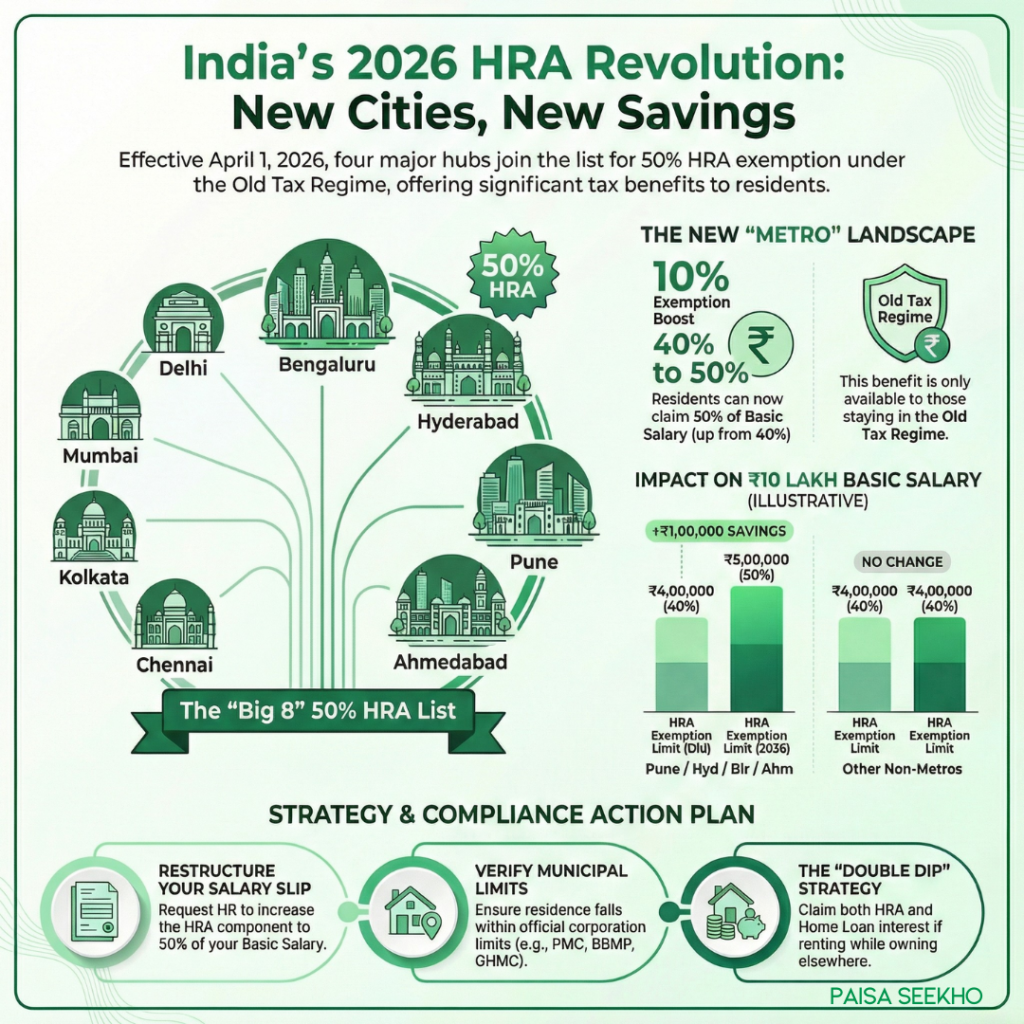

Key Takeaways Regarding HRA exemption cities list 2026:

- The Big Update: Under the Draft Income Tax Rules 2026, Bengaluru, Hyderabad, Pune, and Ahmedabad have been upgraded to the 50% HRA Exemption list.

- Effective Date: This change applies to salaries earned from April 1, 2026.

- The Impact: Employees in these cities can now claim HRA exemption up to 50% of their Basic Salary (previously capped at 40%).

