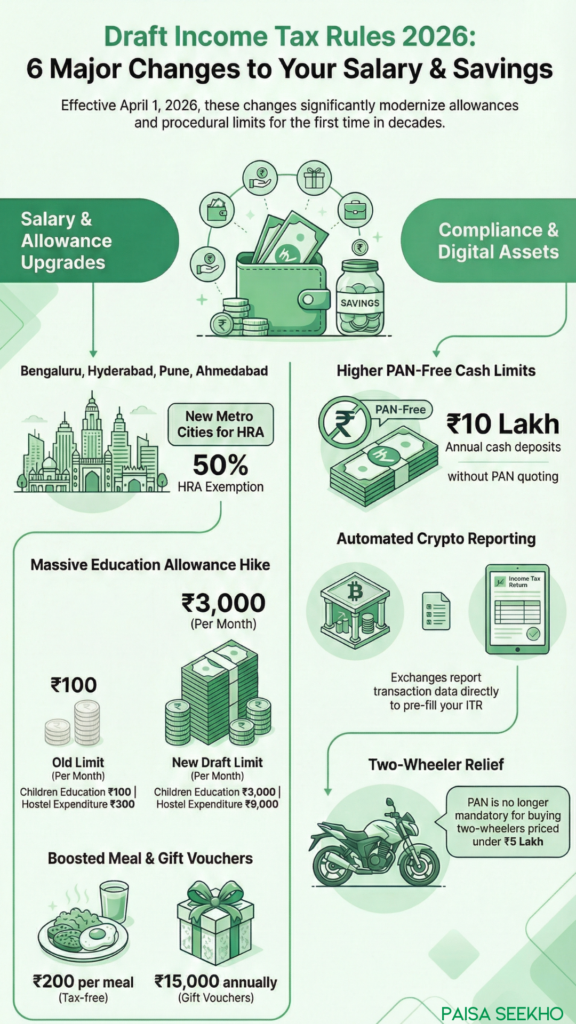

Key Takeaways Regarding the Draft Income Tax Rules 2026:

- HRA Boom: Bengaluru, Hyderabad, Pune, and Ahmedabad proposed to join the 50% HRA Exemption list.

- Allowance Hikes: Children’s Education Allowance increased to ₹3,000/month (up from ₹100). Hostel Allowance up to ₹9,000/month.

- Meal Coupons: Tax-free limit raised to ₹200 per meal.

- PAN Relaxations: Cash deposit limit without PAN raised to ₹10 Lakh/year.

- Effective Date: These rules operationalize the Income Tax Act, 2025 and are effective from April 1, 2026.

For decades, Indian taxpayers have lived under the Income Tax Act of 1961. That era is officially ending.

Earlier this week, the Central Board of Direct Taxes (CBDT) released the Draft Income Tax Rules 2026. These rules are designed to operationalize the newly passed Income Tax Act, 2025, which replaces the 64-year-old legacy law.

While the government’s headline has been “Simplification,” the real story for the Paisaseekho community, especially young professionals in Tier-2 cities and growing families, is in the details. The draft rules propose massive updates to allowances that haven’t been touched since the 1990s.

If you live in a city like Pune or Hyderabad, or if you are paying for your child’s education, these rules might just change your entire tax planning strategy for the financial year 2026-27.

Here is everything you need to know about the Draft Income Tax Rules 2026 and how they impact your wallet.

1. The “Metro” HRA Upgrade: Pune, Hyderabad, & Bengaluru Join the Club

Which cities are eligible for 50% HRA exemption in 2026?

Answer: Under the Draft Income Tax Rules 2026, the list of cities eligible for 50% HRA exemption has been expanded to include Bengaluru, Hyderabad, Pune, and Ahmedabad, alongside the existing metros (Delhi, Mumbai, Kolkata, Chennai).

For years, Indian tax laws defined “Metros” based on the four colonial-era major cities. This meant that a techie paying ₹40,000 rent in Bengaluru (India’s Silicon Valley) could only claim 40% of their basic salary as tax-exempt HRA, while someone in Kolkata could claim 50%.

The new draft rules finally fix this anomaly.

The Impact on Your Salary

This is a game-changer for our audience migrating to these tech hubs. If you opt for the Old Tax Regime, your HRA deduction is calculated as the lowest of three values:

- Actual HRA received.

- Actual Rent paid minus 10% of Basic Salary.

- 50% of Basic Salary (for Metro) OR 40% of Basic Salary (for Non-Metro).

By moving cities like Pune and Hyderabad to the “50% Bracket,” the government has effectively increased the ceiling of your tax savings.

Real-Life Calculation: The “Pune Techie” Scenario

- Name: Rohan (Software Developer in Pune)

- Basic Salary: ₹8 Lakh per annum.

- Rent Paid: ₹4 Lakh per annum (₹33k/month).

- HRA Received: ₹4 Lakh.

| Calculation Step | Old Rule (40% Limit) | New Draft Rule 2026 (50% Limit) |

| A. Actual HRA | ₹4,00,000 | ₹4,00,000 |

| B. Rent – 10% Basic | ₹3,20,000 | ₹3,20,000 |

| C. % of Basic Salary | ₹3,20,000 (40%) | ₹4,00,000 (50%) |

| Exempt HRA (Lowest) | ₹3,20,000 | ₹3,20,000 |

| Taxable HRA | ₹80,000 | ₹80,000 |

Wait, did Rohan save money?

