Key Takeaways Regarding Children’s Education Allowance Limit 2026:

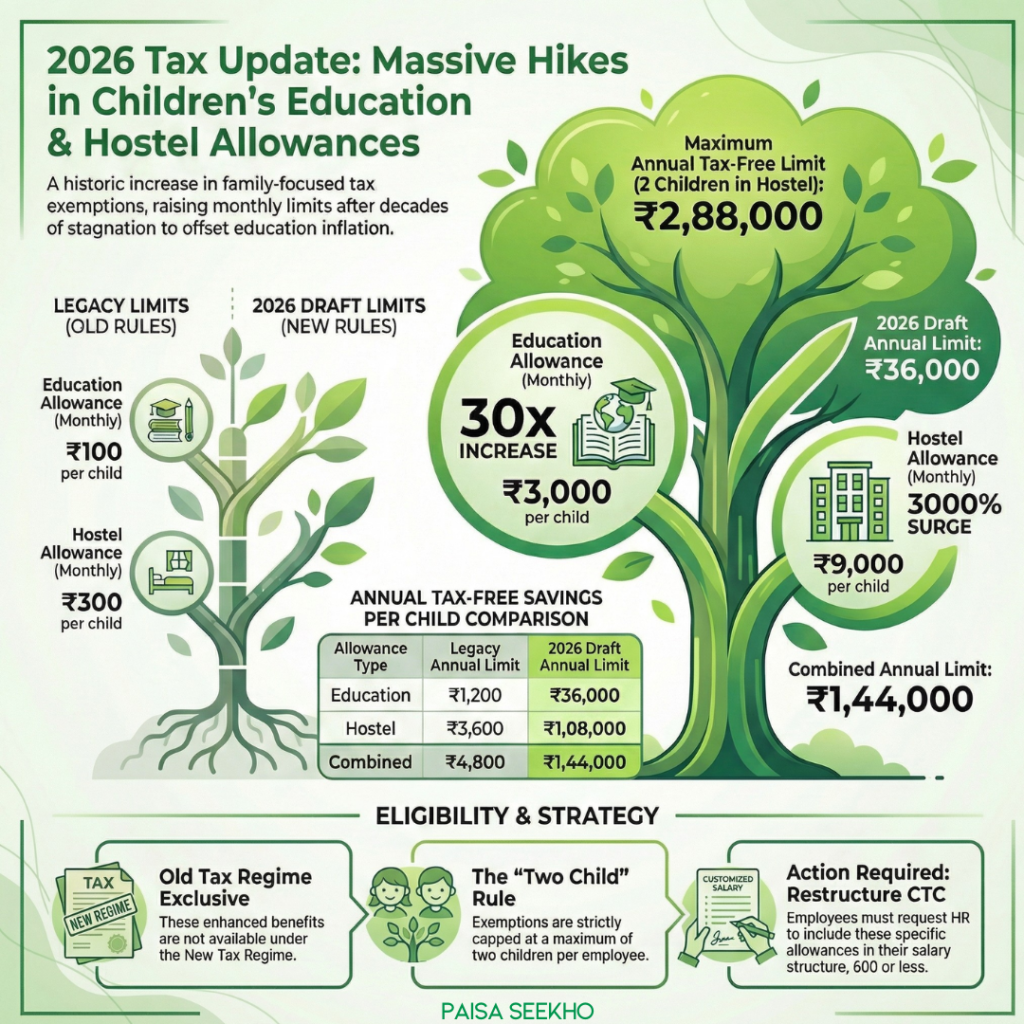

- Education Boost: Under the Draft Income Tax Rules 2026, the Children’s Education Allowance exemption has increased from a mere ₹100/month to ₹3,000/month per child (Max 2 children).

- Hostel Relief: The Hostel Expenditure Allowance has surged from ₹300/month to ₹9,000/month per child.

- Maximum Tax-Free Limit: A parent with two children in a hostel can claim up to ₹2,88,000 per year in tax-free allowances.

- Regime Warning: These enhanced benefits are available ONLY under the Old Tax Regime. The New Tax Regime does not permit these deductions.

- Implementation Date: These rules operationalize the Income Tax Act, 2025, and apply to salaries earned from April 1, 2026.

For nearly three decades, Indian taxpayers have lived with a tax rule that felt disconnected from reality.

If you were a salaried employee between 1997 and 2025, the Income Tax Department allowed you to claim a tax exemption for your child’s education. The amount? A baffling ₹100 per month. In an era where nursery admissions cost more than college degrees did in the 90s, the ₹1,200 annual exemption was largely ignored by most parents.

However, the landscape is shifting dramatically.

