Executive Summary: The 30-Second Financial Plan

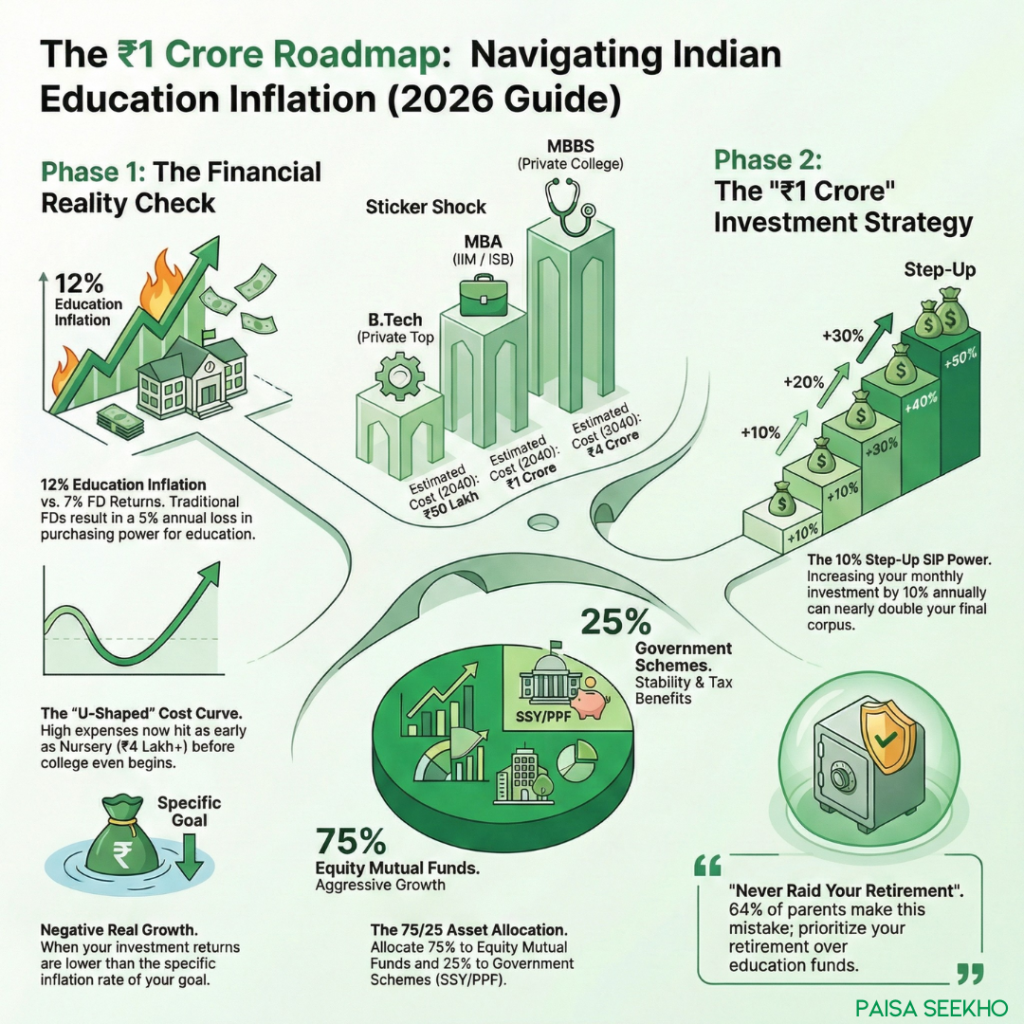

- The Target: You need to target a corpus of ₹50 Lakh for Engineering and ₹4 Crore for Medical degrees by 2040.

- The Obstacle: Education inflation is compounding at 10-12%, twice the rate of general inflation (CPI).

- The Solution: Traditional Fixed Deposits (FDs) offering 6-7% returns result in “negative real growth.”

