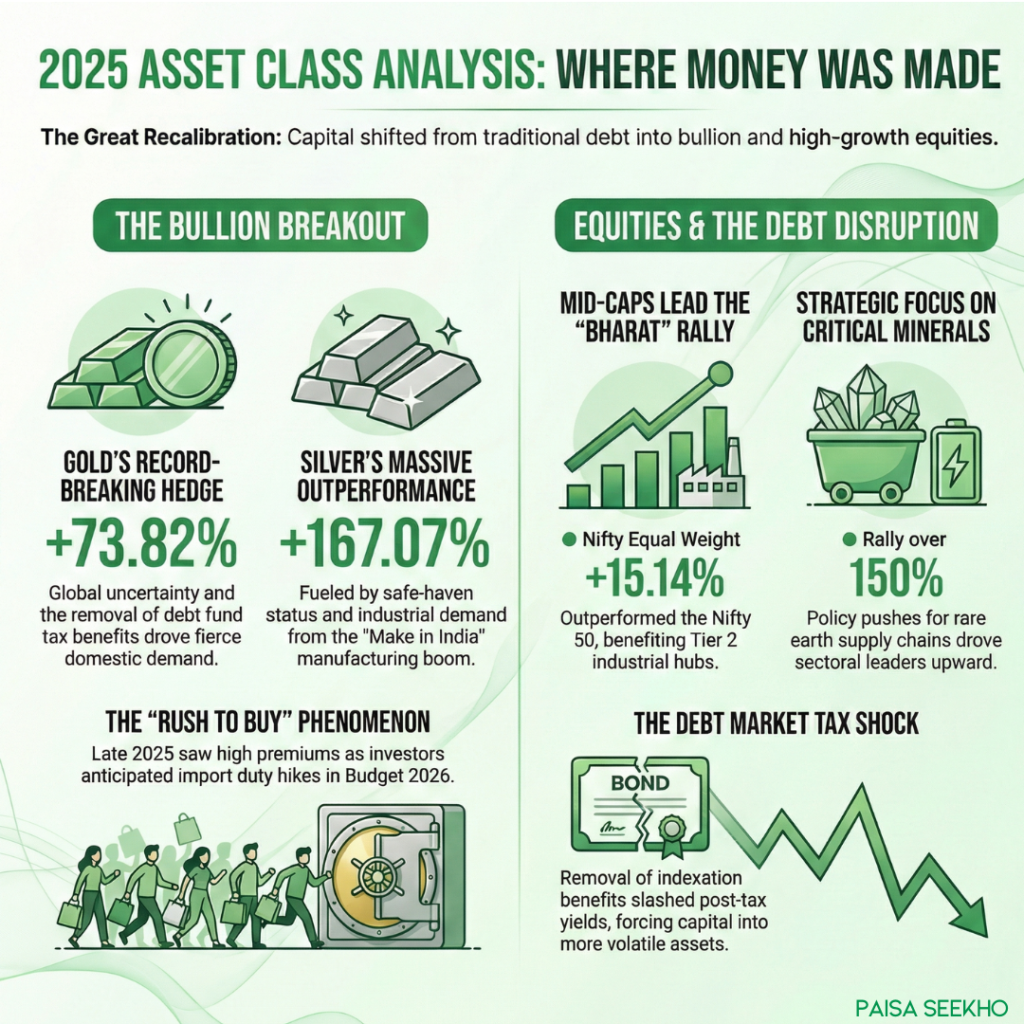

3. The Asset Class Analysis: Where Money Was Made in 2025

For you, the core question is: How did these policies affect investment returns? The year 2025 saw a complete upheaval in the traditional asset hierarchy.

3.1 The Golden Era: Bullion Market Performance

If there is one asset class that defined wealth creation in 2025, it was bullion. The performance of gold and silver far outstripped every other major asset class, driven by a perfect storm of global uncertainty and domestic demand.

Gold: The Ultimate Hedge Gold prices in India began the year at ₹76,308 per 10 grams. By December 31, 2025, the price had skyrocketed to ₹1,32,640 per 10 grams.1

- Return: 73.82% (Absolute return in one calendar year).

