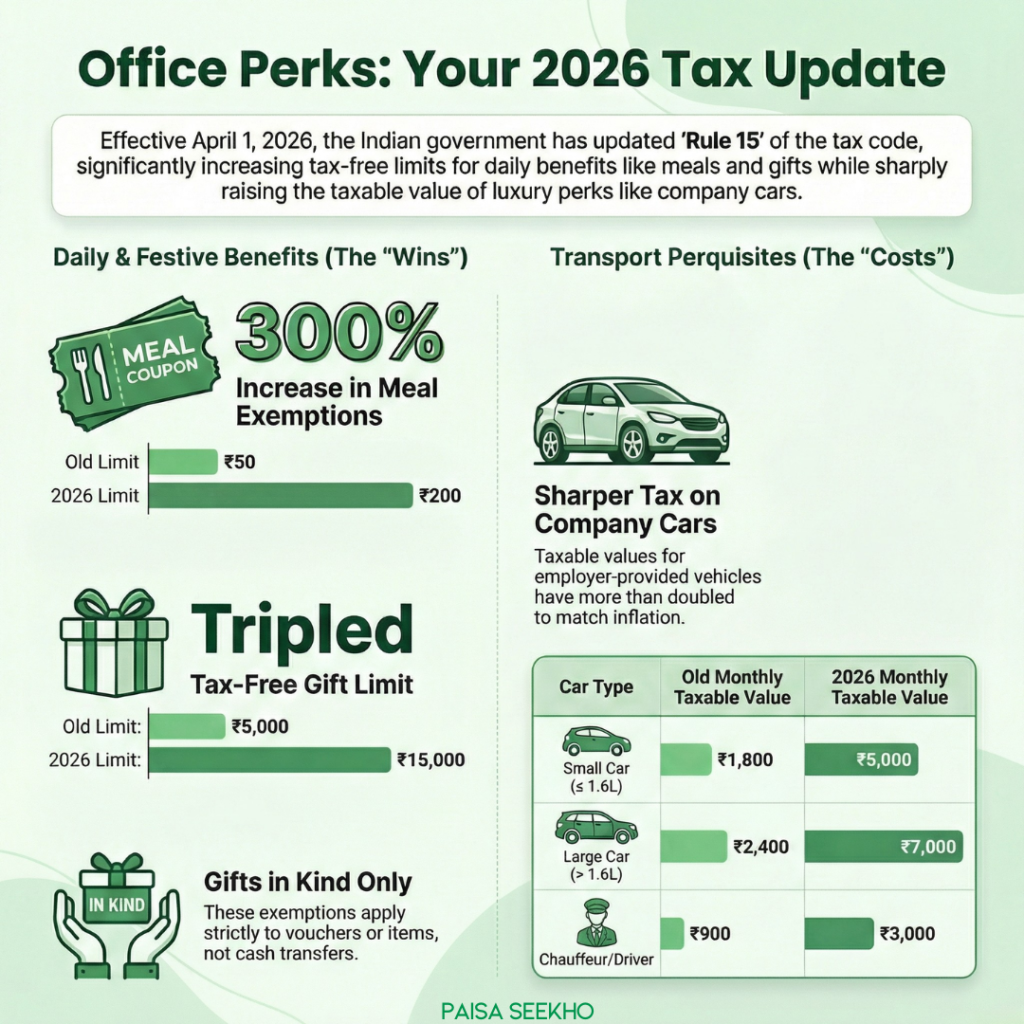

Key Takeaways Regarding the meal coupon tax exemption limit 2026:

- Lunch Upgrade: The meal coupon tax exemption limit 2026 has been raised from ₹50 per meal to ₹200 per meal.

- Gift Bonus: The tax-free gift limit from employer in 2026 has tripled from ₹5,000 to ₹15,000 per year.

- Costly Cars: The taxable perquisite value of a company-provided car has increased sharply. A small car (<1.6L) now adds ₹5,000/month to your taxable income (up from ₹1,800).

- Driver Deduction: The standard deduction for an employer-provided driver has jumped from ₹900/month to ₹3,000/month.

- Rule 15 Impact: These changes fall under the new “Rule 15” of the Draft Income Tax Rules 2026, which operationalize the Income Tax Act, 2025, effective April 1, 2026.

When you land a good corporate job in a tech park in Pune, Hyderabad, or Bengaluru, the HR department usually hands you a salary breakup filled with jargon: “Basic,” “HRA,” “Special Allowance,” and a section called “Perquisites.”