In this specific case, Rohan was limited by his Rent Paid (Condition B). However, for high-income earners whose Basic Salary is high, the “40% Cap” was often the bottleneck.

Let’s look at a Senior Manager:

- Basic Salary: ₹20 Lakh.

- Rent Paid: ₹9 Lakh.

- Condition B (Rent – 10% Basic): ₹7 Lakh.

- Condition C (Old 40%): ₹8 Lakh.

- Condition C (New 50%): ₹10 Lakh.

In scenarios where the rent is very high, the 50% cap provides significantly more breathing room.

Paisaseekho Tip: If you live in Bengaluru, Hyderabad, Pune, or Ahmedabad, recalculate your tax liability under the Old Regime before April 1st. The 10% extra headroom might be the tipping point that makes the Old Regime better for you than the New Regime.

2. The “Parent” Upgrade: Education & Hostel Allowances Skyrocket

What is the new Children Education Allowance limit in 2026?

Answer: The Draft Income Tax Rules 2026 propose increasing the Children’s Education Allowance exemption from ₹100 per month to ₹3,000 per month per child. The Hostel Expenditure Allowance is proposed to increase from ₹300 per month to ₹9,000 per month per child.

This is arguably the most “viral” change in the draft rules. For decades, the ₹100/month allowance (totaling ₹1,200/year) was a joke among taxpayers. It wasn’t enough to buy a single textbook, let alone pay school fees.

The New Numbers (Per Child, Max 2 Children)

| Allowance Type | Old Limit (1962 Rules) | New Limit (Draft 2026) | Annual Benefit (2 Kids) |

| Children Education | ₹100 / month | ₹3,000 / month | ₹72,000 (Tax Free) |

| Hostel Expenditure | ₹300 / month | ₹9,000 / month | ₹2,16,000 (Tax Free) |

Who Benefits?

This is massive for Tier-2 parents sending kids to boarding schools or simply paying high private school fees.

If you have two children in a hostel, you can now claim a combined exemption of:

- Education Allowance: ₹3,000 x 2 x 12 = ₹72,000

- Hostel Allowance: ₹9,000 x 2 x 12 = ₹2,16,000

- Total Tax-Free Income: ₹2,88,000

At a 30% tax bracket, that is a straight tax saving of ~₹86,400 per year.

Important Constraint: This benefit is available primarily under the Old Tax Regime. The New Tax Regime (Section 115BAC) generally does not allow exemptions for allowances. This creates a massive incentive for parents with high education costs to stick with the Old Regime.

3. The “Office Perks” Update: Meals, Gifts, and Cars

Are meal coupons taxable under the 2026 rules?

Answer: No, meal coupons provided by an employer are tax-exempt up to ₹200 per meal under the Draft Income Tax Rules 2026. This is a significant increase from the previous limit of ₹50 per meal.

1. Meal Vouchers (Sodexo/Zeta etc.)

- Old Rule: ₹50 per meal x 2 meals/day (approx ₹2,200/month tax-free).

- New Rule: ₹200 per meal.

- Impact: If your employer offers this, you could potentially receive ₹8,000 – ₹10,000 per month as a tax-free food allowance.

2. Gift Vouchers

- Old Rule: Gifts up to ₹5,000 per annum were tax-free.

- New Rule: The limit is proposed to be raised to ₹15,000 per annum.

- Impact: Expect better Diwali bonuses or birthday vouchers from HR this year without the tax cut.

3. Company Car & Driver

The government has updated the “Perquisite Valuation” for company cars to reflect modern prices.

- The Bad News: The taxable value of a company car (which is added to your salary) is increasing. For example, owning a small car (<1.6L capacity) might now add ₹5,000/month to your taxable income instead of ₹1,800.

- The Good News: If you are provided a driver, the deduction for the driver’s salary (which reduces the taxable perk) has increased from ₹900/month to ₹3,000/month.

4. The “Hassle-Free” Life: PAN Card & Cash Rules

What is the cash deposit limit without PAN in 2026?

Answer: The Draft Income Tax Rules 2026 propose raising the threshold for quoting PAN for cash deposits to ₹10 Lakh per financial year. Previously, a limit of ₹50,000 per day often triggered compliance hassles for small businesses and savers.

For our audience in Tier-2/3 cities who often deal in cash or run family businesses, these procedural changes are a relief.

Key “Ease of Living” Changes

A. Buying a Two-Wheeler

- Old Rule: You had to provide a PAN card to buy any motor vehicle, even a scooty.

- New Draft Rule: PAN is NOT mandatory for two-wheelers unless the value exceeds ₹5 Lakh.

- Why it matters: This removes a hurdle for students or first-time buyers in rural areas who might have the cash but not the paperwork ready.

B. Hotels and Banquets

- Old Rule: Any bill over ₹50,000 required a PAN card. This was a pain for wedding payments or family vacations.

