If you live in a metro city like Mumbai, Bengaluru, or Delhi, you know the drill. You walk into a supermarket with a budget of ₹2,000, and you walk out with two small bags that barely last a week.

For the last three years, the conversation at every dinner table, office canteen, and WhatsApp group has been the same: “Why is everything so expensive?”

We have lived through the “Tomato Shock” where a kilo cost more than a litre of petrol. We have seen Dal Tadka prices at restaurants jump from ₹180 to ₹350. We have watched our salary hikes get eaten up mostly by rent and grocery bills.

But if the Economic Survey 2025-26 is to be believed, the tide has finally turned.

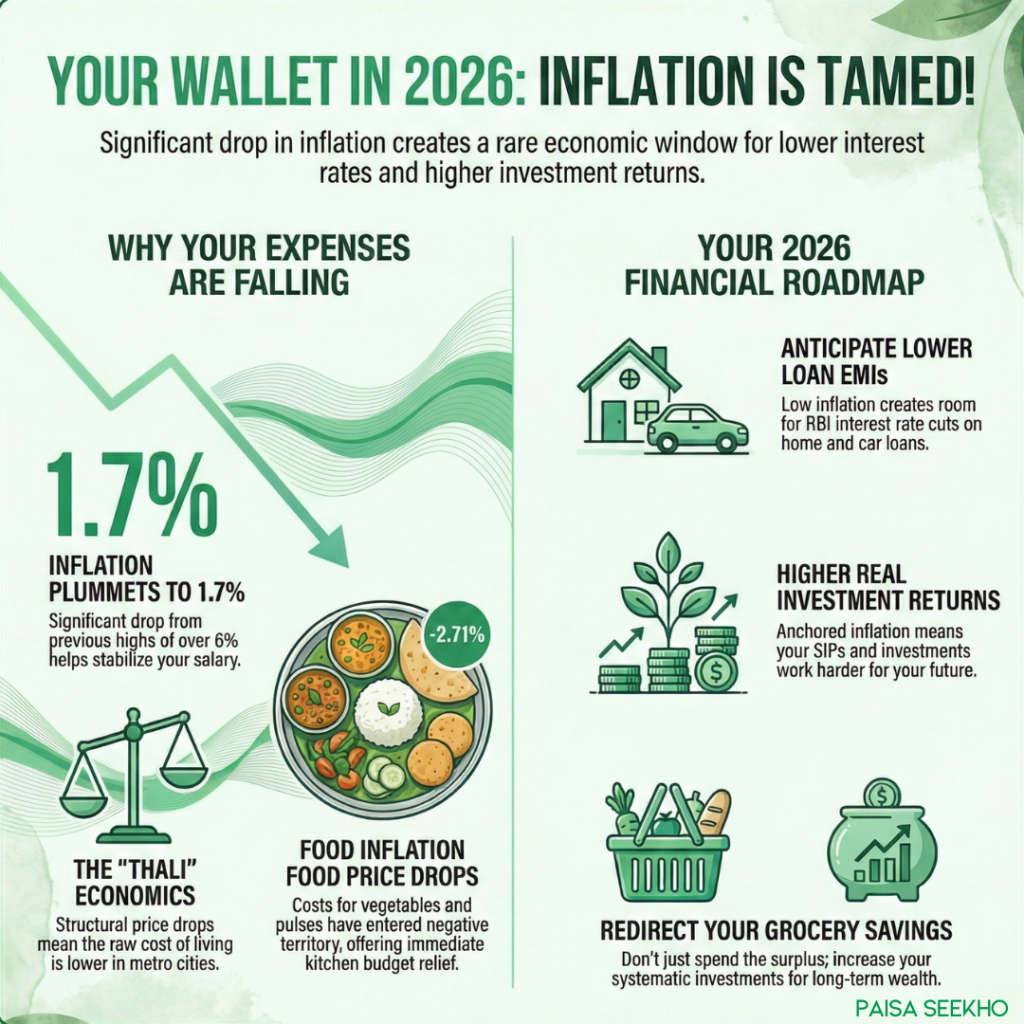

The government’s annual report card on the economy has dropped a figure that should make every middle-class Indian breathe a sigh of relief: 1.7%.

That is the Retail Inflation (CPI) rate for 2025-26. It is not just “lower”; it is historically low. But what does a percentage point in a government PDF mean for your monthly budget? Does it mean your rent in Pune will go down? Will your home loan EMI finally shrink?

In this comprehensive guide, we are decoding Chapter 05 (Inflation) and Chapter 06 (Agriculture) of the Economic Survey 2025-26 to answer one question: Is life in India finally getting cheaper?

Part 1: The Big Number: Inflation at 1.7%

The Context: From “Red” to “Green” Zone

To understand why 1.7% is a big deal, we need to look at the rearview mirror.

- The Danger Zone: In 2022-23, inflation was hovering above 6.7%. That is way above the Reserve Bank of India’s (RBI) comfort zone.

- The Target: The RBI is tasked with keeping inflation at 4%. Anything above 6% is a “fail”; anything below 2% is rare territory.

