Executive Summary

The Union Budget for the fiscal year 2026-27, presented by Finance Minister Nirmala Sitharaman, represents a distinct structural pivot in India’s economic policy. While the preceding decade was characterized by a relentless focus on hard infrastructure—highways, ports, and power plants—the 2026 mandate signals a transition toward “Human Capital Infrastructure” and the “Ease of Living” for the aspirational middle class. This document serves as an exhaustive analysis of the budget’s implications, specifically tailored for the demographic of young Indians residing in Tier 2 and Tier 3 cities—a cohort that stands at the intersection of ambition and opportunity.

The analysis identifies five transformative vectors—or “Ways”—through which this budget will materially alter the trajectory of life for the average citizen: the formalization of the “Orange Economy,” a radical overhaul of the Skilling ecosystem, a renewed stimulus for Urban Housing, a restructuring of Personal Finance incentives, and the hyper-connectivity of Regional Infrastructure.

This report deconstructs the fine print of policy announcements—from the hike in Securities Transaction Tax (STT) to the establishment of AVGC (Animation, Visual Effects, Gaming, and Comics) labs. The aim is to provide actionable insights for wealth creation and career planning. The central thesis of this report is that the government is actively incentivizing a shift from “speculative” wealth generation to “value-driven” economic participation, urging the youth to pivot from day-trading to skill-building, and from metro-centric migration to regional urbanization.

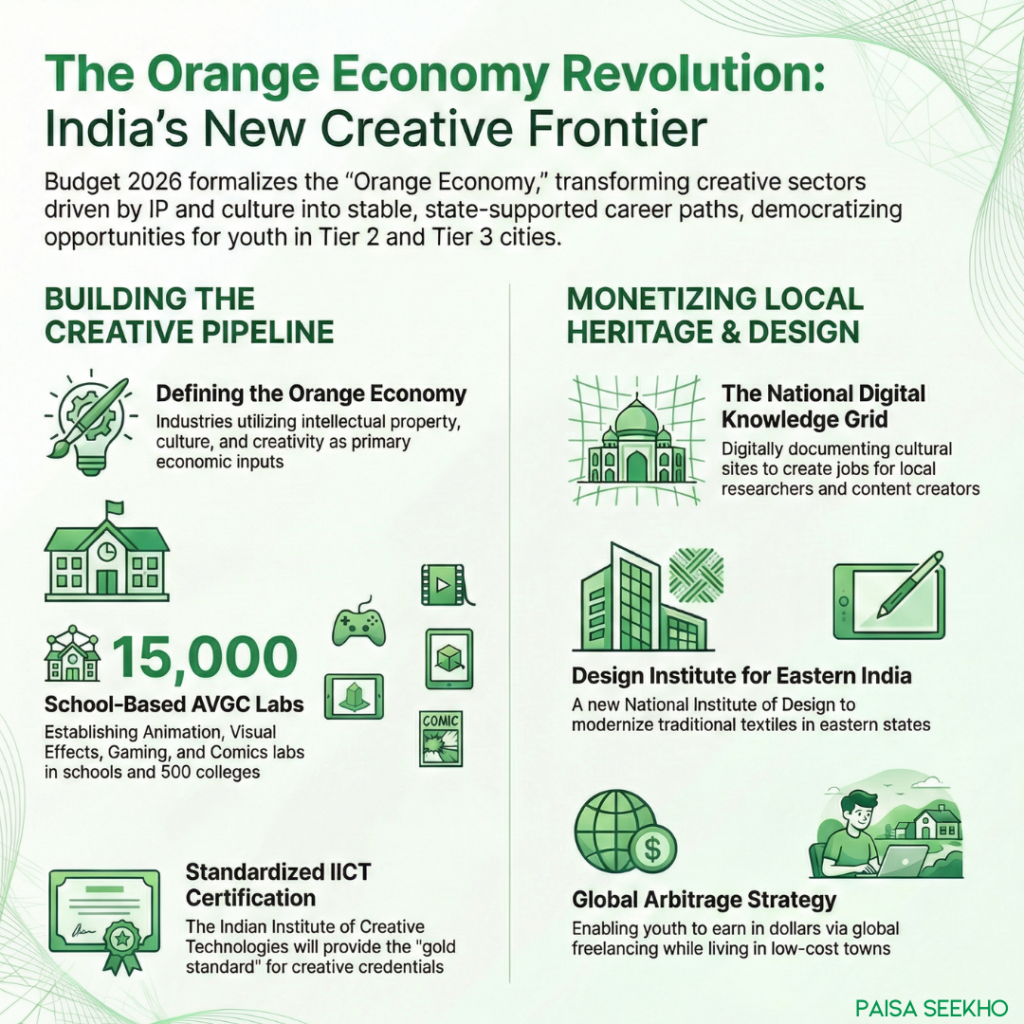

Way 1: The “Orange Economy” Revolution – A New Paradigm for Employment

The most profound structural change introduced in Budget 2026 is the formal recognition and aggressive fiscal support for the “Orange Economy.” For decades, India’s economic narrative has been monopolized by the IT services sector and heavy manufacturing. This budget explicitly broadens that horizon, identifying the creative and cultural industries as the next major engine for employment and export revenue. For young Indians in Tier 2 cities, who may have felt excluded from the traditional coding-centric IT boom due to geographical or educational barriers, this represents a democratization of economic opportunity.

1.1 Defining the Orange Economy in the Indian Context

The term “Orange Economy,” referenced extensively in the Economic Survey 2025-26 and operationalized in this budget, refers to sectors that rely on intellectual property, culture, and creativity as their primary inputs.1 This encompasses a wide spectrum of activities, including Animation, Visual Effects, Gaming, Comics (AVGC), heritage tourism, digital content creation, design, and the performing arts. The Economic Survey argued that these creativity-led sectors should not be viewed merely as niche entertainment or leisure activities, but as central pillars of urban growth, tourism strategy, and employment generation.1

The shift is significant because it moves “content creation” from the informal, precarious gig economy into a formal, state-supported industrial sector. The government is essentially betting that the next wave of Indian unicorns will not just be software service providers, but content creation studios and IP powerhouses. This pivot is particularly relevant for the youth in cities like Indore, Bhubaneswar, Jaipur, or Kochi, where the cost of living is manageable, but creative talent has historically lacked the infrastructure to monetize its skills globally.

1.2 The AVGC Content Creator Labs: Institutionalizing Creativity

A landmark announcement in this budget is the establishment of AVGC Content Creator Labs in 15,000 secondary schools and 500 colleges across India.3

The Strategic Implication of Supply-Side Intervention

This initiative represents a massive supply-side intervention in the labor market. By embedding high-end creative infrastructure directly into the secondary and tertiary education systems, the government is addressing the critical bottleneck of the creative economy: the shortage of skilled talent.

