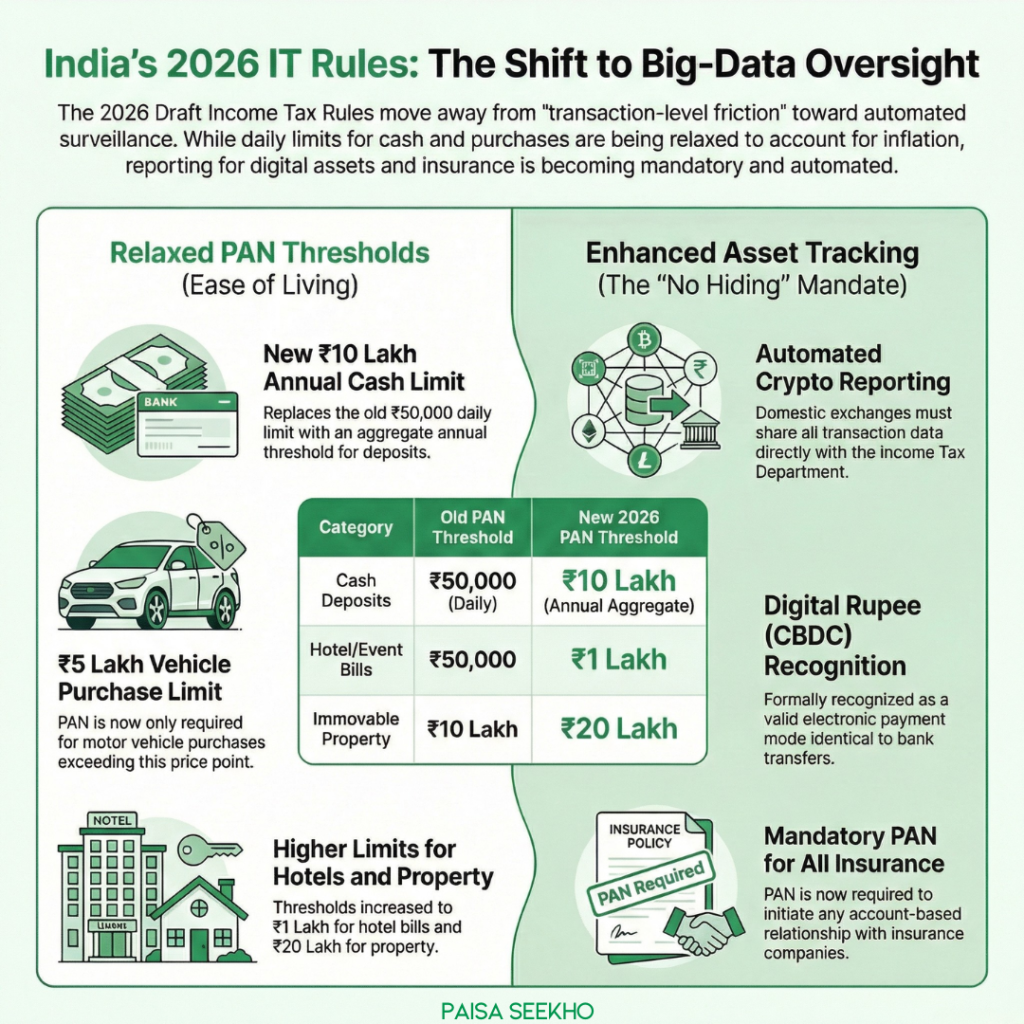

Key Takeaways Regarding Cash Deposit Limit Without PAN 2026 :

- Cash Deposits: The cash deposit limit without PAN 2026 has been changed from ₹50,000 per day to an aggregate of ₹10 Lakh per financial year.

- Vehicle Purchases: The PAN card for two-wheeler purchase rule has been updated. You now only need a PAN if the vehicle costs more than ₹5 Lakh.

- Hotel Bills: You can now spend up to ₹1 Lakh on hotel or banquet bills without providing a PAN card (up from ₹50,000).

- Crypto Reporting: Under the crypto tax reporting India 2026 guidelines, crypto exchanges must mandatorily share all transaction data directly with the Income Tax Department.

- Digital Rupee: The Central Bank Digital Currency (CBDC) has been officially recognized as a valid mode of electronic payment under tax laws.