- New Draft Rule: The threshold is raised to ₹1 Lakh.

C. Foreign Travel

- Old Rule: Strict PAN reporting for foreign currency exchange > ₹50,000.

- New Draft Rule: The limit for quoting PAN for foreign travel expenses/forex is proposed to be hiked to ₹1 Lakh per transaction.

5. Crypto & Digital Assets: The “No Hiding” Clause

Do crypto exchanges report to the Income Tax Department?

Answer: Yes. Under the Draft Income Tax Rules 2026, Crypto-Asset Service Providers (exchanges) are mandated to report detailed transaction data directly to the Income Tax Department.

This is the “Compliance” side of the coin. The government is enabling the Income Tax Department to pre-fill your Virtual Digital Asset (VDA) gains in your Income Tax Return (ITR).

What this means for you:

- Transparency: You cannot hide crypto gains. If you traded on an Indian exchange (like CoinDCX, WazirX, etc.), the taxman already knows your profit/loss.

- TDS Alignment: The 1% TDS deducted on your trades will now reflect seamlessly in your AIS (Annual Information Statement).

- Pre-filled ITR: When you log in to file taxes in July 2027 (for FY 2026-27), your crypto income will likely be auto-populated, just like your salary or interest income.

Warning: If you have been trading on foreign exchanges (P2P) to avoid TDS, the draft rules also tighten the definition of “Resident” and “Source of Income,” making it riskier to evade reporting.

Analysis: Does this Save the “Old Tax Regime”?

This is the most critical question for you.

Since 2023, the government has been pushing the New Tax Regime (lower rates, no exemptions) as the default. It works great for people earning up to ₹15 Lakh who don’t have many investments.

However, the Draft Income Tax Rules 2026 seem to breathe new life into the Old Tax Regime.

Consider a “Super Saver” Profile:

- Lives in Pune (Now 50% HRA eligible).

- Has 2 children in boarding school (₹2.88 Lakh deduction via Education/Hostel allowance).

- Gets Meal Vouchers (₹24k deduction).

- Invests in 80C/80D (Standard ₹1.5L + ₹25k).

The Math Shift:

Previously, the deductions were too small to beat the New Regime’s low rates. But with the Hostel Allowance jumping to ₹9,000 and HRA limits rising, a taxpayer with this specific profile could legally wipe out ₹5 Lakh – ₹7 Lakh from their taxable income purely through allowances.

Verdict:

- Single, Rent < ₹20k, No Kids: Stick to the New Regime.

- Married, Kids in Hostel, High Rent in Pune/Hyd: The Old Regime is back in the game. Do the math.

Conclusion & Next Steps

The Draft Income Tax Rules 2026 are currently open for public consultation until February 22, 2026. While the government may tweak small details, the major changes, especially the HRA expansion and Allowance hikes, are expected to go through because they account for inflation that has been ignored for 30 years.

What should you do now?

- Check your Payroll: If you work in Pune, Hyderabad, Bengaluru, or Ahmedabad, ask your HR if they will update the HRA calculation logic for April 2026.

- Restructure Your Salary: If you have kids, ask your employer to explicitly include “Children Education Allowance” and “Hostel Allowance” as line items in your CTC structure. You can’t claim the exemption if it’s not a specific allowance on your payslip!

- Get Your KYC Done: If you run a small business, ensure your PAN is updated with your banks to take advantage of the higher ₹10 Lakh deposit limit.

Final Thought:

Tax laws usually get stricter. This is one of the rare times they are getting more generous (at least regarding allowances). Don’t let these benefits slip by because you were too lazy to update your salary structure.

Frequently Asked Questions (FAQ)

Q1: When do the Draft Income Tax Rules 2026 come into effect?

Answer: The rules are proposed to come into effect from April 1, 2026, coinciding with the start of the Financial Year 2026-27.

Q2: Can I claim the ₹3,000 Education Allowance in the New Tax Regime?

Answer: Generally, no. Most allowances (except standard deduction and employer NPS contribution) are not available under the New Tax Regime. These hikes are primarily beneficial if you opt for the Old Tax Regime.

Q3: Is the ₹10 Lakh cash deposit limit for one bank account or all accounts?

Answer: The limit of ₹10 Lakh per year for cash deposits without PAN applies to the aggregate (total) of all accounts held by you. Splitting cash into five different banks won’t help if the total exceeds ₹10 Lakh.

Q4: Do I need to submit bills for the Hostel Allowance of ₹9,000?

Answer: Yes. Unlike the old ₹100 allowance which was often ignored, a deduction of ₹9,000/month is significant. Employers will likely require genuine receipts from the educational institution/hostel to process this tax exemption.

Disclaimer: This article is based on the Draft Income Tax Rules 2026 released for public consultation. Final rules notified in March 2026 may have slight variations. Always consult a Chartered Accountant (CA) before filing your taxes.

Glossary for Beginners

- CBDT: Central Board of Direct Taxes (The boss of Income Tax).

- HRA: House Rent Allowance (Salary component for rent).

- VDA: Virtual Digital Asset (Official term for Crypto/NFTs).

- Perquisite: Non-cash benefits provided by your employer (like cars, houses, or waiters).