- The Problem: The global demand for VFX, gaming assets, and animation is exploding, driven by the metaverse, streaming platforms, and the gaming industry. However, India currently lacks a standardized pipeline of trained professionals. Private design schools are often prohibitively expensive and concentrated in major metros, excluding talent from smaller towns.

- The Solution: By establishing labs in 15,000 schools, the government is lowering the barrier to entry. A student in a government school in a Tier 2 district will now arguably have access to industry-standard tools for 3D modeling, animation, or graphic design.

- Tier 2 Advantage: This effectively decentralizes the “production line” of digital content. Just as engineering colleges in the 1990s created the workforce for the IT boom, these labs are intended to create the workforce for the “Content Boom.”

Wealth Creation Insight for the Youth

For you, the actionable insight is a strategic career pivot. The budget signals that “Gaming” and “YouTubing” are no longer hobbies to be pursued on the side, but viable career paths backed by state infrastructure. The demand for trainers to staff these 15,000 labs alone will create tens of thousands of immediate jobs for existing creative professionals. Furthermore, the ability to learn these skills early allows young Indians to tap into the global freelance market—earning in dollars while spending in rupees—a classic geographic arbitrage strategy for wealth accumulation.

1.3 The Indian Institute of Creative Technologies (IICT)

To anchor this new ecosystem, the budget proposes support for the Indian Institute of Creative Technologies (IICT) in Mumbai.4 The IICT is envisioned to function on a hub-and-spoke model. While the headquarters will be in Mumbai—the heart of India’s entertainment industry—the “spokes” (the 500 colleges and 15,000 schools) will facilitate the dissemination of standardized curriculum and certification.

This standardization is crucial for the labor market. Currently, a “certificate in animation” varies wildly in quality depending on the issuer. An IICT-affiliated certification will likely become the gold standard, signaling competence to global employers. For students, acquiring this certification will be a key step in increasing their employability and negotiating power in the job market.

1.4 The Digital Knowledge Grid: Monetizing Heritage

In a unique intersection of technology and culture, the Finance Minister announced the creation of a “National Destination Digital Knowledge Grid”.6

- Objective: To digitally document all places of cultural, spiritual, and historical significance across the country.

- Employment Generation: The Finance Minister explicitly stated that this initiative “will create a new ecosystem of jobs for local researchers, historians, content creators, and technology partners”.7

The Tier 2 and Rural Opportunity

India’s heritage is not concentrated in its metros; it is dispersed across thousands of small towns, villages, and rural districts. The “Digital Knowledge Grid” essentially creates a market for local knowledge.

- Scenario: A young history enthusiast in Hampi, a videographer in Varanasi, or a folklore researcher in Madurai can now find formal employment documenting their local sites for this national grid.

- The “Gig” aspect: This initiative is likely to operate on a project basis, which fits perfectly with the gig-economy preference of Gen Z. It monetizes local proximity and cultural knowledge, creating a niche employment sector that did not exist before. It transforms “heritage” from a passive asset into an active economic generator for local communities.

1.5 The Design Institute for Eastern India

To further balance regional development and address the specific needs of the eastern states, a new National Institute of Design (NID) will be established in the Eastern Region.8 This specifically targets the youth of Eastern India (Bihar, West Bengal, Odisha, Jharkhand), providing them with access to premium design education that was previously accessible primarily in Ahmedabad or Bengaluru.

- Economic Rationale: Eastern India has a rich tradition of textiles, handicrafts, and artisanal products. A local NID can help modernize these traditional industries, adding design value that increases their export potential. For young people in this region, it opens up high-value career paths in industrial design, textile design, and communication design without the need for migration to western India.

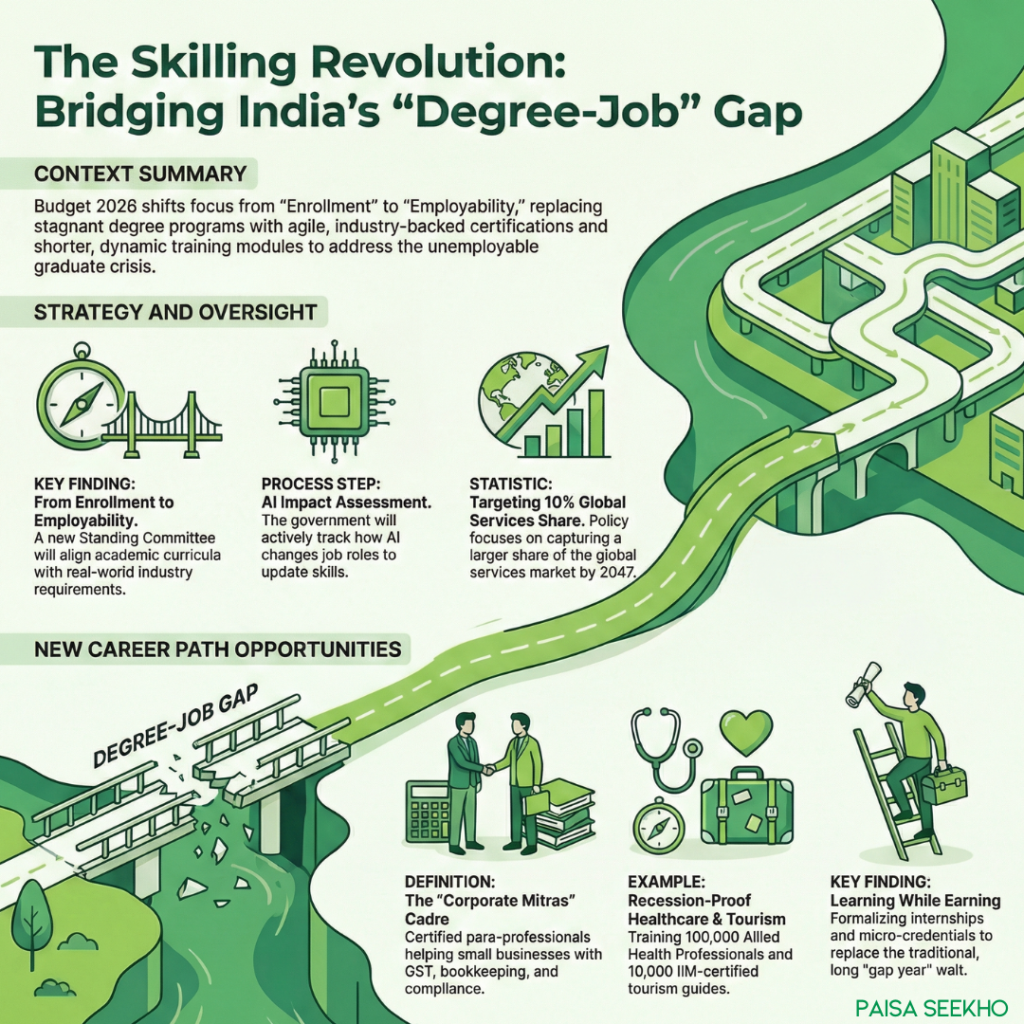

Way 2: The Skilling Revolution – Bridging the “Degree-Job” Gap

The second transformative “Way” this budget changes lives is by fundamentally altering the approach to higher education. The government has tacitly admitted that the traditional degree system is failing to produce employable graduates at the scale required. The focus of Budget 2026 shifts entirely from “Enrollment” (getting students into college) to “Employability” (getting them jobs). For a middle-class family, this is a significant relief, as it addresses the crisis of the “unemployable graduate” and the wasted investment in subpar degrees.