For years, the Indian tax system has operated on a philosophy of constant, low-level friction. Whether you were depositing a bit of extra cash from a Diwali sale, buying a mid-range motorcycle, or booking a banquet hall for a family function, the taxman was always standing there asking for your PAN card.

At the same time, the modern digital economy, specifically cryptocurrencies and Virtual Digital Assets (VDAs), operated in a grey zone, relying mostly on the “honor system” for taxpayers to declare their profits.

With the release of the Draft Income Tax Rules 2026 (designed to operationalize the new Income Tax Act, 2025), the Central Board of Direct Taxes (CBDT) is fundamentally flipping this script.

Tracing the trajectory of our recent economic policies, it is clear the government is moving away from harassing citizens over small daily cash transactions and pivoting toward automated, big-data surveillance of high-value wealth.

If you run a small business, do freelance work, or trade Bitcoin, the rules of engagement change entirely on April 1, 2026. Here is the comprehensive breakdown of how the new PAN card thresholds and Crypto reporting mandates will impact your financial life.

Part 1: The “Ease of Living” Upgrade (New PAN Thresholds)

The most celebrated changes in the Draft Income Tax Rules 2026 revolve around the relaxation of mandatory Permanent Account Number (PAN) quoting limits. The government has recognized that inflation has made the old limits obsolete, disproportionately burdening ordinary citizens.

What is the cash deposit limit without PAN in 2026?

Answer: Under the Draft Income Tax Rules 2026, you must mandatorily quote your PAN for cash deposits or withdrawals only if the aggregate amount reaches ₹10 Lakh or more in a single financial year across one or multiple bank accounts.

The Old Era (The ₹50,000 Daily Trap):

Previously, the rule stated that any cash deposit exceeding ₹50,000 in a single day required a PAN card. This was a massive headache for shopkeepers, freelancers, or anyone dealing with cash-heavy family events. People would routinely split deposits, depositing ₹49,000 on Monday and ₹49,000 on Tuesday, just to avoid the compliance friction.

The New Era (Annual Aggregation):

The new rule abolishes the daily limit and shifts to an annual aggregate.

- Scenario: You run a boutique in a Tier-2 city. You deposit ₹80,000 in cash after a busy festival weekend. Under the 2026 rules, the bank will not ask for your PAN for this specific transaction, provided your total cash deposits for the financial year (April to March) have not yet crossed ₹10 Lakh.

Why this matters:

This is a massive relief for the unorganized sector and rural/semi-urban populations. It reduces daily paperwork while allowing the tax department to focus only on accounts that handle significant cash volume throughout the year.

Do I need a PAN card to buy a bike in 2026?

Answer: Generally, No. The Draft Income Tax Rules 2026 propose that a PAN is only required for purchasing a motor vehicle (including two-wheelers) if the purchase price exceeds ₹5 Lakh.

The Rationalization of Mobility:

Under the old regime, buying almost any four-wheeler required a PAN, while two-wheelers were weirdly exempt. The new rules apply a uniform, value-based threshold.

If you are buying a standard commuter motorcycle (like a Splendor, Pulsar, or Royal Enfield Classic 350) or a scooter (like an Activa), the price will fall well below the ₹5 Lakh mark. You can make this purchase seamlessly without needing a PAN card.

However, if you are purchasing a premium superbike or a car, and the invoice value crosses ₹5 Lakh, quoting your PAN becomes mandatory. This links compliance to luxury rather than basic mobility.

New PAN Limits for Property, Hotels, and Insurance

The draft rules have recalibrated several other daily-life thresholds:

1. Hotel and Event Bills:

- Old Rule: PAN required for hotel/restaurant/banquet bills over ₹50,000.

- New 2026 Rule: PAN is required only if the payment exceeds ₹1 Lakh.

- Impact: Hosting a small wedding reception or a large family dinner will no longer automatically trigger tax scrutiny, accounting for the reality of inflation in the hospitality sector.

2. Immovable Property:

- Old Rule: PAN required for buying/selling property worth more than ₹10 Lakh.

- New 2026 Rule: The threshold has been doubled to ₹20 Lakh.

- Impact: While property in major metros costs crores, many small plots or agricultural land deals in smaller towns fall under the ₹20 Lakh bracket, easing the friction for rural land transfers.

3. Life Insurance (The Exception):

- While most limits were relaxed, insurance got stricter.