For years, Indian employees have treated perquisites (or “perks”) as minor line items. A ₹50 Sodexo coupon here, a ₹5,000 Diwali Amazon voucher there. But with the release of the Draft Income Tax Rules 2026 by the Central Board of Direct Taxes (CBDT) on February 7, 2026, the tax math behind your office perks has undergone a massive structural reset.

The government has slashed the sprawling 1962 tax rules from 511 down to 333 sharp, modernized rules. In doing so, they have rewritten Rule 15, the section that governs how your office perks are taxed. The headline? Your daily lunch just got much more tax-efficient, but driving the company car is going to cost you.

Whether you are a junior developer swiping a Zeta card at the cafeteria or a senior manager driving a company-leased Honda City, this is exactly how the 2026 tax rules will impact your take-home salary.

1. The “Corporate Lunch” Update: Meal Coupons

If you work in a modern corporate office, you are likely familiar with meal vouchers, often distributed via digital cards like Sodexo (Pluxee) or Zeta.

Are meal coupons taxable in 2026?

Answer: No, provided they are used correctly. Under the Draft Income Tax Rules 2026, meal coupons provided by an employer are tax-exempt up to ₹200 per meal. This is a massive 300% increase from the archaic ₹50 per meal limit that existed for decades. Any amount provided beyond ₹200 per meal becomes a taxable perquisite.

Understanding the Sodexo Tax Limit 2026

The previous limit of ₹50 per meal was hopelessly out of touch with modern inflation. Even at a subsidized office canteen, ₹50 barely covers a sandwich, let alone a proper lunch. By upgrading the Sodexo tax limit 2026 to ₹200, the tax department has aligned the rules with economic reality.

The Financial Math:

Typically, companies calculate this benefit assuming one meal per working day (approximately 22 working days a month).

- The Old Math: ₹50/meal x 22 days = ₹1,100 per month.

- Annual Tax-Free Amount: ₹13,200.

- The New 2026 Math: ₹200/meal x 22 days = ₹4,400 per month.

- Annual Tax-Free Amount: ₹52,800.

If you are in the 30% tax bracket, structuring ₹52,800 of your CTC into meal vouchers will save you approximately ₹15,840 in hard cash every year.

The Fine Print for Meal Vouchers

Before you ask HR to dump your entire salary into a Sodexo card, remember the compliance constraints under Rule 15:

- Non-Transferable: The vouchers must be strictly non-transferable.

- Usage Restricted: They can only be used at “eating joints” or for purchasing food and non-alcoholic beverages. You cannot use them to buy electronics or withdraw cash. Digital platforms like Zeta enforce these merchant category codes automatically.

- Working Hours: The exemption technically applies to meals provided “during working hours.”

2. The Festival Bonus: Employer Gift Vouchers

Corporate gifting in India is a massive industry, peaking around Diwali and New Year. However, the taxman has historically been very stingy about these gifts.

What is the tax-free gift limit from employer in 2026?

Answer: Under the Draft Income Tax Rules 2026, the aggregate value of tax-free gifts, vouchers, or tokens provided by an employer to an employee (or their household) has been raised to ₹15,000 per financial year. Previously, this limit was strictly capped at ₹5,000.

How the Gift Tax Mechanics Work

Gifts from your employer are considered a “Perquisite” because they are a benefit arising from your employment.

- Scenario A (Under Old Rules): Your company gave you a ₹10,000 Amazon voucher for Diwali. The first ₹5,000 was tax-free. The remaining ₹5,000 was added to your taxable salary, and you paid income tax on it.

- Scenario B (Under 2026 Draft Rules): Your company gives you a ₹10,000 voucher. Because the limit is now ₹15,000, the entire amount is 100% tax-free.

Why This Matters for Performance Awards

Many modern startups and tech companies use “Spot Awards” or “Peer-to-Peer” reward platforms where employees earn points that can be converted into vouchers. The new tax-free gift limit from employer in 2026 allows companies to reward top performers up to ₹15,000 annually without the employee feeling the pinch of a tax deduction on their reward.

Paisaseekho Tip:

Cash gifts or direct bank transfers from an employer are always 100% taxable, regardless of the amount. The ₹15,000 exemption strictly applies to “gifts in kind” or vouchers/tokens.

3. The Company Car Perquisite: A Costly Upgrade

While the government gave with one hand regarding food and gifts, it took away with the other when it came to motor vehicles. For mid-level and senior management, the “Company Car Lease” is a highly popular tax-saving tool.

Unfortunately, the 2026 rules have delivered a significant tax blow to this perk.

How is company car perquisite calculated in 2026?