2.1 The “Education to Employment” Standing Committee

The government is setting up a high-powered “Education to Employment and Enterprise” Standing Committee.3

- Mandate: To identify the precise gap between academic curriculum and industry requirements, specifically focusing on the Services Sector.

- Goal: To capture a 10% share of the global services market by 2047.

- AI Impact Assessment: Crucially, this committee is tasked with assessing the impact of emerging technologies, including Artificial Intelligence (AI), on jobs and evolving skill requirements.3

Insight: This is a strong signal to students and parents. The government is creating a feedback loop where curriculum changes will happen much faster than in the past. Students should expect the introduction of new, shorter, dynamic courses that replace stagnant 3-year degree syllabi. The advice for youth is to stay agile—the skills required in 2026 may be obsolete by 2030, and this committee is the mechanism to track that shift.

2.2 The “Corporate Mitras”: A New Gig for Commerce Graduates

One of the most specific, actionable, and innovative announcements for Tier 2 commerce students is the creation of the “Corporate Mitras” cadre.11

The Economic Problem

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, but they struggle immensely with compliance. Hiring a fully qualified Chartered Accountant (CA) is often too expensive for a small business in a Tier 3 town with a turnover of ₹50 lakhs. This leads to non-compliance, penalties, and stunted growth.

The Policy Solution

- The Mechanism: Professional bodies like the Institute of Chartered Accountants of India (ICAI), the Institute of Company Secretaries of India (ICSI), and the Institute of Cost Accountants of India (ICMAI) will be facilitated to design short-term, modular courses and practical tools.

- The Role: These courses will train a new cadre of para-professionals—”Corporate Mitras.” These individuals will not be full CAs, but they will be certified to assist MSMEs with routine compliance tasks such as GST filings, basic tax returns, company registrations, and book-keeping.

- Target Geography: The initiative is specifically focused on Tier 2 and Tier 3 towns, where the gap between MSME needs and professional availability is widest.

Wealth Creation Angle:

For a commerce graduate in a small town who finds the rigorous CA exam too difficult or time-consuming to crack, this opens a lucrative alternative career path. It formalizes the “accountant” job, provides a recognized certification from a prestigious body like ICAI, and allows for a stable income. It is the “financial equivalent” of a nursing assistant—vital, in high demand, and accessible. A “Corporate Mitra” could easily service 10-15 small clients, creating a robust independent practice.

2.3 Skilling in Healthcare and Tourism

The budget explicitly targets sectors where the “human touch” is irreplaceable by AI, offering a hedge against automation: Healthcare and Hospitality.

Allied Health Professionals (AHPs)

The budget plans to upgrade existing institutions and set up new ones to train 1 Lakh (100,000) Allied Health Professionals over the next five years.14

- Scope: This covers disciplines such as optometry, radiology, anesthesia, operation theatre technology, and applied psychology.

- Significance: These jobs are recession-proof. As the population ages and healthcare infrastructure expands, the demand for technicians grows. Furthermore, these skills are highly exportable. An X-ray technician trained in India can find employment opportunities in the Middle East, Europe, or North America, where there are chronic shortages of healthcare support staff.

Tourism Guides and the IIM Connection

In a bid to professionalize the tourism sector, the budget proposes a pilot scheme to upskill 10,000 tourist guides in 20 iconic sites.14

- The IIM Factor: The training will be conducted in collaboration with the Indian Institutes of Management (IIMs). This is a game-changer for the status of the profession. Bringing IIMs into tour guide training elevates it from an informal, often touted job to a “certification-backed” career.

- Economic Impact: A guide with an IIM certificate can command higher fees, offer better services to international tourists, and potentially start their own boutique travel agency. It turns a low-wage job into a professional service.

2.4 Internship and Apprenticeship Focus

While the specific allocations for the PM Internship Scheme were a highlight of previous budgets, the continued emphasis on “learning while earning” through these sector-specific schemes (tourism, corporate mitras) reinforces the trend. The message to youth is clear: Don’t wait for a degree to finish; get a certification and start working. The “gap year” or “internship year” is becoming a formalized part of the Indian education journey.