- Old vs. New Regime: This benefit is only available if you opt for the Old Tax Regime. The New Tax Regime (Section 115BAC) does not offer HRA exemptions.

- Action Item: You must submit a revised rent declaration to your HR/Payroll department before April 2026 to adjust your TDS.

For over three decades, the Indian Income Tax Act operated on a colonial definition of “Metro Cities.”

If you lived in Delhi, Mumbai, Kolkata, or Chennai, the government acknowledged that your rent was high and allowed you a 50% HRA exemption. But if you lived in Bengaluru (India’s Silicon Valley), Hyderabad (Cyberabad), or Pune (the Oxford of the East), the taxman treated you like you were living in a small town, capping your exemption at 40%.

That discrimination ends this year.

The Draft Income Tax Rules 2026, released by the CBDT, have finally aligned tax laws with the reality of India’s urbanization. This is the definitive guide to understanding how the New HRA Rules 2026 work, how much tax you will save, and whether you should switch back to the Old Tax Regime.

1. The “Metro” List Update: Which Cities are 50% HRA in 2026?

Which cities are eligible for 50% HRA exemption in 2026?

Answer: According to the Draft Income Tax Rules 2026, the following cities are now classified as “Metropolitan Areas” for the purpose of HRA calculation (Rule 2A):

- Delhi (NCR limits defined)

- Mumbai (MMR limits defined)

- Kolkata

- Chennai

- Bengaluru (New Addition)

- Hyderabad (New Addition)

- Pune (New Addition)

- Ahmedabad (New Addition)

If you reside and pay rent in any of these 8 cities, your HRA exemption limit is 50% of your Basic Salary. For all other cities (e.g., Jaipur, Lucknow, Indore, Chandigarh), the limit remains 40%.

Why This Matters (The “40 vs 50” Math)

Most employees ignore the “40% vs 50%” distinction, assuming their rent is low enough that it doesn’t matter. This is a mistake.

As salaries rise, the “Basic Salary” component grows.

- Scenario: You have a Basic Salary of ₹10 Lakh.

- Old Rule (Pune @ 40%): Max HRA Exemption = ₹4,00,000.

- New Rule (Pune @ 50%): Max HRA Exemption = ₹5,00,000.

That is an additional ₹1 Lakh of tax-free income headroom, created instantly by this rule change.

2. How to Calculate HRA Under the 2026 Rules

How is HRA calculated for Pune/Bengaluru in 2026?

Answer: To calculate your HRA exemption for the Financial Year 2026-27 in the new 50% cities, you must calculate three values. The lowest of the three is your tax-exempt amount. The rest is taxable.

The 3 Golden Numbers:

- Actual HRA Received: (Check your salary slip).

- Rent Paid minus 10% of Basic Salary: (This ensures you actually spent money on rent).

- 50% of Basic Salary: (The new limit for Pune, Hyd, Blr, Ahm).

Note: “Basic Salary” for HRA calculation includes your Basic Pay + Dearness Allowance (DA), if applicable. It does not include other allowances like Special Allowance or Conveyance.

Detailed Calculation: The “Hyderabad Tech Lead”

Let’s look at a realistic example of Priya, a Tech Lead in Hyderabad.

- Annual CTC: ₹24 Lakh

- Basic Salary: ₹12 Lakh

- HRA Received: ₹6 Lakh (50% of Basic)

- Actual Rent Paid: ₹50,000/month = ₹6 Lakh/year

Calculation under OLD Rules (Hyderabad @ 40%):

- Actual HRA: ₹6,00,000

- Rent – 10% Basic: (₹6L – ₹1.2L) = ₹4,80,000

- 40% of Basic: ₹4,80,000

- Exempt Amount: ₹4,80,000 (Lowest of the three)

- Taxable HRA: ₹1,20,000

- Tax Impact: Priya pays tax on ₹1.2 Lakh.