- The Reality in 2026: We are currently sitting at 1.7%.

This isn’t a minor adjustment. It is a structural shift. The Survey explicitly states that India has managed to “tame and anchor” inflation while the rest of the world (especially Europe and parts of the US) is still struggling with sticky prices.

CPI vs. Your Wallet: The Disconnect

A common question we get at Paisaseekho is: “If inflation is 1.7%, why doesn’t my lifestyle feel 98% cheaper?”

Here is the secret: The CPI (Consumer Price Index) measures a “basket” of goods. It includes food, fuel, clothing, and housing.

- What Dropped: Food prices (which make up a huge chunk of the Indian basket) have crashed.

- What Stayed Sticky: Services (your maid, driver, salon costs) and Urban Rent (especially in tech hubs like Bengaluru and Hyderabad).

However, since food is a daily recurring expense, a drop there has the most immediate psychological and financial impact on your “Disposable Income.”

Part 2: The “Thali Economics” – Food Deflation is Here

The most shocking data point in the entire Economic Survey comes from the food sector.

Food Inflation is in negative territory.

By December 2025, food inflation was recorded at -2.71%. This is called Deflation. It means, on average, food items are actually cheaper today than they were a year ago.

1. The Vegetable Victory

Remember the meme-worthy tomato prices? The Survey notes a “steep decline” in vegetable prices.

- Why it happened: Improved supply chains and a massive focus on “Operation Greens” (a government scheme to stabilize prices of Tomato, Onion, and Potato – TOP crops).

- The Impact: If you are shopping for vegetables in Delhi or Chennai, you are likely paying 20-30% less for your weekly greens compared to 2024.

2. Pulses and Edible Oils

For a vegetarian nation, Dal and Oil are non-negotiable.

- Pulses: Inflation here has also entered negative territory. The price spikes in Tur and Urad dal have cooled off significantly due to better domestic production and timely imports.

- Edible Oil: India imports a lot of its cooking oil. Global prices have softened, and the government kept import duties managed to ensure that the benefit reached the consumer.

3. The “Thali Cost” Index

The Economic Survey often references the “Thali Cost”—the cost of preparing a standard vegetarian meal at home.

- In 2024: A standard thali cost might have been approx ₹35-40 (home-cooked).

- In 2026: With vegetable and oil prices down, this cost has theoretically dropped.

What this means for you:

If your household grocery budget was ₹15,000 a month in 2024, it might realistically be around ₹13,500 – ₹14,000 in 2026 for the same quantity of goods. That is a direct saving of ₹1,000+ per month without cutting corners.

Part 3: Why is Food Cheaper? (The Agriculture Angle)

You might think, “Is this just luck? Will prices shoot up again next month?”

Based on Chapter 06 (Agriculture), this stability looks structural, not accidental.

1. Record Production

The Survey highlights “Robust Growth” in agriculture. India isn’t just growing enough; it’s growing a surplus.

- Foodgrains: Wheat and Rice stocks are overflowing in FCI (Food Corporation of India) godowns.

- Horticulture: For the first time, our production of fruits and vegetables is outpacing food grains significantly.

2. Diversification

Farmers are getting smarter. They are moving away from water-guzzling crops to high-value, resilient crops.

- Government Schemes: Initiatives like Pradhan Mantri Krishi Sinchai Yojana (PMKSY) have improved irrigation.

- Supply Chain: The cold storage infrastructure has improved, meaning less food is rotting in transit between a farm in Nashik and a supermarket in Mumbai.

3. The Weather God’s Mercy

While climate change is a threat, the last monsoon cycle was favorable for key regions, filling up reservoirs and ensuring a bumper winter (Rabi) crop.

Part 4: The Ripple Effect – Will My EMI Go Down?

This is the section most Paisaseekho readers care about.

- “I want to buy a house.”

- “I want to buy a car.”

How does cheaper Bhindi (Okra) help you buy a 2BHK in Noida?

The Inflation-Interest Rate Link

The Reserve Bank of India (RBI) works on a simple rule:

- High Inflation = High Interest Rates (To stop people from spending).

- Low Inflation = Low Interest Rates (To encourage growth).

For the last two years, the RBI kept the Repo Rate (the rate at which banks borrow money) high because inflation was high. They didn’t want to cut rates and risk prices shooting up again.

The 2026 Forecast

With inflation anchored at 1.7%, the RBI has massive room to cut rates.

- The Prediction: Analysts expect the RBI to cut the Repo Rate by 50 to 75 basis points (0.5% – 0.75%) over the next 12 months.

The Calculation: What You Save

Let’s assume you have a ₹50 Lakh Home Loan for 20 years.

| Scenario | Interest Rate | Monthly EMI | Total Interest Paid |

| Current (2025) | 9.00% | ₹44,986 | ₹57.9 Lakhs |

| Projected (2026) | 8.25% | ₹42,584 | ₹52.2 Lakhs |

| Savings | – 0.75% | ₹2,402 / month | ₹5.7 Lakhs |

The Verdict:

Low inflation doesn’t just save you ₹1,000 on groceries; it could save you ₹5.7 Lakhs on your home loan over the long run.