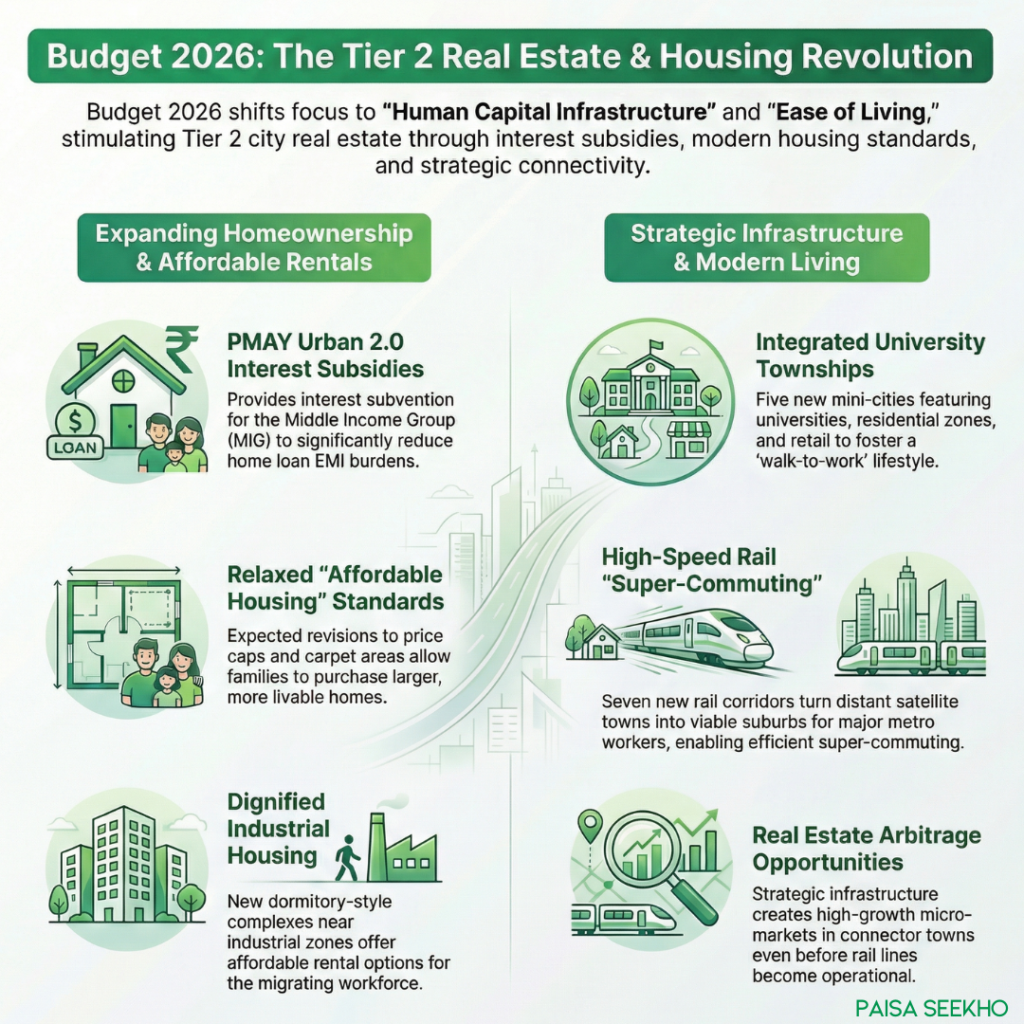

Way 3: Urban Living and Housing – The Tier 2 Real Estate Stimulus

For the Indian middle class, “Roti, Kapda, aur Makaan” (Food, Clothing, and Housing) remains the central aspirational triad. Budget 2026 addresses the “Makaan” aspect with aggressive reforms under PMAY Urban 2.0 and a new focus on Industrial Housing. These measures are set to transform the real estate landscape of Tier 2 cities, making home ownership more accessible and rental options more dignified for the mobile workforce.

3.1 PMAY Urban 2.0: Reviving the Middle-Class Dream

The budget allocates significant funds to PMAY Urban 2.0, aiming to construct 1 Crore urban houses.16 This scheme is a direct successor to the original PMAY but is retooled to address the current market realities.

The Middle-Income Group (MIG) Subsidy

Crucially, the scheme includes an Interest Subsidy Scheme specifically for the Middle Income Group (MIG).16

- Mechanism: The government provides a subsidy on the interest component of the home loan. Historically, this has been around 3-4% interest subvention for a tenure of 20 years, which significantly reduces the EMI burden.

- Price Cap Adjustments: While the exact notification is awaited, industry expectations and budget signals suggest a revision in the definition of “Affordable Housing” to reflect inflation. The price cap is expected to rise from the previous ₹45 Lakhs to a more realistic ₹65-75 Lakhs.18

- Carpet Area: The definition of carpet area for affordable housing is also expected to be relaxed (e.g., from 60/90 sq m to 90/120 sq m), allowing middle-class families to buy larger, more livable homes while still availing of tax benefits and subsidies.

Impact on Wealth:

For a young family in a city like Lucknow, Coimbatore, or Nashik, PMAY 2.0 effectively reduces the cost of borrowing. If the interest subsidy amounts to approximately ₹2.3 – ₹2.6 lakhs (as per historical trends), it acts as a direct discount on the home price.

- The Tier 2 Boom: Developers will shift their focus to projects that fit this price bracket (₹40-70 Lakhs). This will lead to a supply boom in the peripheral areas of Tier 2 cities, creating investment opportunities in real estate. Buying a home in these emerging “PMAY zones” could offer significant capital appreciation over the next decade.

3.2 Industrial Housing: Dormitories for the Workforce

A new scheme for “Industrial Housing” has been introduced.16 This is designed to provide affordable rental or ownership housing for urban workers, essentially creating “dormitory-style” living complexes near industrial zones.

- Why it matters: Young people migrating from villages to industrial hubs often end up living in slums or unauthorized colonies due to high rents and lack of formal housing. Industrial housing provides a dignified, low-cost alternative.

- Economic Mobility: By lowering the “cost of migration,” this scheme encourages more youth to move to cities for jobs. It removes the biggest friction point in labor mobility—the fear of not finding a decent place to live.

3.3 Five Integrated University Townships

The government plans to support states in developing Five Integrated University Townships near industrial and logistics corridors.3

- Concept: These are not just isolated campuses but mini-cities containing universities, research centers, residential complexes, and retail zones.

- Lifestyle Impact: For students, researchers, and academic staff, this offers a “walk-to-work” lifestyle similar to Western university towns (like Oxford, Cambridge, or Palo Alto).

- Real Estate Micro-markets: These townships will create high-quality micro-markets for real estate. Investing in residential property near these planned townships is a strategic long-term bet, as the constant influx of students and faculty ensures high rental yield and occupancy rates.

3.4 Transit-Oriented Development (TOD) and the 7 Corridors

The announcement of Seven High-Speed Rail Corridors (e.g., Mumbai-Pune, Pune-Hyderabad, Hyderabad-Bengaluru, Delhi-Varanasi, Varanasi-Siliguri, Chennai-Bengaluru) 22 is a game-changer for living standards and regional economics.

The “Super-Commuter” Phenomenon

High-speed connectivity allows people to live in cheaper satellite towns and work in major metros. A 3-hour journey reduced to 1 hour turns a distant town into a suburb.

- Real Estate Arbitrage: Property prices in the nodes along these corridors (e.g., a small town halfway between Pune and Hyderabad) will appreciate faster than in the metros themselves.

- Wealth Insight: The smart money is on buying land or property in these “connector towns” before the rail line is operational. This is a key insight for wealth creation—buy land where the train will stop.