Calculation under DRAFT 2026 Rules (Hyderabad @ 50%):

- Actual HRA: ₹6,00,000

- Rent – 10% Basic: (₹6L – ₹1.2L) = ₹4,80,000

- 50% of Basic: ₹6,00,000

- Wait, is the exemption still ₹4,80,000? Yes. In this specific case, Priya is limited by “Rent minus 10% Basic.” However, if Priya negotiates a salary restructure or her rent increases to ₹60,000/month (₹7.2L/year), the new limit kicks in.

Let’s see what happens if her rent is ₹60k:

- Rent Paid: ₹7,20,000.

- Rent – 10% Basic: ₹6,00,000.

- Old 40% Limit: ₹4,80,000 (She would have been capped here!).

- New 50% Limit: ₹6,00,000.

- New Exempt Amount: ₹6,00,000.

Result: By moving to the 50% bracket, Priya saves tax on an additional ₹1,20,000. At a 30% tax slab, that is a direct saving of ₹36,000 cash per year.

3. The Strategy: Old Regime vs. New Regime

Does the HRA change apply to the New Tax Regime?

Answer: No. The New Tax Regime (Default Regime u/s 115BAC) does not allow HRA exemptions. If you opt for the New Regime, you pay tax on your entire HRA component, regardless of whether you live in Pune, Mumbai, or a village.

This creates a massive “Decision Point” for 2026.

When should you switch to the Old Regime?

With the inclusion of Pune, Hyderabad, Bengaluru, and Ahmedabad in the 50% list, the “Breakeven Point” for the Old Regime has shifted.

The “Rent Threshold” Rule of Thumb: If you pay rent that is roughly 20% to 25% of your Gross Salary, the Old Regime (with HRA exemption) will likely beat the New Regime in 2026.

Why? The New Regime offers lower tax rates but zero deductions. The Old Regime has high tax rates but huge deductions.

- Before 2026: A Pune employee was capped at 40% deduction. Even if they paid high rent, they couldn’t claim enough to beat the New Regime.

- After 2026: The 50% cap allows for a massive deduction.

Example:

- Salary: ₹20 Lakh.

- Rent: ₹5 Lakh (Pune).

- Old Regime Deduction: ~₹4.5 Lakh (HRA) + ₹1.5 Lakh (80C) + ₹50k (NPS) = ₹6.5 Lakh Total Deduction.

- Taxable Income: ₹13.5 Lakh.

- Result: You will pay significantly less tax than under the New Regime (which would tax you on nearly the full ₹20 Lakh).

Paisaseekho Action Item: Use an “Income Tax Calculator 2026” tool. Do not assume the New Regime is better just because it was better last year. The rules of the game have changed.

4. Documentation: What HR Will Ask For

With great tax savings comes great paperwork. Since the exemption limits are higher, the Income Tax Department (ITD) has tightened the scrutiny in the Draft Rules 2026.

What documents are required for HRA exemption in 2026?

Answer: To claim the enhanced 50% HRA exemption, you must provide the following to your employer (HR) before the January-March 2027 proof submission window:

- Valid Rent Agreement:

- Must cover the financial year (April 2026 – March 2027).

- Must clearly state the monthly rent.

- Crucial: If you are in Pune/Hyd/Blr, ensure the address clearly falls within the municipal corporation limits (PMC, BBMP, GHMC). Properties in far-off suburbs might still be classified as “Non-Metro” if they fall under Gram Panchayats (Check with HR on this specific “Pin Code” rule in the draft).

- Rent Receipts:

- Monthly or Quarterly receipts signed by the landlord.

- Must show a Revenue Stamp (for cash payments > ₹5,000).

- Landlord’s PAN Card (The “Draft Rule” Twist):

- Old Rule: Mandatory only if rent > ₹1 Lakh/year (₹8,333/month).

- New Draft Rule: The threshold remains ₹1 Lakh/year, BUT the draft rules propose linking this to the landlord’s AIS (Annual Information Statement) immediately.