Answer: Under the Draft Income Tax Rules 2026, the taxable value of an employer-provided car (used for both official and personal purposes) has been sharply increased. For cars with an engine capacity below 1.6 litres, a flat ₹5,000 per month is added to your taxable income (up from ₹1,800). For cars above 1.6 litres, ₹7,000 per month is added (up from ₹2,400).

To understand why this is painful, you must understand how “Perquisite Valuation” works. When your employer pays for your car, the Income Tax Department assumes you are deriving a personal benefit from it. They assign a “notional value” to this benefit and add it to your taxable salary.

The old rates were set decades ago. The 2026 rules have recalibrated these values to match current inflation, effectively tripling the taxable amount.

The Impact on “CTC Car Leasing”

Let’s look at the standard scenario: Mixed Use (The car is used for both office commuting and personal weekend trips, and the employer pays for fuel and maintenance).

| Engine Capacity | Old Taxable Value (Per Month) | New Taxable Value 2026 (Per Month) | Increase in Taxable Income |

| Small Car (≤ 1.6 Litres) | ₹1,800 | ₹5,000 | + ₹3,200 / month |

| Large Car (> 1.6 Litres) | ₹2,400 | ₹7,000 | + ₹4,600 / month |

Real-World Scenario: The SUV Driver

- Profile: Sameer is a VP in a tech firm. He has a company-leased SUV (engine > 1.6L) through his CTC package. His employer reimburses all fuel and maintenance.

- Old Tax Burden: The IT department added ₹2,400/month (₹28,800/year) to Sameer’s taxable income. At a 30% slab, he paid ₹8,640 in tax for the privilege of driving the car.

- New 2026 Tax Burden: The IT department now adds ₹7,000/month (₹84,000/year) to his taxable income. At a 30% slab, he will pay ₹25,200 in tax.

That is a straight out-of-pocket tax increase of over ₹16,000 per year, just because the valuation rules changed.

What if the Employee pays for fuel?

If you own the car (or lease it) and the company provides it, but you pay for the fuel and maintenance out of your own pocket for personal use, the perquisite value is lower, but it has still increased sharply:

- ≤ 1.6 Litres: Increased from ₹600/month to ₹2,000/month.

- > 1.6 Litres: Increased from ₹900/month to ₹3,000/month.

Crucial Warning for April 2026: Tax experts note that the Company car perquisite calculated in 2026 will apply to all existing leases, not just new ones signed after April 1. If you are locked into a 3-year corporate car lease right now, your TDS (Tax Deducted at Source) will automatically jump in April 2026.

4. The Chauffeur Relief: Driver Salary Deductions

While the car itself has become more expensive from a tax perspective, the government has offered slight relief if your employer also provides a driver.

Understanding the Driver salary allowance tax rules

When an employer provides a chauffeur to run the motor car, this is considered an additional perquisite on top of the car itself.

- The Old Rule: The driver perk was valued at a flat ₹900 per month (₹10,800/year), regardless of the car size.

- The New 2026 Rule: The driver perk valuation has been increased to ₹3,000 per month (₹36,000/year).

How do you read this change?

It depends on who is paying the driver.

- If the Employer directly provides the driver: Your taxable income goes up. Previously, having a company driver only added ₹900/month to your taxable salary. Now it adds ₹3,000/month.

- If you hire the driver and the Employer reimburses you: This is where it acts as a deduction. If your driver’s actual salary is ₹15,000/month, the tax department assumes ₹3,000 of that is a “taxable perquisite” to you, but the remaining amount (if structured correctly against official use) might be treated more favourably than before.

The Total “Car + Driver” Tax Package (Mixed Use, Employer pays fuel):

- Small Car + Driver: ₹5,000 + ₹3,000 = ₹8,000 / month added to taxable income. (Up from ₹2,700).

- Large Car + Driver: ₹7,000 + ₹3,000 = ₹10,000 / month added to taxable income. (Up from ₹3,300).

5. Strategy: Should You Cancel Your CTC Car Lease?

Given these drastic increases in perquisite valuation under the Draft Income Tax Rules 2026, many corporate employees are wondering: “Is a CTC Car Lease still worth it?”

The short answer is: Usually, yes, but the profit margin has shrunk.

A CTC Car Lease allows you to pay the monthly EMI of the car from your pre-tax salary.

- If you buy a car yourself, you pay the EMI from your post-tax (in-hand) salary.

- If your lease rental is ₹30,000 a month (₹3.6 Lakhs a year), a CTC lease essentially deducts ₹3.6 Lakhs from your taxable income. You save roughly ₹1.08 Lakhs in tax (at the 30% slab).