Actionable Advice:

If you are on a floating rate loan (which most home loans are), do not switch to a fixed rate. Ride the curve down. If you are planning to buy a car, waiting until the second half of 2026 might get you a cheaper loan deal.

Part 5: The “Fine Print” – What is NOT Cheaper?

At Paisaseekho, we value honesty over hype. While the Economic Survey paints a rosy picture, your bank statement might disagree in some areas. Here is where inflation is still biting.

1. The “Rent” Paradox

The Survey mentions inflation dropping, but if you live in Bengaluru (Whitefield/Indiranagar), Gurugram, or Hyderabad, your rent has likely gone up by 10-15%.

- Why? This is “Asset Inflation,” not CPI Inflation. The return-to-office mandates have caused a surge in demand for housing in IT corridors. The Survey acknowledges that urban housing constraints are real.

2. Gold & Silver

Chapter 05 explicitly states that “Core Inflation” is sticky because of Precious Metals.

- The Cause: Global wars and uncertainty lead investors to buy Gold as a safe haven.

- The Result: Gold prices are hitting record highs. If you are planning a wedding in 2026, your jewellery budget will need to be higher, even if the catering budget (food) is lower.

3. Climate Risks

The Survey includes a warning: Geopolitics and Climate Change.

A single heatwave in March or a disrupted shipping route in the Red Sea can spike prices again. The 1.7% figure is a “snapshot,” not a lifetime guarantee.

Part 6: Your “Paisaseekho” Action Plan for 2026

So, you have some extra cash from lower grocery bills, and potentially lower EMIs. What should you do?

1. The “Inflation Surplus” Strategy

Calculate exactly how much you are “saving” due to stable prices.

- Example: If your household run rate dropped by ₹2,000/month.

- Do Not: Spend it on a new OTT subscription.

- Do: Start a Micro-SIP. Invest that ₹2,000 into a Nifty 50 Index Fund. Over 10 years, that small surplus can turn into ₹4.5 Lakhs.

2. Lock in “Real Returns”

- Concept: Real Return = Interest Rate – Inflation.

- The Math: If your Fixed Deposit gives you 7% and Inflation is 1.7%, your Real Return is 5.3%.

- Context: In the past, when inflation was 6% and FD was 7%, you only made 1% real profit.

- Move: Fixed Deposits and Debt Mutual Funds are actually attractive right now because they are beating inflation by a huge margin.

3. Negotiate Your Rent

Armed with the data that “Headline Inflation is down to 1.7%,” try to negotiate with your landlord. Use the general economic sentiment to argue against an arbitrarily high 10% annual hike. It might not work in Indiranagar, but it might work in a Tier-2 city.

Conclusion: The Year of the Saver

2026 is shaping up to be a unique year. For the first time in a long time, the macroeconomic winds are blowing in favor of the Middle-Class Saver.

The “Tax” of inflation has been lifted. The cost of food (your most basic necessity) is down. The cost of borrowing (loans) is likely to go down.

This is a window of opportunity. The money you save at the grocery store today shouldn’t just vanish into lifestyle spends. It should be the seed capital for your future wealth.

Inflation is down. Don’t let your guard down. Invest the difference.

Frequently Asked Questions (FAQs)

Q1: Is this “Deflation” bad for the economy?

Ans: Generally, deflation (falling prices) is bad because it means companies stop producing. However, the Survey clarifies that this is primarily Food Deflation caused by excess supply, not lack of demand. People are still buying; farmers are just producing more. This is the “Good” kind of price drop for consumers.

Q2: Will “Grocery Costs in Chennai” be different from Delhi?

Ans: Yes. The Survey notes regional variations. Southern states often have different supply chains for items like Coconut oil or Rice compared to the North. However, the trend of falling vegetable prices is nationwide due to better logistics.

Q3: Does this mean I shouldn’t ask for a salary hike?

Ans: Absolutely not. Companies might use “low inflation” as an excuse to give lower appraisal hikes (e.g., “Inflation is only 1.7%, take a 4% hike”).

- Counter-argument: Remind them that “Lifestyle Inflation” and “Rental Inflation” in metro cities are still high. Your value is based on your performance, not the price of onions.

Q4: Will home loan interest rates go down in 2026?

Ans: Highly likely. With inflation at 1.7% and the US Fed also signaling rate cuts, the RBI is expected to lower the Repo Rate. Analysts predict a reduction of 0.50% to 0.75% by the end of 2026.

Q5: Is it a good time to buy a car?

Ans: Yes, but wait for the second half of the year. If the RBI cuts rates, car loans will get cheaper. Also, Chapter 05 hints at global commodity prices (steel, plastic) softening, which might keep car showroom prices stable.

Disclaimer: This blog is based on data from the Economic Survey 2025-26. Financial markets are subject to risks. Please consult a SEBI-registered investment advisor before making financial decisions.