- Warning: If you claim ₹5 Lakh HRA, your landlord will see ₹5 Lakh income in their tax portal. If they don’t file taxes, you might get a notice. Ensure your landlord is “Tax Compliant” before signing the lease!

- Landlord’s Aadhaar (Optional but Recommended):

- If the landlord does not have a PAN, the draft rules allow for a declaration with Aadhaar, but this triggers a higher TDS audit risk. Avoid if possible.

5. Advanced Strategy: The “Double Dip” (HRA + Home Loan)

Can I claim HRA and Home Loan Interest deduction together in 2026?

Answer: Yes. The Draft Rules 2026 have not removed the ability to claim both HRA and Section 24(b) Home Loan Interest deduction simultaneously, provided you meet specific conditions.

This is the “Holy Grail” of tax planning for our audience in their 30s who might be buying a flat in Bengaluru/Pune while still renting near the office.

The “Pune 50%” Strategy

Imagine you work in Hinjewadi (Pune IT Park) but bought a house in Kharadi (other side of town) or in your hometown (Nagpur).

- Living Situation: You live in a rented flat in Hinjewadi to be close to work.

- Rent Paid: ₹4 Lakh/year.

- HRA Claim: You can claim this fully (up to 50% basic) because you actually pay rent.

- Ownership Situation: You own a home in Nagpur (or Kharadi) where your parents live, or it is vacant.

- Loan Interest Paid: ₹2 Lakh/year.

- Section 24(b) Claim: You can claim deduction up to ₹2 Lakh for “Self-Occupied” property interest (or full interest if let-out).

Total Deduction Potential:

- HRA (Old Regime): ₹4 Lakh

- Home Loan Interest: ₹2 Lakh

- Standard Deduction: ₹50k

- 80C: ₹1.5 Lakh

- Total Wiped Off Income: ~₹8 Lakh!

Constraint: You cannot claim HRA if you live in the same house you own. You must genuinely live in a rented property. The 50% HRA upgrade makes this “Double Dip” strategy even more lucrative for people in the new Metro cities.

6. City-Specific Guide: What to Watch Out For

For Bengaluru (The “ORR” Conundrum)

- Context: Many tech parks (Outer Ring Road, Whitefield) fall under the BBMP (Bruhat Bengaluru Mahanagara Palike).

- The Trap: Some newer extensions might technically fall under “Gram Panchayats” or “Town Municipal Councils” (e.g., outskirts of Electronic City).

- Advice: Check your rent agreement. Does it say “Bengaluru” or a specific village name? The 50% rule strictly applies to the Urban Agglomeration defined in the Census. Ensure your pin code is listed in the 50% notification.

For Hyderabad (The “Cyberabad” Zone)

- Context: Hyderabad has the GHMC (Greater Hyderabad Municipal Corporation).

- Good News: The draft rules have been generous with Hyderabad, covering almost the entire HMDA (Hyderabad Metropolitan Development Authority) region.

- Impact: Even if you live in Gachibowli or Manikonda, you are safe for the 50% limit.

For Pune (The “PMRDA” Confusion)

- Context: Pune is expanding into the PMRDA region (Wagholi, Manjri, etc.).

- The Trap: Historically, only PMC (Pune Municipal Corporation) and PCMC (Pimpri Chinchwad) areas were considered “Urban.”

- Advice: The Draft Rules 2026 explicitly name “Pune Urban Agglomeration.” This usually includes PCMC. So, if you live in Pimpri or Chinchwad and work in Pune, you are likely eligible for the 50% cut.

7. Salary Restructuring: What to Ask Your Boss

If you are moving to one of these 4 cities, or already live there, you need to have a chat with HR.

The “Optimum Salary Structure” for 2026

Most companies structure salaries with HRA at 40% of Basic by default for non-metros.