- Drivers: Beyond global wars and US dollar fluctuations, domestic demand in India was fierce. The removal of indexation on debt funds (discussed below) spooked conservative investors, pushing them back to the oldest asset in the book. Additionally, fears of an import duty hike in Budget 2026 led to a “rush to buy” in late 2025, pushing premiums to decade highs.15

Silver: The Outperformer

Often ignored, Silver delivered an eye-watering return.

- Jan 1, 2025: ₹85,913 per kg.

- Dec 31, 2025: ₹2,29,452 per kg.

- Return: 167.07%.1

- Investment Insight: Silver’s rally is driven by its dual nature—it is a precious metal and an industrial metal essential for solar panels and electronics (key “Make in India” sectors). For Tier 2 investors, Silver represented a high-beta play on the manufacturing boom.

Table 3: Bullion Returns in 2025 (The “Safe Haven” Rally) 1

| Asset | Price (Jan 1, 2025) | Price (Dec 31, 2025) | Absolute Return |

| Gold (10g) | ₹76,308 | ₹1,32,640 | +73.82% |

| Silver (1kg) | ₹85,913 | ₹2,29,452 | +167.07% |

3.2 Equity Markets: The Triumph of “Bharat” Companies

The equity market story in 2025 was one of breadth. While the Nifty 50 index (representing the largest 50 companies) delivered a modest return of roughly 11.88%, the broader market told a different story.

Nifty 50 vs. Nifty Equal Weight The Nifty Equal Weight Index, which assigns the same weightage to a mid-sized Tata company as it does to Reliance Industries, returned 15.14%.7

- The Interpretation: The “average” stock performed better than the “largest” stocks. This is consistent with the Tier 2/3 economic revival. Companies focused on domestic consumption, infrastructure, and manufacturing (often mid-caps) benefited more from Budget 2025’s Capex push than the export-oriented IT giants that dominate the Nifty 50.

- Sectoral Winners:

- Public Sector Undertakings (PSUs): Benefited from the government’s continued dividend demands and operational freedom.

- Critical Minerals: Stocks like Hindustan Copper rallied over 150% in FY26 16, driven by the government’s strategic push to secure rare earth supply chains—a direct outcome of policy focus on reducing import dependence.

3.3 The Debt Market Disruption: The Indexation Shock

The most controversial aspect of the fiscal landscape in 2025 was the treatment of Debt Mutual Funds. The Finance Act 2024 (and maintained in Budget 2025) removed the indexation benefit for debt funds, a move that fundamentally broke the bond market for retail investors.

- The Old Rule: Investors paid tax on gains after adjusting for inflation (Indexation). If inflation was 5% and the bond returned 7%, tax was paid only on the real 2% gain.

- The New Rule: Gains are added to income and taxed at the slab rate (or a flat 12.5% without indexation for some categories, causing massive confusion).

- The Consequence: For a middle-class retiree in a 30% bracket, a debt fund returning 7% pre-tax yields only 4.9% post-tax. With inflation at 1.33% (temporarily) this seems fine, but if inflation reverts to 5%, the real return becomes zero. This policy forced capital out of stable debt funds and into volatile equities and gold, increasing systemic risk for households.4