Earlier this week, the Central Board of Direct Taxes (CBDT) released the highly anticipated Draft Income Tax Rules 2026. These rules are the operational framework for the new Income Tax Act, 2025. Among the sweeping changes, the most celebrated update for the middle class is the aggressive rationalization of family-focused allowances. The government has finally acknowledged the crushing weight of education inflation.

This is the definitive Paisaseekho guide to understanding exactly how the new Children’s Education Allowance and Hostel Expenditure Allowance work, how much tax you can legally save, and the paperwork you need to prepare before April 2026.

1. The Education Allowance Hike: From ₹100 to ₹3,000

What is the new children’s education allowance limit in 2026?

Answer: According to the Draft Income Tax Rules 2026, the tax exemption limit for the Children’s Education Allowance has been increased to ₹3,000 per month per child. This benefit can be claimed for a maximum of two children.

This represents a staggering 30x increase from the legacy rule. It transforms what used to be a negligible deduction into a primary tax-saving tool for young parents.

The Financial Impact on Your Wallet

To understand the gravity of this change, we must look at the annual savings. Most private schools in India, even in Tier-2 and Tier-3 cities, charge tuition fees ranging from ₹3,000 to ₹10,000 per month. The new limit effectively makes the first ₹36,000 of your annual school fees completely tax-free per child.

Comparing the Eras (Per Child):

- The Old Rule (Pre-2026): ₹100/month = ₹1,200/year.

- The New Draft Rule (2026): ₹3,000/month = ₹36,000/year.

If you fall into the 30% income tax bracket, the legacy rule saved you a mere ₹360 a year. Under the new 2026 rules, that single line item on your salary slip saves you ₹10,800 in hard cash per child annually.

2. The Hostel Allowance Hike: A Game Changer for Tier-2 Families

How much hostel allowance can I claim per child in 2026?

Answer: The Draft Income Tax Rules 2026 propose raising the Hostel Expenditure Allowance exemption from ₹300 per month to ₹9,000 per month per child. Like the education allowance, this is capped at a maximum of two children.

While the education allowance makes headlines, the hostel allowance is the true sleeper hit of the new tax draft.

Why This Matters for Migrant Students

Many families in smaller towns make immense financial sacrifices to send their children to boarding schools, residential colleges, or major educational hubs (like Kota, Pune, or Bengaluru) for better opportunities. Hostel and mess fees in these institutions routinely cross ₹1 Lakh to ₹2 Lakh per year.

The previous exemption of ₹300/month (₹3,600/year) offered no real relief. The new exemption of ₹1,08,000 per year per child entirely reshapes the tax planning strategy for families with children living away from home.

The “Double Benefit” Clarification

A common point of confusion is whether you can claim both.

Yes, you can. If your child is enrolled in a residential school (boarding school), you are paying both for their education and their accommodation. Therefore, you can claim the Children’s Education Allowance (₹3,000/month) AND the Hostel Expenditure Allowance (₹9,000/month) simultaneously for the same child.

3. Real-Life Scenarios: Calculating Your Tax ROI

Let us break down the mathematics of these new draft rules using practical scenarios common to the Paisaseekho community.

Scenario A: The Single Child (Day Scholar)

- Profile: Rahul and Sneha live in Lucknow. They have one 6-year-old daughter attending a local private school.

- School Fees Paid: ₹5,000/month.

- Allowance Structure: Rahul’s HR structures his CTC to include ₹3,000/month as “Children’s Education Allowance.”

- Tax Exemption: ₹3,000 x 12 months = ₹36,000.

- Direct Tax Saved (at 30% slab): ₹10,800 per year.

Scenario B: Two Children (Day Scholars)

- Profile: Amit has two children, aged 8 and 12, studying in Ahmedabad.

- Allowance Structure: Amit ensures his employer allocates ₹6,000/month (₹3k x 2) toward education allowance.

- Tax Exemption: ₹3,000 x 2 kids x 12 months = ₹72,000.

- Direct Tax Saved (at 30% slab): ₹21,600 per year.

…And Scenario C: Two Children (Boarding School / Hostel)

- Profile: Vikram lives in a Tier-3 town but has sent his two teenagers to a residential school in Dehradun.

- Allowance Structure: Vikram’s HR department includes both allowances in his salary slip.

- Education Allowance: ₹6,000/month (for two kids)

- Hostel Allowance: ₹18,000/month (for two kids)

- Total Annual Exemption: * Education: ₹72,000

- Hostel: ₹2,16,000

- Grand Total: ₹2,88,000 tax-free income.

- Direct Tax Saved (at 30% slab): ₹86,400 per year.

By simply optimizing his salary structure under the Draft Income Tax Rules 2026, Vikram effectively earns nearly ₹90,000 more in hand every year.

4. The Catch: Old Tax Regime vs. New Tax Regime

Can I claim Children’s Education Allowance in the New Tax Regime?