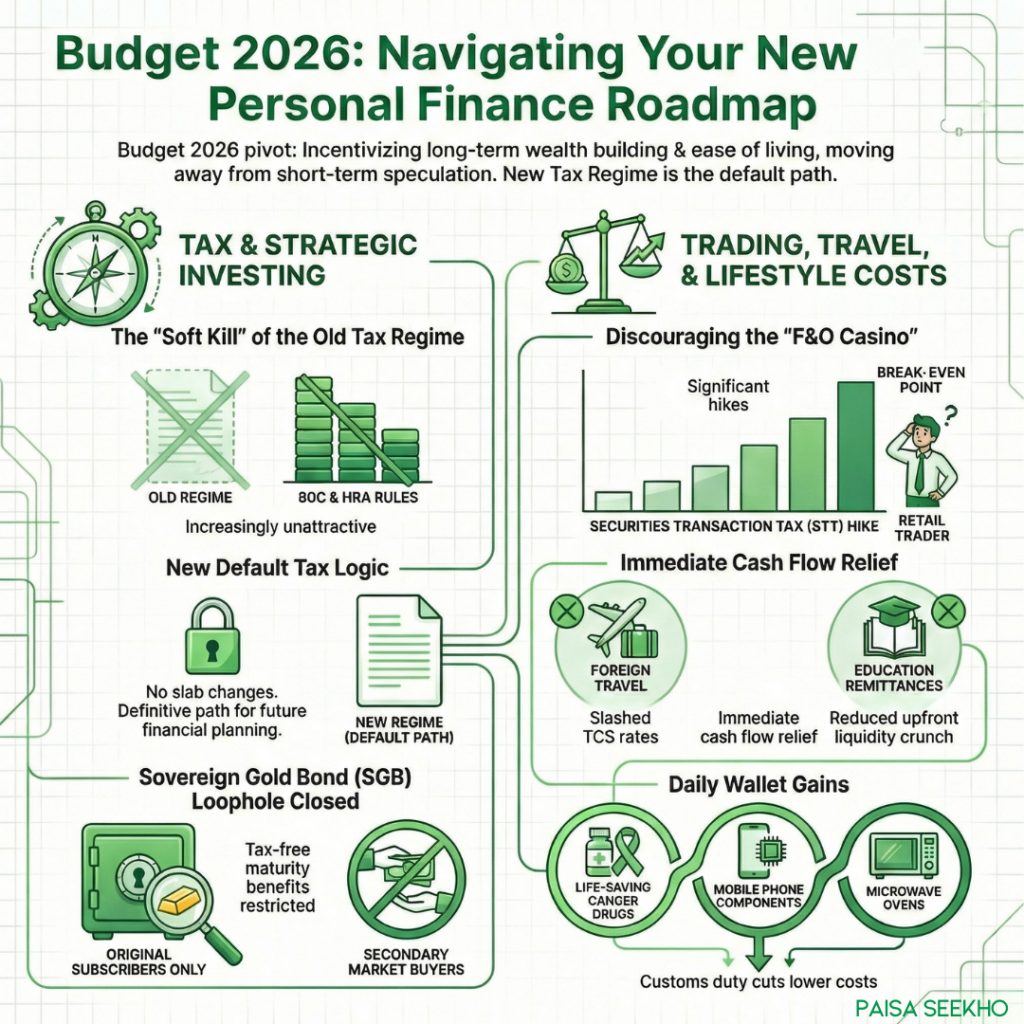

Way 4: Personal Finance – Taxation, Trading, and Savings

Budget 2026 brings a mix of relief and restriction, creating a new framework for how Indians should save and invest. The overarching theme is a push towards long-term asset creation and an active discouragement of short-term speculation.

4.1 Income Tax: The New Regime becomes the Only Regime

The Finance Minister announced no changes to income tax slabs for the fiscal year 2026-27.24

The Signal in the Silence

While many expected tax cuts, the decision to keep slabs unchanged sends a powerful signal. The government is consolidating the New Tax Regime as the default and effectively the only future path.

The Status Quo:

- New Regime: No tax up to ₹7 Lakhs (plus standard deduction = ₹7.75 Lakhs tax-free). It offers lower rates but no deductions.

- Old Regime: Remains cluttered with high rates but allows deductions (80C, HRA, etc.). By not updating the 80C limit (which has been stuck at ₹1.5 Lakhs for over a decade) or the HRA rules, the government is letting inflation make the Old Regime less attractive every year.

- Strategy: Taxpayers holding on to the Old Regime for HRA and 80C benefits need to do a hard calculation. As income rises, the simplicity and lower rates of the New Regime often outweigh the deductions of the Old. The “soft kill” of the Old Regime is underway; young earners should plan their finances assuming the deductions will eventually vanish.

4.2 The “F&O Shock”: Hike in Securities Transaction Tax (STT)

The budget has delivered a significant blow to the rampant speculation in Futures and Options (F&O), a segment that has seen explosive growth among young retail traders.23

The New Rates

The following table summarizes the changes in Securities Transaction Tax (STT):

| Derivative Type | Old STT Rate | New STT Rate (Budget 2026) | Increase Factor |

| Futures | 0.02% | 0.05% | 2.5x |

| Options (on Premium) | 0.1% | 0.15% | 1.5x |

| Options Exercise | 0.125% | 0.15% | 1.2x |

Impact on Traders

This hike directly increases the “break-even” point for a trade.

- The Scalper’s Dilemma: A trader who “scalps” (takes small profits on small price moves) will see a significant chunk of their profit eaten by taxes. On a high-volume trading day, a trader might pay thousands more in STT regardless of whether they made a profit or a loss.

- Behavioral Nudge: The government wants young Indians to stop treating the stock market as a casino. The Economic Survey likely highlighted the risks of retail capital being wiped out in derivatives.

- Shift focus to Swing Trading or Long-term Investing. The statistical edge in F&O has just become much harder to maintain due to higher transaction costs.

4.3 Sovereign Gold Bonds (SGB): Closing the Loophole

A subtle but painful change was made to the taxation of Sovereign Gold Bonds (SGB).28

The Change

Previously, there was an ambiguity that allowed investors to buy SGBs from the secondary market (stock exchange) and claim tax-free capital gains if held to maturity. The budget clarifies and amends this: Capital Gains tax exemption at maturity is ONLY available for original subscribers.

- Implication: If you buy an SGB on the stock exchange today (secondary market) and hold it till its maturity in 2028, you will be liable to pay capital gains tax on the profit.

- Strategy: Investors should now prefer buying SGBs only during the primary issuance windows (when RBI releases them) to ensure tax-free maturity. Buying from the secondary market is only viable if the bonds are trading at a steep discount that compensates for the future tax liability.

4.4 TCS Reduction: Cheaper Foreign Travel and Education

In a move that significantly benefits the aspirational middle class, Tax Collected at Source (TCS) has been slashed.23

The New Rates

| Category | Old TCS Rate | New TCS Rate | Impact |

| Foreign Tour Packages | 5% (up to ₹7L), 20% (above) | 2% (Flat) | Immediate cash flow relief for travelers. |

| Education Remittance (LRS) | 5% | 2% | Cheaper to send money to students abroad. |

| Medical Treatment | 5% | 2% | Relief for families seeking treatment overseas. |

- Ease of Living: This puts more cash in the hand of the middle class immediately. Previously, booking a ₹2 Lakh Europe trip meant ₹10,000 to ₹40,000 blocked as TCS, which could only be claimed back as a refund next year. Now, the upfront cost is lower, reducing the liquidity crunch for families.

4.5 Cost of Living Adjustments

The budget impacts the daily wallet through changes in customs duties.23

Cheaper Items:

- Cancer Drugs: 17 life-saving drugs exempted from customs duty, providing massive relief to families battling critical illness.

- Mobile Phones & Chargers: Duty cuts on components like PCBA and chargers will likely lead to a marginal drop in smartphone prices.