- New 2026 Rule: PAN is now mandatory for initiating any account-based relationship with an insurance company. Previously, it was only required if premiums exceeded ₹50,000 a year. The government wants to track all insurance-based investments from day one.

Part 2: The “No Hiding” Mandate (Crypto & VDAs)

While the government is looking away from your ₹60,000 cash deposit, it is fixing its gaze firmly on your digital wallet.

Do crypto exchanges share data with Income Tax Department in 2026?

Answer: Yes, mandatorily. The Draft Income Tax Rules 2026 require Crypto-Asset Service Providers (domestic crypto exchanges like WazirX, CoinDCX, etc.) to share detailed, comprehensive transaction data directly with the Income Tax Department.

The End of “Voluntary” Disclosure

Since 2022, India has heavily taxed Virtual Digital Assets (VDAs) at a flat 30% rate (plus 4% cess), with no deductions allowed for losses. Furthermore, a 1% TDS (Tax Deducted at Source) under Section 194S is levied on crypto transfers.

However, for the past few years, the burden of calculating and declaring these trades fell largely on the taxpayer. Many young investors simply “forgot” to mention their crypto gains in their ITR, assuming the taxman wouldn’t notice.

The Draft rules for Virtual Digital Assets (VDA) 2026 officially close this loophole.

- Mandatory Reporting: Exchanges must now follow strict due diligence and report transaction volumes, buy/sell values, and user PAN details to the CBDT.

- Pre-Filled ITRs: Because the exchanges are feeding this data directly to the government, your crypto trades will now automatically populate in your Annual Information Statement (AIS) and your pre-filled Income Tax Return (ITR).

- Global Standards: This move brings India’s crypto framework in line with global financial tracking standards, making digital assets as transparent to the government as a standard bank fixed deposit.

What about the Digital Rupee (CBDC)?

Interestingly, the draft rules formally recognize the Central Bank Digital Currency (CBDC), the Digital Rupee, as an accepted mode of electronic payment. This solidifies the government’s stance: decentralized private crypto is treated as a highly-taxed speculative asset, while the RBI-backed Digital Rupee is treated identically to normal fiat currency (UPI/Bank transfers) for tax and business purposes.

Part 3: Real-World Scenarios (How to Stay Safe)

Let’s look at how these new rules interact in the real world for a typical Paisaseekho reader.

Scenario A: The Cash-Heavy Freelancer

- Profile: Aisha runs a freelance event management business in Jaipur. She often receives payments in cash from local clients.

- The 2026 Rule Application: Aisha must monitor her total cash deposits across all her bank accounts. If she deposits ₹1 Lakh in May, ₹3 Lakh in October, and ₹5 Lakh in December, her total is ₹9 Lakh. She does not need to declare PAN for these.

- The Danger Zone: If she gets another ₹1.5 Lakh cash payment in February, bringing her annual total to ₹10.5 Lakh, she must quote her PAN for that final deposit. More importantly, the bank will report this aggregate ₹10.5 Lakh cash deposit directly to the Income Tax Department via an SFT (Specified Financial Transaction) report. Aisha must ensure this ₹10.5 Lakh is accurately reflected as business income in her ITR to avoid a notice.

Scenario B: The Crypto “Hodler”

- Profile: Karan bought ₹50,000 worth of Bitcoin on an Indian exchange in 2023. In 2026, it is worth ₹1,50,000, and he decides to sell it to pay for a vacation.

- The 2026 Rule Application: When Karan hits “Sell” on the exchange, 1% TDS is automatically deducted. Under the new draft rules, the exchange instantly reports this ₹1,50,000 sale to the IT Department against Karan’s PAN.

- The Tax Math: Karan has a flat profit of ₹1,00,000. He owes 30% tax (₹30,000) plus cess. When he logs into the income tax portal in July 2027, he will see this ₹1,00,000 profit already written into his draft return. If he tries to delete it or ignore it, the system will flag an immediate mismatch.

Scenario C: Trading on Foreign Exchanges (The Grey Area)

- The Loophole: What if Karan trades on a foreign exchange (like Binance) that doesn’t report to the Indian government?

- The Reality Check: While foreign exchanges might not follow CBDT reporting rules directly, the moment Karan tries to bring that money back into an Indian bank account (via P2P transfers or wire transfers), the banking system will flag the high-value transaction. Furthermore, under India’s Black Money Act, failing to declare foreign assets (which VDAs held on foreign servers technically are) carries severe penalties. The new rules signal that the government’s patience with offshore crypto evasion is wearing extremely thin.