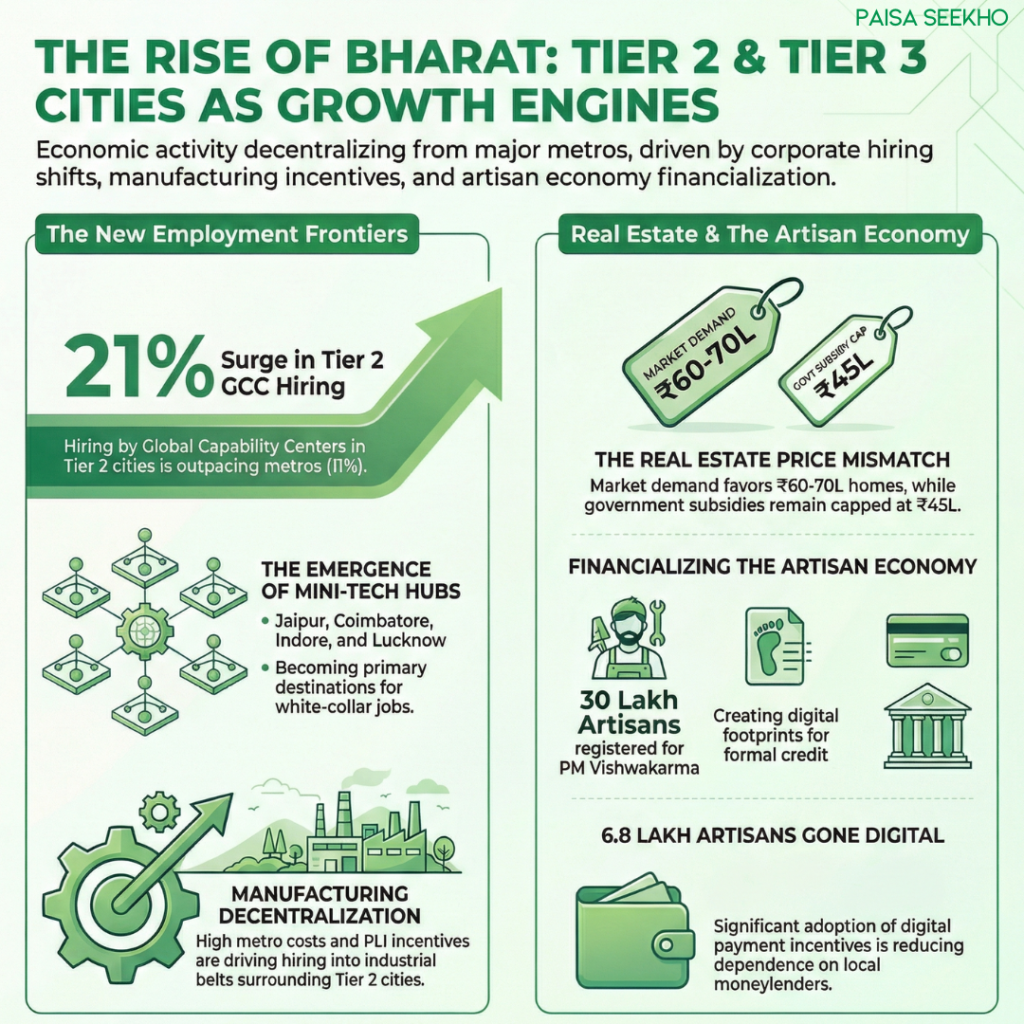

4. The Geography of Growth: Tier 2 and Tier 3 Cities

Budget 2025 had a stated objective of “balanced regional growth.” Data from the ground suggests this is actively playing out, creating specific investment opportunities in non-metro India.

4.1 The Employment Shift: GCCs and Manufacturing

The narrative that “jobs are only in Bangalore and Gurgaon” was challenged in 2025.

- Global Capability Centers (GCCs): While metros still hold the lion’s share, Tier 2 cities witnessed a 21% Year-on-Year growth in hiring by GCCs, outpacing the 11% growth in metros.18

- The Hubs: Cities like Jaipur, Coimbatore, Indore, and Lucknow are emerging as mini-tech hubs. This brings white-collar disposable income to these regions, fueling demand for housing, retail, and entertainment.

- Manufacturing: The decentralization of manufacturing, driven by high costs in metros and PLI incentives, has led to a hiring surge in industrial belts surrounding Tier 2 cities.19

4.2 The Real Estate Boom in Non-Metros

Real estate in Tier 2 cities is no longer just about “plots.” It is about vertical growth and lifestyle housing.

- Price Appreciation: While national price growth moderated, Tier 2 cities saw sustained demand. However, a critical policy gap emerged. The government’s “Affordable Housing” definition caps the property value at ₹45 Lakh for subsidies.