- Microwave Ovens: Duty cuts on magnetrons and parts will lower the cost of this common household appliance.

- Seafood & Leather Goods: Duty cuts on inputs for these sectors are aimed at boosting exports, but may also lower domestic prices for footwear and bags.

- Costlier Items:

- Imported Plastic/PVC: To encourage domestic manufacturing and discourage plastic use.

- F&O Trading: As discussed, the transaction cost has risen.

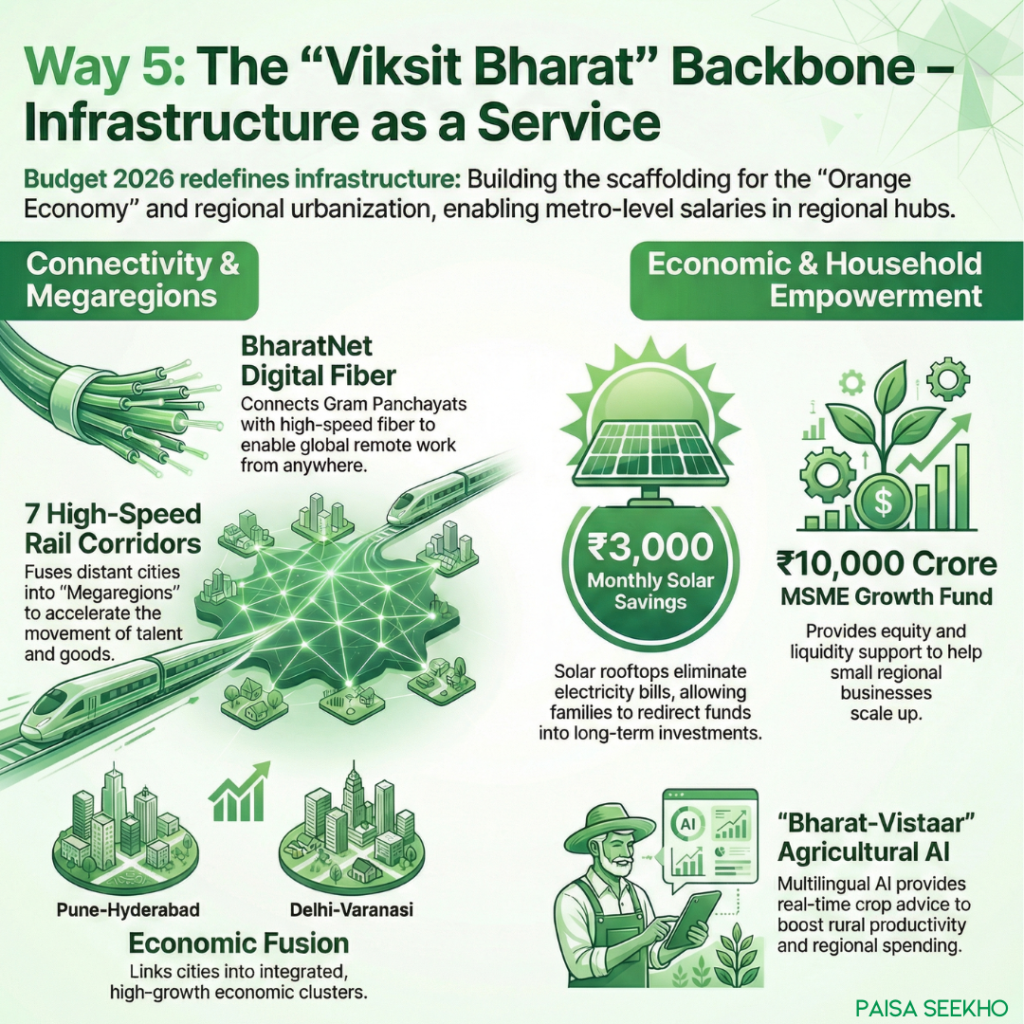

Way 5: Infrastructure & Ease of Living – The “Viksit Bharat” Backbone

Infrastructure in Budget 2026 is viewed not just as “concrete pouring” but as “Connectivity as a Service.” For a young person in a Tier 2 city, this infrastructure creates the platform upon which their career, business, and lifestyle will be built.

5.1 BharatNet and Digital Connectivity

The budget continues the massive outlay for BharatNet to connect every Gram Panchayat with high-speed optical fiber.4

- Tier 2 Context: While major cities have 5G, the “hinterland” (villages around Tier 2 cities) often suffers from poor connectivity. BharatNet closes this gap.

- Ripple Effect: Reliable high-speed internet in rural areas enables the “Orange Economy” discussed in Way 1. A creator can live in a village 50km from Indore and upload 4K videos without data interruptions. It also enables remote work, allowing youth to earn metro salaries while living in low-cost rural homes, maximizing their savings rate.

5.2 The 7 Growth Corridors: Creating Megaregions

The announcement of Seven High-Speed Rail Corridors aims to fuse distinct cities into economic clusters.22

Routes:

- Mumbai to Pune

- Pune to Hyderabad

- Hyderabad to Bengaluru

- Hyderabad to Chennai

- Chennai to Bengaluru

- Delhi to Varanasi

- Varanasi to Siliguri

- Economic Fusion: Pune and Hyderabad are currently distinct economies separated by a long journey. High-speed rail merges them into a single economic corridor. This integration facilitates the movement of talent, goods, and services, creating a “Megaregion” that rivals global economic zones like the Pearl River Delta.

- Opportunity: Youth living in towns along these routes (e.g., Solapur, Kalaburagi) will see a surge in warehousing, logistics, and service jobs.

5.3 Agricultural AI: “Bharat-Vistaar”

The introduction of “Bharat-Vistaar”, a multilingual AI tool for agriculture 4, is vital for Tier 2 cities that often act as trading hubs for rural produce (mandis).

- Function: It integrates AgriStack portals and ICAR research with AI to give farmers customized, real-time advice on crops and weather.

- Economic Impact: Higher farm productivity means more disposable income in rural India. Since Tier 2 cities are the primary markets for rural spending (cars, tractors, FMCG, services), an AI-driven boom in agriculture directly fuels the consumption economy of these cities.

5.4 Green Energy & Solar Rooftops

The budget maintains a strong focus on the PM Surya Ghar Muft Bijli Yojana (free electricity via solar).

- Wealth Effect: For a middle-class family, eliminating the electricity bill (saving ₹2,000-₹3,000/month) is equivalent to a massive salary hike. This savings can be redirected into SIPs (Systematic Investment Plans), compounding wealth over time.

- Green Jobs: The installation and maintenance of these solar panels create technical jobs in every district, fitting into the skilling narrative.

5.5 MSME Support: The ₹10,000 Crore Growth Fund

Recognizing that MSMEs are the biggest employers in Tier 2 India, the budget announces a ₹10,000 Crore SME Growth Fund.33

- Equity Support: This fund will provide equity and liquidity support to help small businesses scale up.