- The Strategy: A portfolio mix of Equity Mutual Funds (70-80%) for growth and Government Schemes (SSY/PPF) for stability, combined with a Step-Up SIP of 10% annually.

- The Golden Rule: Never compromise your retirement corpus; 64% of parents make this mistake.

Introduction: The “Sticker Shock” is Real

If you recently walked into a preschool in Gurugram or Hyderabad and were quoted ₹4 Lakh for a nursery admission, you have officially met the “Great Indian Education Inflation”.

For decades, Indian parents operated on a simple financial model: save a little in the bank, maybe buy an LIC policy, and pay for college from current income. Today, that model is mathematically broken. As revealed in our 2025 Education Inflation Report, the cost of education is rising at 10-12% annually, while middle-class salaries in sectors like IT are growing at a much slower pace.

The numbers are terrifying: A private engineering degree that costs ₹20 Lakh today is projected to cost ₹50 Lakh by 2040. A medical degree? A staggering ₹4 Crore.

At Paisaseekho, we don’t believe in fear-mongering; we believe in “financial engineering.” The problem is massive, but it is solvable if (and only if) you abandon the old rules of saving and adopt a new rigorous approach to investing. This comprehensive guide will walk you through the exact steps to future-proof your child’s education without going broke.

Phase 1: The Diagnosis – Why “Safe” Savings Are Killing Your Goals

Before we discuss where to put your money, we must understand why the traditional “safety” of Fixed Deposits (FDs) and Endowment Plans is actually dangerous.

1.1 The “Negative Real Return” Trap

Most Indian parents naturally gravitate towards FDs or traditional insurance policies because they offer “guaranteed returns” of 6% to 7%. However, when the cost of the goal (education) is rising at 12%, a 7% return is actually a loss of 5% in purchasing power every year.

- The Math: If a college seat costs ₹100 today, it will cost ₹112 next year (12% inflation).

- Your Savings: If you put ₹100 in an FD, it becomes ₹107 next year.

- The Gap: You are short by ₹5.

Over 15 years, this gap compounds exponentially. As our report highlighted, traditional savings methods cannot beat 12% education inflation. You aren’t saving; you are slowly falling behind.

1.2 The “Front-Loading” of Costs

Historically, you only needed big money for college (age 18). Today, the cost curve is “U-shaped,” with massive expenses hitting you as early as age 3 (Nursery). With premium nursery fees hitting ₹2.5 Lakh to ₹4.3 Lakh per year, parents are draining their liquidity before the real compounding magic can even begin.

Takeaway: You need an investment vehicle that generates alpha (returns above 12%). The only asset class in India capable of consistently delivering 12-15% over the long term is Equity.

Phase 2: The Calculator – How Much Do You Actually Need?

You cannot hit a target you haven’t defined. Most parents underestimate the future cost because they think in today’s prices. You must think in future prices.

Using the data from our extensive 2025 analysis, here is the “Future Cost Table” you should stick to your refrigerator.

The 2040 Price Tags (Projected)

| Education Goal | Current Cost (2024-25) | Inflation Rate | Target Corpus (2040) |

| B.Tech (Private Top Tier) | ₹20 Lakh | 10% | ₹45 – ₹52 Lakh |

| MBA (IIM/ISB Class) | ₹25 Lakh | 10% | ₹80 Lakh – ₹1 Crore |

| MBBS (Private College) | ₹1 Crore | 10% | ₹3.5 Crore – ₹4 Crore |

| Study Abroad (US/UK) | ₹50 Lakh | 6% (USD Inflation) + 4% (Rupee Depr.) | ₹1.5 Crore+ |

Action Step: Pick your target. If you have a newborn today, your magic number for a standard professional degree is ₹1 Crore. If you are aiming for Medical, it is ₹4 Crore.

Phase 3: The Investment Strategy – The “Core & Satellite” Approach

To reach ₹1 Crore in 15-18 years, you need a strategy that balances aggression (to beat inflation) with security (to ensure the money is there when needed).