- The Mismatch: In growing cities like Coimbatore or Mohali, input costs have pushed the price of a standard 2BHK to ₹60-70 Lakh. Thus, the middle class in these cities is priced out of the subsidy but priced in to the market, buying homes without government support.20 This resilience proves the strength of demand.

4.3 The Artisan Economy: PM Vishwakarma

For the rural and semi-urban economy, the PM Vishwakarma Scheme has been a quiet revolution.

- Scale: By December 2025, 30 lakh artisans were registered, with 23 lakh receiving training.21

- Financialization: Over 6.8 lakh artisans received digital payment incentives. This is crucial for you to understand: formerly unbanked artisans are now creating digital financial footprints. This makes them eligible for formal credit, reducing their dependence on local moneylenders and increasing their capacity to consume and invest.22

5. Digital Assets and Modern Finance

The financial landscape of 2025 is digital-first, even in the hinterlands.

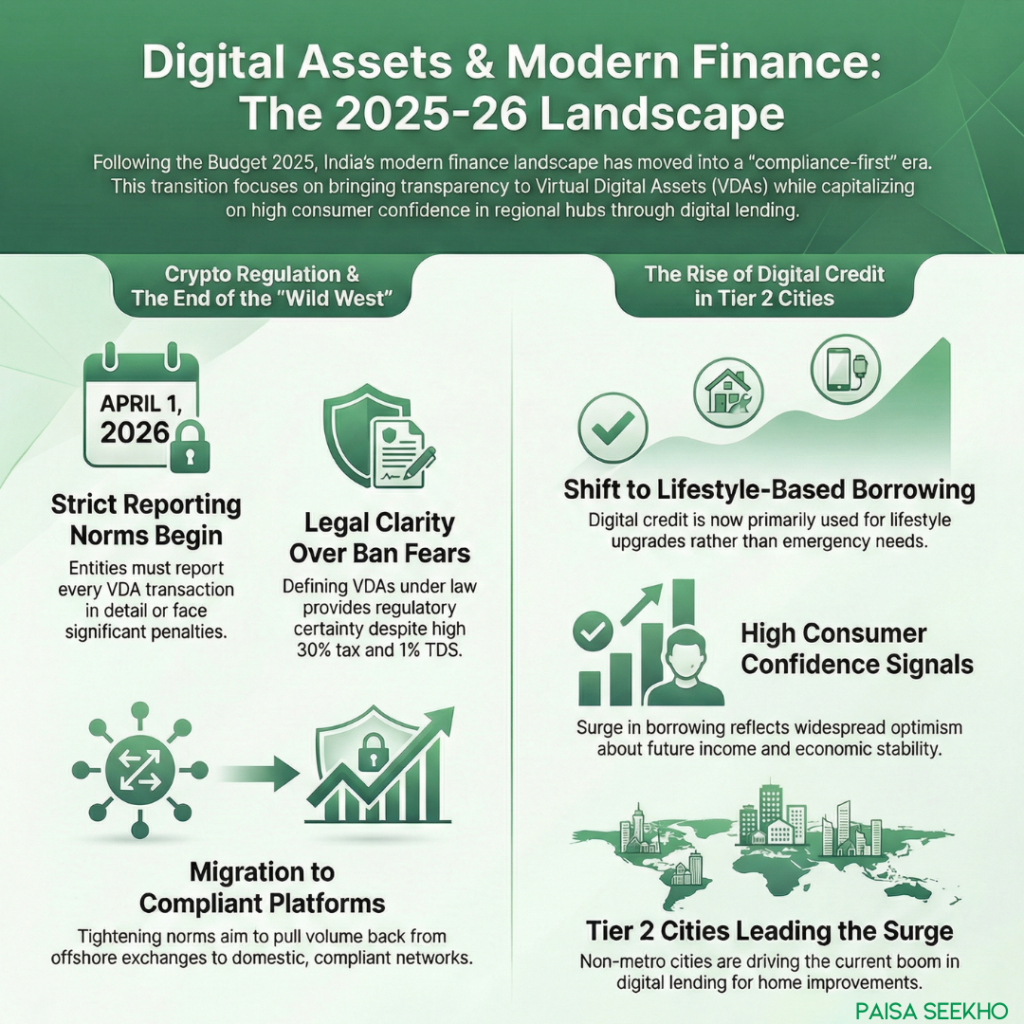

5.1 Crypto Regulation: The Tightening Noose

Budget 2025 and subsequent notifications clarified that the “Wild West” era of crypto is over. From April 1, 2026, strict reporting norms for Virtual Digital Assets (VDAs) will come into force.23

- Impact: Entities must report every transaction in detail. Failure to do so attracts penalties.