Answer: No. Under the current framework and the proposed Draft Income Tax Rules 2026, special allowances like the Children’s Education Allowance and Hostel Expenditure Allowance are not permitted as deductions under the New Tax Regime (Section 115BAC).

This creates the most critical financial crossroads for salaried parents in FY 2026-27.

For the past few years, the government has heavily incentivized the New Tax Regime by offering lower tax slab rates and a higher rebate threshold. For young, unmarried professionals with minimal investments, the New Regime is undeniably superior.

However, the massive hikes in the 2026 draft rules breathe powerful new life into the Old Tax Regime.

The Breakeven Math for Parents

If you choose the Old Tax Regime, you face higher percentage tax rates, but you get to shrink your “taxable income” base using deductions.

Imagine a taxpayer earning ₹18 Lakhs a year.

If they have two kids in a hostel, they can claim:

- Standard Deduction: ₹50,000

- Section 80C (EPF/Tuition/PPF): ₹1,50,000

- Section 80D (Health Insurance): ₹25,000

- Education Allowance (New): ₹72,000

- Hostel Allowance (New): ₹2,16,000

Total Deductions = ₹5,13,000.

Their taxable income drops from ₹18 Lakhs to roughly ₹12.8 Lakhs.

When you compare the tax on ₹12.8L in the Old Regime versus the tax on ₹17.5L (only standard deduction allowed) in the New Regime, the Old Regime suddenly becomes highly competitive, and often cheaper, for parents facing heavy schooling costs.

5. Eligibility Criteria: Who Qualifies for the Exemption?

To prevent misuse of these high-value allowances, the Income Tax Department maintains strict eligibility definitions.

1. The Definition of “Child”

- Biological and Adopted: The allowance is valid for biological children, legally adopted children, and stepchildren.

- Siblings Excluded: You cannot claim this allowance for funding the education of your younger brother or sister, even if you are their legal guardian.

- Age Limit: The allowance is generally available for children from the nursery level up to the age of 25, provided they are enrolled in full-time education.

2. The “Two Child” Rule

- The exemption is strictly capped at a maximum of two children per employee.

- Exception: If the second childbirth results in multiple births (twins or triplets), the exemption can be extended to cover the additional child as per existing tax precedents, though this is rare and subject to scrutiny.

3. Both Parents Working

- If both the husband and wife are salaried employees and both receive a Children’s Education Allowance from their respective employers, can both claim the ₹3,000 exemption?

- Yes. The exemption is tied to the individual taxpayer, not the child. If the school fees are high enough to justify it (e.g., ₹8,000/month), the father can claim his ₹3,000 exemption and the mother can claim her ₹3,000 exemption. However, the combined claimed amount cannot exceed the actual total fees paid to the institution.

4. Recognized Institutions Only

- The child must be enrolled in a formally recognized educational institution (School, College, or University) situated in India.

- Coaching Centers: Fees paid to private coaching institutes (for IIT-JEE, NEET, UPSC, etc.) do not qualify for this allowance. The institution must provide formal schooling or degree-granting courses.

6. Documentation Checklist: Be Audit-Ready

When the limit was ₹100, the tax department rarely bothered to verify claims. With the limit jumping to ₹3,000 and ₹9,000, employers and the tax authorities will demand stringent proof.

What documents are required for Education and Hostel Allowance in 2026?

Answer: To claim the enhanced allowances, you must submit valid fee receipts issued by the educational institution to your employer during the annual investment declaration window (usually January-February).

Checklist for Valid Receipts:

- Institution Details: The receipt must clearly show the name, address, and affiliation of the school/college.

- Child’s Name: The receipt must bear the name of the child for whom the allowance is being claimed.

- Financial Year Alignment: The fee receipt must correspond to the academic term falling within the financial year you are claiming the tax for (e.g., April 2026 to March 2027).

- Itemized Billing: This is crucial. A lump-sum receipt stating “School Fees” might be rejected if you are claiming Hostel Allowance. The receipt must clearly demarcate:

- Tuition Fees (Qualifies for Education Allowance & Sec 80C)

- Hostel / Boarding Fees (Qualifies for Hostel Allowance)

- Transport/Bus Fees (Generally not exempt)

- Development Fees / Donations (Not exempt)

7. How to Restructure Your Salary for 2026 (Email Template)

The biggest mistake employees make is assuming these tax benefits apply automatically. They do not. To claim an allowance, that specific allowance must exist as a defined line item on your CTC (Cost to Company) structure. If your entire salary is lumped into “Basic” and “Special Allowance,” you cannot claim the ₹3,000 education benefit, no matter how many receipts you have.

You must proactively ask your HR/Payroll department to restructure your pay.