- Credit Guarantee: The budget enhances credit support, ensuring that small shopkeepers and factory owners can get loans without excessive collateral.

- Banking for Viksit Bharat: A high-level committee will be set up to reform the banking sector to better serve the needs of MSMEs 34, ensuring that credit flows to the smallest borrower in the remotest town.

Deep Dive Analysis: The “Wealth Effect” Calculation

To make this report actionable, we must quantify the impact. How does Budget 2026 theoretically change the bank balance of a 25-year-old earning ₹8 Lakhs p.a. in a Tier 2 city?

Scenario: The “Smart Saver” vs. The “Speculator”

| Parameter | The Speculator (Old Habits) | The Smart Saver (Budget 2026 Aligned) |

| Income Source | Salary + F&O Trading | Salary + Freelancing (Orange Economy) |

| Tax Regime | Old Regime (Struggling with proofs) | New Regime (Default, hassle-free) |

| Trading Cost | High (0.15% STT eats profits) | Low (Long-term Equity/SIPs) |

| Housing | Renting in a metro | Buying in Tier 2 (PMAY 2.0 Subsidy) |

| Gold Investment | Buying SGB on Secondary Market | Buying SGB in Primary Issue |

| Foreign Trip | Paying 5-20% TCS | Paying 2% TCS (Cash flow relief) |

| Upskilling | Expensive private courses | “Corporate Mitra” / AVGC Lab course |

Conclusion of Analysis:

Budget 2026 penalizes the Speculator significantly through STT hikes and SGB tax tightening. Conversely, it heavily subsidizes the Smart Saver who aligns with government priorities: living in Tier 2/3 cities (PMAY), working in creative/service sectors (AVGC/Mitra), and investing for the long term.

Strategic Recommendations for the Audience

Based on the exhaustive analysis of Budget 2026, here are the strategic takeaways for young Indians:

- Pivot to the “Orange Economy”:

- If you are a student, look for colleges that are adopting the AVGC Creator Labs. These skills (3D modeling, VFX) will be the “English literacy” of the next decade.

- If you are in Humanities/History, look for the Digital Knowledge Grid projects. It’s the first time the government is directly funding heritage documentation jobs.

- Rethink Real Estate Strategy:

- Don’t wait to buy a house in a Metro where prices are unaffordable. Use PMAY Urban 2.0 to buy a property in a developing Tier 2 city, specifically near the 7 new High-Speed Corridors. The appreciation there will outperform metros.

- Stop F&O Trading Immediately:

- The government is explicitly telling you to stop. The STT hike makes it mathematically very difficult for small retail traders to be profitable. Shift that capital into Mutual Funds or Direct Equity where taxes are stable.

- Leverage “Ease of Living” for Savings:

- Utilize the TCS cut (2%) to plan foreign travel or upskilling abroad.

- Use the Solar Rooftop schemes to kill your electricity bill and invest that savings.

- Get Certified:

- Degrees are losing value. Certifications are gaining. Whether it’s the “Corporate Mitra” certificate from ICAI or a Tourism Guide certificate from an IIM, these “micro-credentials” are the new currency for employment.

Conclusion

Budget 2026 is not a “freebie” budget; it is an “enabler” budget. It does not put cash directly into bank accounts (except for housing subsidies), but it builds the scaffolding for wealth creation. For the young Indian in a Tier 2 city, the scaffolding is made of Creative Labs, High-Speed Trains, Affordable Housing, and Simplified Taxes.

The “change in life” promised by this budget will not happen overnight. It will happen when a student in Ranchi gets a job in a Mumbai-based VFX studio while working remotely from home (thanks to BharatNet), buys a house in Ranchi (thanks to PMAY 2.0), and invests their savings in a diverse portfolio (avoiding the F&O trap). This is the vision of Viksit Bharat—decentralized, skilled, and digitally empowered.

Works cited

- Budget 2026: Sitharaman backs ‘Orange Economy’, shifts focus on animation, visual effects, gaming & comics sector, accessed February 1, 2026, https://m.economictimes.com/news/economy/policy/budget-2026-sitharaman-backs-orange-economy-shifts-focus-on-animation-visual-effects-gaming-comics-sector/articleshow/127834598.cms

- Budget 2026: What is ‘Orange Economy’, why the government is backing animation, gaming, VFX, comics and how is it linked to content creators?, accessed February 1, 2026, https://m.economictimes.com/news/new-updates/budget-2026-what-is-orange-economy-why-the-government-is-backing-animation-gaming-vfx-comics-and-how-is-it-linked-to-content-creators/articleshow/127840890.cms

- Budget 2026: Skilling, education tied to jobs push in services, new …, accessed February 1, 2026, https://www.business-standard.com/amp/budget/news/budget-2026-27-skilling-education-jobs-services-new-economy-126020100946_1.html

- Union Budget 2026-27: Rare earths, semiconductors & Orange Economy – key takeaways, accessed February 1, 2026, https://timesofindia.indiatimes.com/business/india-business/union-budget-2026-27-rare-earths-semiconductors-orange-economy-key-takeaways/articleshow/127836605.cms

- Orange Economy: India ramps up animation and gaming skilling push in Budget 2026, accessed February 1, 2026, https://www.forbesindia.com/amp/article/budget-2026/orange-economy-india-ramps-up-animation-and-gaming-skilling-push-in-budget-2026/2990967/1

- Budget 2026: Govt to create Digital Knowledge Grid to document India’s heritage, accessed February 1, 2026, https://www.storyboard18.com/how-it-works/budget-2026-digital-knowledge-grid-to-create-jobs-for-historians-content-creators-says-fm-sitharaman-88612.htm

- accessed February 1, 2026, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2221403®=3&lang=1#:~:text=She%20also%20stated%2C%20%E2%80%9CA%20National,content%20creators%20and%20technology%20partners.%E2%80%9D

- Union Budget 2026: Top 12 takeaways, accessed February 1, 2026, https://www.newindianexpress.com/amp/story/nation/2026/Feb/01/union-budget-2026-top-12-takeaways

- Speech – Union Budget, accessed February 1, 2026, https://www.indiabudget.gov.in/doc/budget_speech.docx

- BUDGET 2026: Focus on skilling youth in healthcare and tourism, accessed February 1, 2026, https://www.thestatesman.com/india/budget-2026-focus-on-skilling-youth-in-healthcare-and-tourism-1503550139.html

- Budget 2026: Skilling, education tied to jobs push in services, new economy, accessed February 1, 2026, https://www.business-standard.com/budget/news/budget-2026-27-skilling-education-jobs-services-new-economy-126020100946_1.html