- Taxation: The 30% flat tax and 1% TDS remain the biggest friction points, driving volume to offshore exchanges or underground P2P networks. However, for the compliant investor, the regulatory clarity (VDAs are now assets defined under the law) removes the fear of a “ban”.23

5.2 The Rise of Digital Credit

A survey by Moneyview in late 2025 highlighted a surge in digital credit usage in Tier 2 cities. Interestingly, this credit is not just for emergencies but for “lifestyle upgrades” and home improvements.12 This signals high consumer confidence—people borrow to upgrade when they are optimistic about future income.

6. Critical Gaps: The Unfinished Agenda of Budget 2025

Despite the progress, significant gaps remain that have caused friction for the investing class. These gaps form the core “Demands” for Budget 2026.

6.1 The Section 80C Anachronism

Section 80C, which allows a deduction of ₹1.5 Lakh for savings (PPF, LIC, ELSS), has remained unchanged since 2014.

- The Erosion: In 2014, ₹1.5 Lakh was a significant sum. Adjusted for inflation over 12 years, the real value of this deduction has halved.

- The Demand: Industry bodies like CII and FICCI are unanimous: the limit must be raised to at least ₹3 Lakh to restore its relevance and encourage long-term capital formation.24

6.2 The Housing Cap

As noted, the ₹45 Lakh cap for “Affordable Housing” is obsolete. It ignores the inflation in cement, steel, and labor that has occurred since the cap was set.

- The Gap: A huge segment of Tier 2 homebuyers are denied tax benefits (like additional deduction on interest) because their homes cost ₹55 Lakh or ₹60 Lakh—the new “entry-level” price.20

6.3 The Debt Fund Crisis

The removal of indexation on debt funds remains a sore point. It has created an uneven playing field where equities are taxed favorably (12.5% LTCG) while debt is taxed punitively (slab rates). This discourages risk-averse behavior and forces retirees into volatile markets.4

7. Budget 2026: Expectations and Strategic Outlook

As we look toward February 1, 2026, the expectations are clear. The government has the fiscal space (due to high growth and tax buoyancy) to address these gaps.

7.1 Scenario Analysis for Budget 2026

Scenario A: The “Middle Class” Stimulus (High Probability)

- Action: Increase Section 80C limit to ₹2.5 Lakh; Hike Standard Deduction to ₹1,00,000.

- Impact: Massive boost to disposable income. Insurance and Mutual Fund sectors will rally.

- Investor Strategy: Be ready to increase SIPs in ELSS funds.

Scenario B: The “Asset Class” Correction (Medium Probability)

- Action: Restore indexation benefits for Debt Mutual Funds (with a longer holding period, say 5 years). Reduce Gold import duty to cool prices.

- Impact: Gold prices in India may correct (buying opportunity). Debt funds become attractive again.

- Investor Strategy: Shift emergency funds from FDs to Debt Funds immediately if this is announced.

Scenario C: The “Real Estate” Push (High Probability)

- Action: Redefine “Affordable Housing” to ₹75 Lakh for metro/Tier 1 cities and ₹60 Lakh for Tier 2.

- Impact: A surge in sales for mid-segment developers (e.g., Godrej Properties, Sobha, and regional players).

- Investor Strategy: Look at stocks of housing finance companies and cement manufacturers.

7.2 Specific Sectoral Expectations

- Crypto: The industry is lobbying hard for a reduction in TDS from 1% to 0.01% to bring liquidity back to Indian exchanges.27

- MSMEs: Continued support for the Credit Guarantee Scheme to ensure the Tier 2 job engine keeps humming.