- The Problem: Even if the government allows 50% exemption, if your salary slip only gives you 40% HRA, you can’t claim 50%. You can’t claim exemption on money you didn’t receive!

Email Template to HR:

Subject: Request for Salary Restructuring – HRA Adjustment for FY 2026-27

Dear HR/Payroll Team,

With the Draft Income Tax Rules 2026 classifying [Your City: e.g., Pune] as a Metro City eligible for 50% HRA exemption, I would like to request a restructuring of my salary for the upcoming financial year.

Currently, my HRA is set at 40% of Basic. I request you to increase the HRA component to 50% of Basic (by adjusting Special Allowance) to align with the new tax rules and maximize my tax efficiency.

Please let me know the procedure to effect this change from April 2026.

Why HR might say “No”:

- It increases the “Gross Salary” if they don’t reduce Special Allowance.

- It might impact “Gratuity” or “PF” calculations if they lower Basic Salary to increase HRA.

- Counter: Ask them to keep the “Cost to Company” (CTC) constant and just swap “Special Allowance” (fully taxable) with “HRA” (partially exempt). This costs the company nothing but saves you tax.

Conclusion: The “Old Regime” Strike Back

The expansion of the 50% HRA list to include Pune, Hyderabad, Bengaluru, and Ahmedabad is not just a minor tweak—it is a structural shift in how the Indian middle class pays tax.

For the last three years, the narrative has been “Switch to the New Regime.” The Draft Rules 2026 challenge that narrative. By acknowledging the high cost of living in Tier-1 and emerging Tier-1 cities, the government has given the Old Tax Regime a powerful second wind.

Your Checklist for April 2026:

- Check your city status: Are you in the new “Big 8” list?

- Calculate your Rent-to-Income Ratio: Is rent > 20% of income?

- Restructure Salary: Ensure your HRA component is 50% of Basic.

- Validate Landlord: Get their PAN.

- Choose Regime: Compare Old (with 50% HRA) vs New (Flat rates).

Don’t leave money on the table. The “Pune is a village” era of taxation is finally over.

Frequently Asked Questions (FAQ)

Q1: Can I claim 50% HRA if I live in Bengaluru but my office is in Mysore?

Answer: HRA exemption is based on where you reside (where you pay rent), not where your office is located. If you live in Bengaluru and commute/telecommute to Mysore, and pay rent in Bengaluru, you can claim the 50% exemption.

Q2: What if I pay rent to my parents in Pune?

Answer: You can claim HRA for rent paid to parents provided:

- You actually transfer the money (bank trail required).

- Your parents declare this as “Rental Income” in their ITR.

- You do not co-own the property with them. With the 50% limit, this strategy becomes more attractive, but ensure strict compliance to avoid notices.

Q3: I live in Gurgaon. Is it 50% or 40%?

Answer: Gurgaon (Gurugram) falls under the definition of Delhi NCR (National Capital Region). Historically, Delhi was 50%, but NCR cities like Gurgaon/Noida were often debated. The Draft Rules 2026 explicitly clarify that NCR cities are eligible for the 50% limit. So yes, Gurgaon is 50%.

Q4: If I move from Indore (40%) to Pune (50%) in the middle of the year, how is HRA calculated?

Answer: HRA is calculated on a monthly basis.

- For the months you lived in Indore: 40% limit applies.

- For the months you lived in Pune: 50% limit applies. You cannot apply the 50% limit to the whole year if you only lived in Pune for 3 months.

Disclaimer: This article is based on the Draft Income Tax Rules 2026 released for public consultation. Final rules notified in March 2026 may have slight variations. Always consult a Chartered Accountant (CA) before filing your taxes.

Glossary for Beginners

- HRA: House Rent Allowance.

- Basic Salary: The core component of your salary (excluding allowances).

- CTC: Cost to Company (Your total salary package).

- TDS: Tax Deducted at Source (Tax cut by your boss before paying you).

- AIS: Annual Information Statement (The taxman’s report card of your finances).