- Education Budget 2026 LIVE: IIT Creator Labs, new design institute, girls’ hostels and Ayurveda centres announced as skilling gets major push – The Times of India, accessed February 1, 2026, https://timesofindia.indiatimes.com/business/india-business/education-budget-2026-announcements-highlights-education-sector-fm-sitharaman-allocation-school-colleges-job-career/articleshow/127832315.cms

- Budget 2026-2027 Speech of Nirmala Sitharaman Minister of …, accessed February 1, 2026, https://static.pib.gov.in/WriteReadData/specificdocs/documents/2026/feb/doc202621775901.pdf

- Budget 2026-27 focuses on skilling and upskilling across healthcare and tourism, accessed February 1, 2026, https://m.economictimes.com/news/economy/policy/budget-2026-27-focuses-on-skilling-and-upskilling-across-healthcare-and-tourism/articleshow/127837994.cms

- UNION BUDGET 2026-27 PROPOSES A SCHEME TO SUPPORT STATES IN ESTABLISHING FIVE REGIONAL MEDICAL HUBS TO PROMOTE MEDICAL TOURISM, accessed February 1, 2026, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2221403®=3&lang=1

- MINISTRY OF HOUSING AND URBAN AFFAIRS DEMAND NO. 60 Ministry of Housing and Urban Affairs (In ` crores) – Union Budget, accessed February 1, 2026, https://www.indiabudget.gov.in/doc/eb/sbe60.pdf

- Cabinet Approves PMAY-Urban 2.0: Lessons From The Past Still Remain Unaddressed, accessed February 1, 2026, https://thesecretariat.in/article/cabinet-approves-pmay-urban-2-0-lessons-from-the-past-still-remain-unaddressed

- Budget 2026 Affordable Housing Relief Explained | Housivity, accessed February 1, 2026, https://housivity.com/blog/budget-2026-affordable-housing-explained

- Budget Watch 2026: Real Estate Players Seek Policy Alignment with Rising Urban Housing Costs – The Realty Today, accessed February 1, 2026, https://therealtytoday.com/news/market-insights/budget-watch-2026-real-estate-players-seek-policy-alignment-with-rising-urban-housing-costs

- State Finances, Government of Rajasthan – Comptroller and Auditor General of India, accessed February 1, 2026, https://saiindia.gov.in/webroot/uploads/download_audit_report/2019/Report_No_2_of_2019_State_Finances_Government_of_Rajasthan.pdf

- From IIT labs to girls’ hostels: Education takeaways from Budget 2026–27, ETEducation, accessed February 1, 2026, https://education.economictimes.indiatimes.com/amp/news/industry/from-iit-labs-to-girls-hostels-education-takeaways-from-budget-202627/127835570

- Union Budget 2026: Nirmala Sitharaman announces three-Kartavya framework to accelerate economic growth, accessed February 1, 2026, https://timesofindia.indiatimes.com/business/india-business/union-budget-2026-nirmala-sitharaman-announces-three-kartavya-framework-to-accelerate-economic-growth/articleshow/127833889.cms

- India Budget 2026 Key Takeaways: Trains, treks, chips and …, accessed February 1, 2026, https://m.economictimes.com/news/economy/policy/budget-2026-key-takeaways-from-union-budget-income-tax-personal-finance-common-man-benefits-msmes-pli-scheme-agriculture-health-education-fiscal/articleshow/127832014.cms

- Union Budget 2026: ‘No Change’ in Income Tax Slabs for FY27, Check New Tax Regime vs Old Tax Regime Rates, accessed February 1, 2026, https://sundayguardianlive.com/india/budget-2026-no-change-in-income-tax-slabs-for-fy27-check-new-tax-regime-vs-old-tax-regime-rates-167732/

- Did Budget 2026 announce any tax relief for salaried taxpayers? Here’s the answer, accessed February 1, 2026, https://www.indiatoday.in/business/budget/story/did-budget-2026-announce-any-tax-relief-for-salaried-taxpayers-here-is-the-answer-2861368-2026-02-01

- Income Tax Slabs Budget 2026 Highlights: No changes in income tax rates, slabs for FY 2026-27; some TCS, TDS changes & new deadline for filing revised returns announced, accessed February 1, 2026, https://timesofindia.indiatimes.com/business/india-business/income-tax-slabs-2026-27-live-updates-budget-2026-new-tax-regime-vs-old-regime-tax-rates-standard-deduction-section-80c-latest-income-tax-slab-changes-tax-announcements-news/liveblog/127830491.cms

- Budget 2026: STT Hike on F&O Trading Jolts Markets – Multibagg AI, accessed February 1, 2026, https://www.multibagg.ai/market-pulse/articles/budget-2026-stt-hike-derivatives-cml3flutn0006li0jx58dmb2h

- SGB Tax Rules Change in Budget 2026: Exemption Now Limited | Market News & Analysis, accessed February 1, 2026, https://www.multibagg.ai/market-pulse/articles/budget-2026-sgb-tax-rules-cml3i469c0009qn0jc0q0xw62

- SGB redemption will no longer be tax free for these investors as budget 2026 introduces new taxation rules for FY 2027 – The Economic Times, accessed February 1, 2026, https://m.economictimes.com/wealth/invest/sgb-redemption-will-no-longer-be-tax-free-for-these-investors-as-budget-2026-introduces-new-taxation-rules-for-fy-2027/articleshow/127841071.cms

- Budget 2026: Check what gets cheaper and costlier in Union Budget this year, accessed February 1, 2026, https://m.economictimes.com/news/economy/policy/budget-2026-what-gets-cheaper-costlier-and-expensive-in-union-budget-2026-27-check-full-list/articleshow/127832136.cms

- Union Budget 2026-27: What gets cheaper, what gets costlier, accessed February 1, 2026, https://timesofindia.indiatimes.com/business/india-business/union-budget-2026-27-what-gets-cheaper-what-gets-costlier-smartphone-alcohol-tobacco-microwave-trading-leather-sea-food-cancer-medicines-sports-equipment/articleshow/127836396.cms

- Union Budget 2026: Complete list of commodities that will get cheaper and costlier in the food and beverage industry, accessed February 1, 2026, https://timesofindia.indiatimes.com/life-style/food-news/union-budget-2026-complete-list-of-commodities-that-will-get-cheaper-and-costlier-in-the-food-and-beverage-industry/photostory/127839820.cms

- Budget 2026: Dedicated fund, liquidity and credit support to boost MSME sector, accessed February 1, 2026, https://www.forbesindia.com/article/budget-2026/budget-2026-dedicated-fund-liquidity-and-credit-support-to-boost-msme-sector/2990974/1

- Budget 2026–27 Full Speech & Highlights: Speech concludes in 85 …, accessed February 1, 2026, https://www.forbesindia.com/article/news/union-budget-2026-27-finance-minister-nirmala-sitharaman-speech-defence-pli-manufacturing-key-announcements-live-updates-liveblog/2990897/1