8. Strategic Portfolio Construction for 2026

For someone in a Tier 2 city, here is the synthesized investment strategy based on this research:

8.1 The “Barbell” Strategy

- Safety (40%): Do not rely solely on FDs. If Budget 2026 fixes Debt Fund taxation, move capital there. If not, utilize the Senior Citizen Savings Scheme (SCSS) or Sukanya Samriddhi Yojana (SSY) which still offer high rates (8.2%).28

- Growth (40%): Focus on the Nifty Equal Weight theme. Buy mutual funds that have high exposure to mid-caps and manufacturing themes (“Make in India”), rather than just the top 10 heavyweights.

- Hedge (20%): Silver over Gold. With the industrial demand rising and the price momentum strong, Silver offers better growth potential, though with higher volatility.

8.2 Real Estate Strategy

If you are planning to buy a home, wait until February 2026. If the affordable housing limit is raised, you could save lakhs in taxes and subsidies. Focus on emerging suburbs of Tier 2 cities where infrastructure (metro, ring roads) is currently being built.

8.3 Insurance Planning

Ignore the “tax saving” aspect of insurance. With the New Tax Regime likely to remain the default, buy Term Insurance purely for risk coverage. Do not mix insurance with investment.

8.4 The “Bharat” Equity Theme

Look for listed companies that serve the Tier 2/3 consumer:

- Small Finance Banks: They are the primary lenders to the PM Vishwakarma beneficiaries and MSMEs.

- Two-Wheeler & Tractor Stocks: A play on the rural recovery (if government intervention supports farm incomes).

- Cement & Piping: Direct beneficiaries of the housing push.

Conclusion

The fiscal year 2025-26 was a year of transition. Budget 2025 broke the old habits of the Indian investor—removing the safety net of indexation and the compulsion of 80C savings. It forced the middle class to become active investors, leading to the massive flows into gold and equities.

As we stand on the threshold of Budget 2026, the hope is for rationalization. The government has successfully stabilized inflation and spurred growth. Now, it must ensure that the tax system is fair—that it rewards long-term capital formation in debt and real estate, and that it acknowledges the rising cost of living for the aspirational middle class in India’s heartland.

For the investor, the message is clear: The era of “lazy savings” is over. Wealth in 2026 will belong to those who understand the new tax architecture, leverage the growth of Tier 2 cities, and diversify beyond the traditional Fixed Deposit.

9. Appendix: Comprehensive Data Tables

9.1 Gold vs. Silver Performance (2025)

| Metric | Gold (10g) | Silver (1kg) |

| Jan 1, 2025 Price | ₹76,308 | ₹85,913 |

| Dec 31, 2025 Price | ₹1,32,640 | ₹2,29,452 |

| Absolute Return | 73.82% | 167.07% |

| Primary Driver | Safe Haven / Central Bank Buying | Industrial Demand / Safe Haven |

9.2 Small Savings Scheme Interest Rates (Jan-Mar 2026)

28

| Scheme | Interest Rate | Compounding Frequency | Status |

| Sukanya Samriddhi Yojana (SSY) | 8.2% | Annually | Unchanged |

| Senior Citizen Savings Scheme (SCSS) | 8.2% | Quarterly | Unchanged |

| National Savings Certificate (NSC) | 7.7% | Annually | Unchanged |

| Public Provident Fund (PPF) | 7.1% | Annually | Unchanged |

| Kisan Vikas Patra (KVP) | 7.5% | Annually | Unchanged |

Note: Despite rising yields in the market at various points, the government kept these rates steady, making SSY and SCSS highly attractive relative to inflation.

9.3 Budget 2025 Tax Slabs (New Regime)

| Annual Income (₹) | Tax Rate |

| 0 – 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Standard Deduction: ₹75,000. Rebate u/s 87A ensures zero tax payable for income up to ₹12 Lakh.