Part 4: The Strategic Shift, Why the Government is Doing This

To truly master your tax planning, you have to understand why the rules are changing.

The Draft Income Tax Rules 2026 represent a massive shift from “transaction-level friction” to “pattern-based oversight.”

The Income Tax Department has realized that harassing a citizen over a ₹50,000 hotel bill wastes administrative resources. It generates massive amounts of useless paperwork. Instead, they are leveraging technology. By raising the limits, they filter out the “noise” of everyday middle-class life.

By demanding data directly from banks (for ₹10 Lakh aggregate deposits) and crypto exchanges (for all VDA trades), they are building a silent, automated surveillance net. They don’t need to ask you for your PAN card at the counter anymore; their AI systems are already tracking the metadata of your wealth.

What this means for you: The era of “hiding” income is largely over. The technology is too good, and the reporting mandates are too strict. Your financial strategy for 2026 and beyond must be based on legal tax optimization (using exemptions like the new 50% HRA limits or the hiked Education Allowances we discussed previously), not evasion.

Conclusion: Getting Ready for April 2026

The Draft Income Tax Rules 2026 are a net positive for the average taxpayer. They strip away the annoying red tape of small purchases while bringing much-needed clarity (albeit strict clarity) to the digital asset space.

Your Checklist before the rules go live:

- Audit Your Cash: If you rely heavily on cash, start maintaining a simple ledger. Do not let your aggregate bank deposits blindly cross the ₹10 Lakh threshold unless you have the accounting records to back up where that cash came from.

- Download Your Crypto Ledgers: Go to your crypto exchanges and download your transaction history for the past few years. Calculate your true cost basis. When the auto-populated data arrives in your 2026 ITR, you need your own records to verify if the exchange reported the numbers accurately.

- Breathe Easy on Vehicles: If you’ve been putting off buying a scooter or a budget motorcycle because of PAN card documentation hassles, you can proceed smoothly once the rules are officially notified.

Taxes don’t have to be terrifying when you understand the mechanics behind them. Stay compliant, optimize your allowances, and keep your focus on growing your wealth.

Frequently Asked Questions (FAQ)

Q1: What happens if I deposit exactly ₹9,99,999 in cash across the year?

Answer: Technically, you stay just under the ₹10 Lakh threshold for mandatory PAN quoting and SFT reporting. However, algorithms at modern banks are programmed to flag “structuring” (deliberately keeping deposits just below reporting thresholds to evade scrutiny). If you run a legitimate business, it is always safer to quote your PAN and declare the income.

Q2: Does the ₹10 Lakh cash limit apply to withdrawals as well?

Answer: Yes. The draft rules propose that the ₹10 Lakh aggregate limit applies to cash deposits or withdrawals. Withdrawing massive amounts of cash is viewed with the same regulatory suspicion as depositing it.

Q3: Are crypto losses tax-deductible under the 2026 rules?

Answer: No. The foundational rules set under Section 115BBH remain unchanged. You cannot offset losses from one crypto asset against profits from another, nor can you carry forward crypto losses to future years. You are taxed purely on the winning trades.

Q4: If I buy a car for ₹4.5 Lakh, do I need to give my PAN?

Answer: Under the proposed Draft Rules 2026, no. Because the purchase price is under the ₹5 Lakh threshold, quoting a PAN is not mandatory.

Q5: When will these rules be finalized?

Answer: The draft rules are open for public feedback until February 22, 2026. After consultations, the CBDT is expected to notify the finalized rules by the first week of March, taking effect alongside the Income Tax Act, 2025, on April 1, 2026.

Disclaimer: This article is based on the Draft Income Tax Rules 2026 released for public consultation. Final rules notified may have variations. Always consult a certified tax professional or CA before making final tax declarations.

Glossary

- VDAs: Virtual Digital Assets (The legal term for cryptocurrencies, NFTs, and tokens).

- CBDC: Central Bank Digital Currency (The official Digital Rupee backed by the RBI).

- SFT: Specified Financial Transaction (High-value transactions that banks/entities legally must report to the tax department).

- AIS: Annual Information Statement (A comprehensive view of your financial data collected by the tax department).