Now, under the new rules, the government will add back ₹84,000 (for a >1.6L car) as a perquisite value.

- You still get a net reduction in taxable income of ₹2,76,000 (₹3,60,000 – ₹84,000).

- You still save ~₹82,800 in tax.

The Verdict: The CTC leasing model remains tax-efficient compared to buying a car with a standard auto loan. However, its efficiency has been heavily diluted. You are no longer getting away with a negligible ₹28,800 perquisite addition.

If you are planning to sign a new lease in 2026, you must run the math with your company’s leasing partner (like ALD Automotive, LeasePlan, or Orix) using the new Rule 15 values.

6. Action Plan: What You Need to Ask HR Today

The Draft Income Tax Rules 2026 are slated to take effect on April 1, 2026. This means your payroll department is currently configuring their software for the new financial year. Do not wait until your May salary slip to realize your TDS has spiked or you missed out on meal vouchers.

The “Office Perks” Restructuring Checklist:

1. Activate the Maximum Meal Allowance

If your company offers Sodexo or Zeta, write to HR:

- “I request my meal voucher allowance to be restructured to the new maximum limit of ₹4,400 per month (₹200/meal x 22 days) starting April 2026 to optimize my tax liability.”

2. Check Your Gift Vouchers

If you are due for a performance bonus in April, ask if it can be delivered as a gift voucher instead of a cash payout.

- “With the tax-free gift limit rising to ₹15,000, can my upcoming Q1 spot-award be processed as an Amazon Pay voucher rather than a taxable salary component?”

3. Brace for the Car Lease TDS Hit

If you currently drive a company-leased car, contact your payroll team immediately:

- “Could you please provide a simulation of my projected TDS for April 2026 based on the revised motor car perquisite valuation under the new Draft Rules?”

Conclusion: A Shift Toward Reality

The Draft Income Tax Rules 2026 represent a massive modernization of India’s tax code. For decades, the tax department pretended that a meal cost ₹50, an education cost ₹100, and running a car was dirt cheap.

The new “Rule 15” brings these numbers into 2026.

For the average employee looking to save tax on daily expenses, the hikes to the meal voucher limit and gift allowances are brilliant wins. They represent clean, easy-to-claim tax deductions that don’t require heavy paperwork.

However, for the executive class, the free ride on company cars is over. The taxman has finally priced the luxury of a chauffeur and an SUV at market rates.

As a taxpayer, your goal isn’t to fight the rules; it’s to adapt your salary structure to them.

Frequently Asked Questions (FAQ)

Q1: Can I claim the ₹4,400 Sodexo meal allowance if I opt for the New Tax Regime?

Answer: This is a critical point. Generally, perquisite exemptions (like meal vouchers and gifts) are permitted under the Old Tax Regime. The New Tax Regime restricts most allowances. You must verify with your tax consultant whether Rule 15 exemptions will be explicitly permitted under Section 115BAC for the FY 2026-27 cycle once the final notification is released in March.

Q2: Are cash gifts from my employer tax-free up to ₹15,000?

Answer: No. Cash gifts, no matter how small, are treated as salary income and are fully taxable. The ₹15,000 exemption strictly applies to vouchers, tokens, or gifts in kind (like a physical watch or a retail store gift card).

Q3: How does the IT department know if my car is < 1.6L or > 1.6L?

Answer: The cubic capacity (cc) of the engine is recorded on the vehicle’s Registration Certificate (RC). 1.6 Litres equates to 1600cc. A Maruti Swift or Hyundai i20 usually falls below 1.6L. A Honda City, Hyundai Creta, or Mahindra XUV700 usually exceeds 1.6L. Your HR uses the RC copy to calculate your specific perquisite value.

Q4: What if I use the company car 100% for official office duties?

Answer: If you can mathematically prove the car is used “wholly and exclusively in the performance of official duties,” the perquisite value is Nil. However, to prove this, you must maintain a stringent physical logbook detailing every journey’s date, destination, mileage, and official purpose, which must be certified by the employer. In reality, most employees find this documentation too tedious and accept the standard “Mixed Use” taxable valuation.

Q5: When do these changes become final?

Answer: The Draft Income Tax Rules 2026 are open for public feedback until February 22, 2026. After reviewing suggestions, the CBDT is expected to notify the final, binding rules in the first week of March, taking effect on April 1, 2026.

Disclaimer: This article is based on the Draft Income Tax Rules 2026 released for public consultation. Final rules notified in March may have slight variations. Always consult a Chartered Accountant (CA) or your payroll department before making final tax declarations.