Final Thoughts

So, the stage is set for Budget 2026. The government has the funds (fiscal headroom), and the middle class has the expectations. Will the Finance Minister fix the 80C limit and the housing cap to keep this consumption engine running? Or will the focus shift elsewhere?

Works cited

- Is large-scale silver and gold buying by Indians driving the price rise? How it can impact you and what you should do – The Economic Times, accessed January 25, 2026, https://m.economictimes.com/wealth/invest/indians-drive-gold-and-silver-prices-in-2025-whats-behind-the-surge-and-what-it-means-for-you/articleshow/126415729.cms

- consumer price index numbers on base 2012=100 for rural, urban and combined for the month of december, 2025 – PIB, accessed January 25, 2026, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2213736®=3&lang=1

- Union Budget 2025: Key Tax Updates, Economic Growth & Sector Highlights – RBL Bank, accessed January 25, 2026, https://www.rbl.bank.in/blog/banking/tax/union-budget-2025-tax-updates-economic-highlights

- UNION BUDGET – FY 2025-26 – AMFI, accessed January 25, 2026, https://www.amfiindia.com/Themes/Theme1/downloads/AMFIUnionBudgetProposalsforFY2025-26.pdf

- consumer price index numbers on base 2012=100 for rural, urban and combined for the month of september, 2025 – PIB, accessed January 25, 2026, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2178447

- Year on Year Inflation rate based on CPI – Ministry of Statistics and Program Implementation, accessed January 25, 2026, https://www.mospi.gov.in/uploads/latestReleases/latest_release_1765535195348_9e92bc5c-fe73-44ac-bfb8-d587b1f59218_Press_Release_CPI_November_2025.pdf

- Nifty Equal Weight Index returns a lot more than Nifty 50 in 2025, accessed January 25, 2026, https://m.economictimes.com/mf/analysis/nifty-equal-weight-index-returns-a-lot-more-than-nifty-50-in-2025/articleshow/126739589.cms

- Budget being prepared under better-than-expected growth & inflation scenarios, says Crisil chief economist – The Times of India, accessed January 25, 2026, https://timesofindia.indiatimes.com/business/india-business/budget-being-prepared-under-better-than-expected-growth-inflation-scenarios-says-crisil-chief-economist/articleshow/127369961.cms

- highlights of union budget 2025-26 – PIB, accessed January 25, 2026, https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2098353

- Budget 2026 income tax expectations: Will new income tax regime be made more lucrative?, accessed January 25, 2026, https://timesofindia.indiatimes.com/business/financial-literacy/taxation/budget-2026-income-tax-expectations-will-new-income-tax-regime-be-made-more-lucrative/articleshow/126524323.cms

- India – 2025-26 Union Budget Makes Amendments Pertaining to Individuals, Employers, accessed January 25, 2026, https://kpmg.com/xx/en/our-insights/gms-flash-alert/flash-alert-2025-035.html

- India’s Hidden Boom: Tier II Cities Fuel Digital Credit Surge for Lifestyle Upgrades!, accessed January 25, 2026, https://www.whalesbook.com/news/English/tech/Indias-Hidden-Boom-Tier-II-Cities-Fuel-Digital-Credit-Surge-for-Lifestyle-Upgrades/69539c924342f77179e61e8f

- Budget 2026: Why income tax amendments will be made in the 2025 Act instead of the repealed 1961 law, accessed January 25, 2026, https://m.economictimes.com/wealth/tax/budget-2026-why-income-tax-amendments-will-be-made-in-the-2025-act-instead-of-the-repealed-1961-law/articleshow/126601175.cms

- Budget 2026 Expectations LIVE: What to expect on taxes, growth, and key sectors, accessed January 25, 2026, https://indianexpress.com/article/india/budget-2026-expectations-live-updates-date-time-income-tax-changes-old-vs-new-regime-10488606/

- Gold prices surge to new highs: How investors can pick the right gold investment route in 2026, accessed January 25, 2026, https://www.businesstoday.in/personal-finance/investment/story/gold-prices-surge-to-new-highs-how-investors-can-pick-the-right-gold-investment-route-in-2026-512790-2026-01-24