3.1 The Engine: Equity Mutual Funds (75% Allocation)

This is non-negotiable. As the report states, wealth creation strategies must be aggressive and started early.

- Why: Nifty 50 and Mid-cap indices have historically delivered 12-14% CAGR over 15-year periods. This is the only way to match the 12% fee hikes of private schools.

- What to Buy:

- Index Funds (Nifty 50 / Sensex): 40% of your portfolio. Low cost, captures the growth of the top Indian companies.

- Flexi-Cap Funds: 20% of your portfolio. Allows fund managers to pivot between large giants and fast-growing mid-caps.

- Mid-Cap Funds: 15% of your portfolio. High volatility but essential for the “kicker” returns needed to reach ₹4 Crore.

3.2 The Anchor: Fixed Income / Government Schemes (25% Allocation)

You need a safety net that is immune to stock market crashes.

- Sukanya Samriddhi Yojana (SSY): If you have a girl child, this is a must-have. It currently offers returns higher than FDs and is tax-free (EEE status). It perfectly matches the timeline for college education (maturity at 21 years).

- PPF (Public Provident Fund): A solid 15-year lock-in tool for boys (or if SSY is maxed out). It provides the stability to balance the volatility of your equity funds.

3.3 The Secret Weapon: The “Step-Up” SIP

Most parents start an SIP (Systematic Investment Plan) and forget it. This is a mistake. Your salary grows every year; your savings must too.

- The Power of 10%: If you start a ₹10,000 SIP and increase it by just 10% every year (e.g., ₹11,000 in Year 2), you can accumulate nearly 2x the corpus compared to a flat SIP.

- Scenario: To reach ₹1 Crore in 18 years (assuming 12% return):

- Flat SIP: You need to invest ₹13,500/month.

- Step-Up SIP (10%): You can start with just ₹7,500/month.

This makes the goal achievable for middle-class families earning ₹12-15 Lakh per year.

Phase 4: The “Optimization” Strategy – Saving ON Education

Saving for education is only half the battle. You must also control the cost of education. The “Education Inflation Crisis” is partly driven by “Premiumization”—the belief that higher fees equal better learning. Our research shows this is often a myth.

4.1 Rationalize the Board Choice: CBSE vs. IB/IGCSE

A massive driver of cost is the shift to International Boards.

- The Cost: An IB school costs ₹3–10 Lakh/year, while a good CBSE school costs ₹1–1.5 Lakh/year.

- The ROI: Unless you are 100% certain your child will go abroad for undergraduate studies, the IB premium often yields low ROI. The Indian competitive exam system (JEE/NEET) is still largely aligned with CBSE.

- Strategy: Choose a robust CBSE school and invest the difference (₹2-3 Lakh/year) into a mutual fund. That difference alone, compounded over 12 years, could pay for the entire undergraduate degree! This is what we call “Rationalizing the Premium”.

4.2 Avoid the “Unbundling” Traps

Schools have unbundled fees to charge extra for “Annual Days,” “Technology Fees,” and “Parent Orientations”.

- Strategy: When budgeting, always add 25% to the quoted tuition fee to account for these hidden costs. Do not be blindsided.

- Vendor Monopolies: Parents are often forced to buy shoes and books at 5x prices. While difficult to fight individually, forming Parent Associations to collectively bargain for open-market purchases is a growing trend in Tier 1 cities.

Phase 5: The Safety Net – Protecting the Goal

Your savings plan assumes you will be alive and earning for the next 18 years. What if you aren’t?

5.1 Term Insurance is Mandatory

If you are the primary breadwinner, you need a Term Insurance policy that covers:

- Your current loans (Home/Car).

- Your family’s living expenses.

- The Future Cost of Education (₹1 Crore).

- Do not mix insurance with investment. Buy a pure term plan. It is cheap and effective.

5.2 The “Retirement Raid” – A strict No-No

Our report found that 64% of parents are willing to liquidate their retirement savings for their child’s education. This is financial suicide.