Email Template to HR:

Subject: Request for CTC Restructuring: Inclusion of Education & Hostel Allowance (FY 2026-27)

Dear [HR Manager / Payroll Team Name],

In light of the Draft Income Tax Rules 2026, which have increased the exemption limits for specific family allowances, I would like to request a restructuring of my salary components for the upcoming financial year (April 2026 onwards).

To help optimize my tax liabilities under the Old Tax Regime, I request that you allocate portions of my fully taxable ‘Special Allowance’ into the following heads, keeping my overall Gross CTC unchanged:

- Children’s Education Allowance: ₹6,000 per month (for 2 children).

- Hostel Expenditure Allowance: ₹18,000 per month (for 2 children). [Remove if not applicable]

I will ensure that all relevant fee receipts from recognized educational institutions are submitted within the required timelines for tax verification.

Please let me know the internal process or forms required to implement this adjustment.

Best regards,

[Your Name]

[Employee ID]

8. Section 80C vs. Education Allowance: The Crucial Difference

Many taxpayers confuse the Children’s Education Allowance (Section 10(14)) with the Tuition Fee Deduction (Section 80C). They are two entirely different tax-saving mechanisms, and the best part is: You can use both.

| Feature | Children’s Education Allowance | Tuition Fee Deduction (Sec 80C) |

| Source of Rule | Section 10(14) & Rule 15 | Section 80C |

| Nature | An Allowance given by your employer. | A Deduction on money you spent yourself. |

| Limit (Draft 2026) | Up to ₹36,000/year per child. | Included in the overall ₹1.5 Lakh 80C limit. |

| What it Covers | General education expenses (broad). | Strictly “Tuition Fees” only. (No bus, no late fees). |

| Max Children | Up to 2 children. | Up to 2 children. |

The Strategy:

If you pay ₹1,00,000 a year in school fees:

- Ask your employer to give you ₹36,000 as Education Allowance. This becomes tax-free.

- Take the remaining ₹64,000 (if it is purely tuition fee) and declare it under Section 80C to exhaust your ₹1.5 Lakh investment limit without needing to buy extra insurance or mutual funds.

Conclusion: Don’t Leave Money on the Table

The Draft Income Tax Rules 2026 represent a rare moment where the tax code has been adjusted to reflect the genuine struggles of the salaried middle class. The hikes to the Children’s Education Allowance and Hostel Expenditure Allowance are historic corrections of outdated metrics.

For parents navigating the ever-increasing costs of schooling in India, these rules offer a substantial financial cushion. However, this cushion is not handed out by default. It requires you to calculate your expenses, choose the Old Tax Regime, and actively communicate with your payroll department.

As the April 2026 implementation date approaches, gather your school receipts, do the math, and ensure your salary structure works for your family’s future, not just for the taxman.

Frequently Asked Questions (FAQ)

Q1: What is the new children’s education allowance limit in the 2026 draft rules?

Answer: The proposed limit is ₹3,000 per month per child, up to a maximum of two children.

Q2: Is the ₹3,000 allowance applicable for preschool or nursery fees?

Answer: Yes. The Income Tax Act does not define a minimum age. As long as the preschool or nursery is a recognized educational institution and provides valid fee receipts, it is generally accepted for the allowance.

Q3: My child studies abroad. Can I claim the Children’s Education Allowance?

Answer: No. The Income Tax rules traditionally stipulate that the educational institution must be situated within India to qualify for this specific allowance exemption.

Q4: Can I claim Hostel Allowance if my child lives in a private PG (Paying Guest) accommodation?

Answer: This is a grey area. The rule specifically states “Hostel Expenditure Allowance.” A hostel formally managed by or attached to the school/college is completely safe. A private PG might be rejected by a strict assessing officer during an audit. It is best to obtain a formal receipt that clearly denotes the accommodation as a student hostel.

Q5: When do these draft rules become official law?

Answer: The Draft Income Tax Rules 2026 are open for public consultation until February 22, 2026. After incorporating feedback, the CBDT is expected to notify the final rules in March 2026. The new limits will apply to income earned starting from April 1, 2026 (Financial Year 2026-27).

Disclaimer: This article is based on the Draft Income Tax Rules 2026 released for public consultation. Final rules notified may have variations. Always consult a certified tax professional or CA before making final tax declarations.

Glossary for Beginners

- Allowance: A fixed amount of money given by your employer for specific expenses (like education or rent) on top of your basic salary.

- Exemption: Specific income that the government allows you to exclude entirely from your tax calculation.

- Old Tax Regime: The traditional tax system that features higher tax slab rates but allows you to claim numerous exemptions and deductions (like HRA, 80C, and Education Allowance).

- CBDT: Central Board of Direct Taxes—the government body responsible for drafting and enforcing income tax rules in India.