- How Top Rare Earth Metal Stocks Performed in FY26: Hindustan Copper, GMDC, MOIL, OMDC – Ventura Securities, accessed January 25, 2026, https://www.venturasecurities.com/blog/how-top-rare-earth-metal-stocks-performed-in-fy26-hindustan-copper-gmdc-moil-omdc/

- Debt mutual funds may get tax relief on capital gains, accessed January 25, 2026, https://nangia.com/debt-mutual-funds-may-get-tax-relief-on-capital-gains/

- Tier-2 cities lead GCC hiring surge with 21% growth, metros still dominate share: Report, accessed January 25, 2026, https://gcc.economictimes.indiatimes.com/news/industry-trends/gcc-hiring-grows-21-in-tier-2-cities-metro-dominance-continues/123140037

- How Tier-2 & Tier-3 Cities Are Driving Manufacturing Hiring in India – Taggd, accessed January 25, 2026, https://taggd.in/blogs/manufacturing-hiring-in-tier-2-and-tier-3-cities/

- Budget Expectation For Real-Estate: Aligning Policy With The Market Reality, accessed January 25, 2026, https://www.businessworld.in/article/budget-expectation-for-real-estate-aligning-policy-with-the-market-reality-590204

- PM Vishwakarma Scheme provides end-to-end holistic support to artisans of 18 traditional trades; 23.09 Lakh beneficiaries trained – PIB, accessed January 25, 2026, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2198702®=3&lang=1

- PM Vishwakarma Scheme provides end-to-end holistic support to artisans of 18 traditional trades; 23.09 Lakh beneficiaries trained | IBEF, accessed January 25, 2026, https://www.ibef.org/news/pm-vishwakarma-scheme-provides-end-to-end-holistic-support-to-artisans-of-18-traditional-trades-23-09-lakh-beneficiaries-trained

- Budget 2025: Govt tightens crypto reporting norms, new compliance rules from April 2026, accessed January 25, 2026, https://bfsi.economictimes.indiatimes.com/news/policy/budget-2025-govt-tightens-crypto-reporting-norms-new-compliance-rules-from-april-2026/117822615

- 10 years, no relief: Budget 2026 to finally hike 80C limit to Rs 3 lakh, boost home loan tax benefits?, accessed January 25, 2026, https://www.financialexpress.com/money/10-years-no-relief-budget-2026-to-finally-hike-80c-limit-to-rs-3-lakh-boost-home-loan-tax-benefits-4116852/

- Budget 2026: Increase Section 80C deduction limit to ₹3.5 lakh, industry body suggests, accessed January 25, 2026, https://upstox.com/news/personal-finance/tax/budget-2026-increase-section-80-c-deduction-limit-to-rs-3-5-lakh-industry-body-suggests/article-187932/

- Union Budget 2026: How India’s future-ready real estate is being shaped, accessed January 25, 2026, https://m.economictimes.com/industry/services/property-/-cstruction/union-budget-2026-future-ready-real-estate-india-cbre-report-2026-amid-affordable-housing-gcc-boom-and-data-centres/articleshow/127382956.cms

- Industry players call for Budget 2026 to level the playing field on how cryptos are taxed, accessed January 25, 2026, https://www.thehindu.com/business/budget/industry-players-call-for-budget-2026-to-level-the-playing-field-on-how-cryptos-are-taxed/article70521527.ece

- Interest Rate on National Savings Schemes, accessed January 25, 2026, https://www.nsiindia.gov.in/InternalPage.aspx?Id_Pk=132

- Latest Post Office Small Savings Schemes rates: Government notifies for Jan-March 2026 quarter; check interest rates for PPF, Sukanya Samriddhi Yojana & more – The Times of India, accessed January 25, 2026, https://timesofindia.indiatimes.com/business/financial-literacy/savings/latest-post-office-small-savings-schemes-rates-government-notifies-for-jan-march-2026-quarter-check-interest-rates-for-ppf-sukanya-samriddhi-yojana-more/articleshow/126274474.cms