- The Reality: Your child can get an education loan for college. You cannot get a retirement loan for old age.

- The Consequence: If you spend your retirement corpus on fees, you risk becoming a burden on your child in your 70s, reversing any advantage you gave them.

- Rule: Your retirement SIPs must occur before your child’s education SIPs.

Phase 6: Actionable Roadmap by Age

Here is a timeline to keep you on track.

Stage 1: The Early Years (Age 0-5)

- Focus: Aggressive Growth.

- Action: Start a SIP immediately. 80% Equity, 20% SSY/PPF.

- Schooling: Resist the urge for “Premium” nurseries. A ₹4 Lakh nursery seat has zero correlation with future success. Save that money.

Stage 2: The Middle Years (Age 6-13)

- Focus: Sustainability & Skill Building.

- Action: Step-up your SIPs as your income grows.

- Schooling: Focus on “Skill Acquisition” over “School Brand.” Spend on coding classes, sports, or languages rather than just a fancier school building.

- Review: Check your portfolio performance every 6 months.

Stage 3: The Critical Years (Age 14-17)

- Focus: De-risking.

- Action: As college approaches, the equity market becomes risky. Start moving money from Equity Mutual Funds to safer Liquid Funds or FDs 2 years before the goal. You cannot afford a market crash when the fee is due.

- Discussion: Have an honest conversation with your child about the budget. If the goal is ₹50 Lakh and they want a course costing ₹80 Lakh, discuss the role of an Education Loan for the bridge amount.

Conclusion: Be the CEO of Your Household

The education market in India has turned into a business that operates with the “pricing power of a cartel”. It is designed to extract maximum value from your emotions.

To win this game, you must stop thinking like an emotional parent and start thinking like a CEO.

- Forecast the liabilities (Projected Fees).

- Secure the funding (SIPs + Insurance).

- Manage the cash flow (Avoid unbundled hidden costs).

The “Old Rules” of saving are dead. The new rule is simple: Invest early, invest aggressively, and never sacrifice your own retirement. Your child’s best asset is not just a degree—it is financially independent parents.

Frequently Asked Questions (FAQs)

Q: Should I take an education loan even if I have savings?

A: Yes, it can be a smart move. Education loans often come with tax benefits (Section 80E) and help build the child’s credit history. More importantly, they prevent you from liquidating your retirement corpus. If the degree has a high ROI (like an IIM MBA), a loan is financially prudent.

Q: Is Sukanya Samriddhi Yojana (SSY) enough for my daughter’s education?

A: No. While SSY is excellent for the debt portion of your portfolio, the maximum investment is capped (currently ₹1.5 Lakh/year), and the returns (approx. 8%) lag behind the 10-12% education inflation rate. You must supplement SSY with Equity Mutual Funds.

Q: How much of my salary should go towards school fees?

A: Ideally, school fees should not exceed 10-15% of your annual take-home income. Current trends show fees consuming 40-50% in some households, which is unsustainable and leaves no room for wealth creation.

Q: My child is 10 years old, and I haven’t started saving. Is it too late?

A: It is not too late, but you have lost the advantage of compounding. You need to save much more aggressively (perhaps 30-40% of income) and may need to rely on a mix of aggressive equity funds and education loans to bridge the gap.

Q: Why are international schools so expensive?

A: International schools (IB/IGCSE) have higher infrastructure costs and pay “management fees” to foreign entities or management companies, which drives up fees. Additionally, they often cater to a “premiumization” psychology where high fees are seen as a status symbol.

Glossary for Parents

- Education CPI: The specific inflation rate for education, which is currently double the general inflation rate.

- Step-Up SIP: Increasing your monthly investment amount by a fixed percentage (e.g., 10%) every year to match income growth.

- Solvency Gap: The difference between the money you have and the money you need for education.

- Unbundling: The practice of schools charging separately for admission, tech, annual days, etc., to make tuition fees look lower.